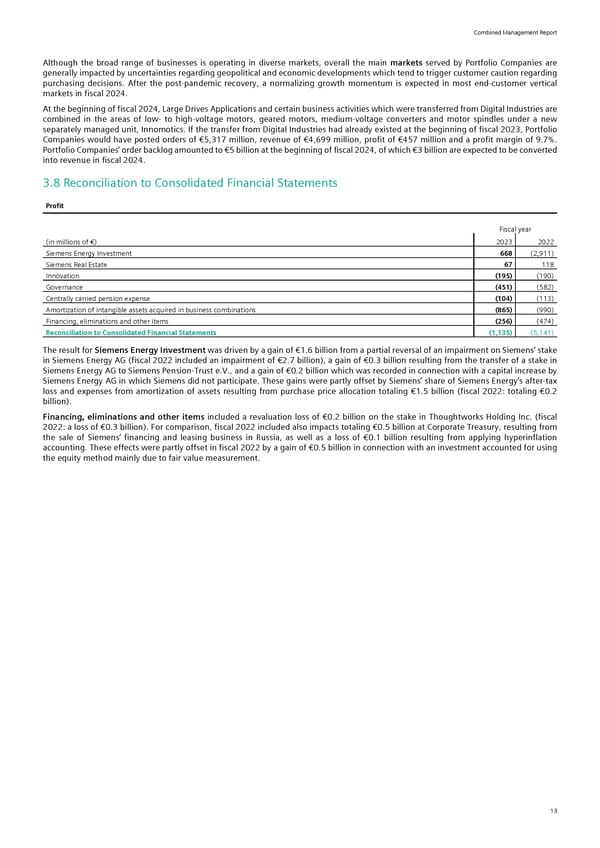

Combined Management Report Although the broad range of businesses is operating in diverse markets, overall the main markets served by Portfolio Companies are generally impacted by uncertainties regarding geopolitical and economic developments which tend to trigger customer caution regarding purchasing decisions. After the post-pandemic recovery, a normalizing growth momentum is expected in most end-customer vertical markets in fiscal 2024. At the beginning of fiscal 2024, Large Drives Applications and certain business activities which were transferred from Digital Industries are combined in the areas of low- to high-voltage motors, geared motors, medium-voltage converters and motor spindles under a new separately managed unit, Innomotics. If the transfer from Digital Industries had already existed at the beginning of fiscal 2023, Portfolio Companies would have posted orders of €5,317 million, revenue of €4,699 million, profit of €457 million and a profit margin of 9.7%. Portfolio Companies’ order backlog amounted to €5 billion at the beginning of fiscal 2024, of which €3 billion are expected to be converted into revenue in fiscal 2024. 3.8 Reconciliation to Consolidated Financial Statements Profit Fiscal year (in millions of €) 2023 2022 Siemens Energy Investment 668 (2,911) Siemens Real Estate 67 118 Innovation (195) (190) Governance (451) (582) Centrally carried pension expense (104) (113) Amortization of intangible assets acquired in business combinations (865) (990) Financing, eliminations and other items (256) (474) Reconciliation to Consolidated Financial Statements (1,135) (5,141) The result for Siemens Energy Investment was driven by a gain of €1.6 billion from a partial reversal of an impairment on Siemens' stake in Siemens Energy AG (fiscal 2022 included an impairment of €2.7 billion), a gain of €0.3 billion resulting from the transfer of a stake in Siemens Energy AG to Siemens Pension-Trust e.V., and a gain of €0.2 billion which was recorded in connection with a capital increase by Siemens Energy AG in which Siemens did not participate. These gains were partly offset by Siemens’ share of Siemens Energy’s after-tax loss and expenses from amortization of assets resulting from purchase price allocation totaling €1.5 billion (fiscal 2022: totaling €0.2 billion). Financing, eliminations and other items included a revaluation loss of €0.2 billion on the stake in Thoughtworks Holding Inc. (fiscal 2022: a loss of €0.3 billion). For comparison, fiscal 2022 included also impacts totaling €0.5 billion at Corporate Treasury, resulting from the sale of Siemens’ financing and leasing business in Russia, as well as a loss of €0.1 billion resulting from applying hyperinflation accounting. These effects were partly offset in fiscal 2022 by a gain of €0.5 billion in connection with an investment accounted for using the equity method mainly due to fair value measurement. 13

Siemens Report FY2023 Page 14 Page 16

Siemens Report FY2023 Page 14 Page 16