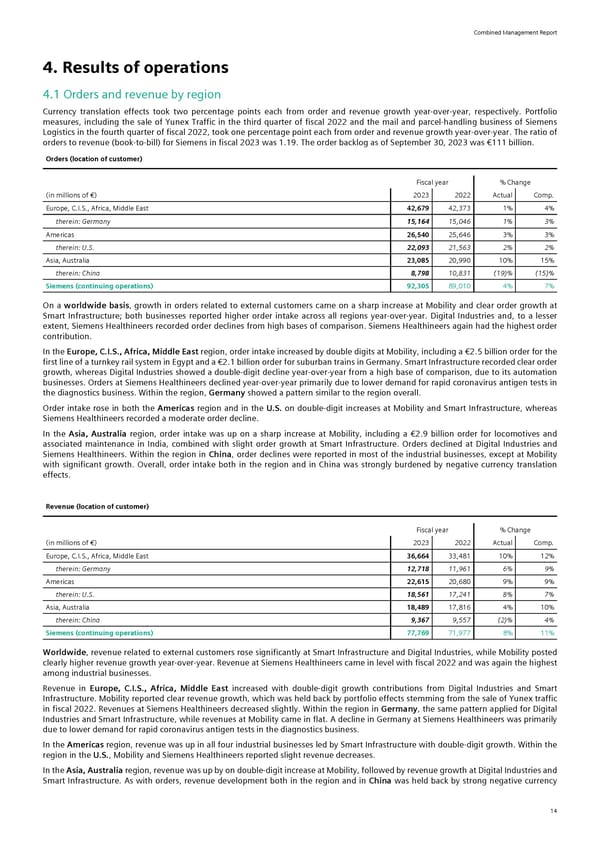

Combined Management Report 4. Results of operations 4.1 Orders and revenue by region Currency translation effects took two percentage points each from order and revenue growth year-over-year, respectively. Portfolio measures, including the sale of Yunex Traffic in the third quarter of fiscal 2022 and the mail and parcel-handling business of Siemens Logistics in the fourth quarter of fiscal 2022, took one percentage point each from order and revenue growth year-over-year. The ratio of orders to revenue (book-to-bill) for Siemens in fiscal 2023 was 1.19. The order backlog as of September 30, 2023 was €111 billion. Orders (location of customer) Fiscal year % Change (in millions of €) 2023 2022 Actual Comp. Europe, C.I.S., Africa, Middle East 42,679 42,373 1% 4% therein: Germany 15,164 15,046 1% 3% Americas 26,540 25,646 3% 3% therein: U.S. 22,093 21,563 2% 2% Asia, Australia 23,085 20,990 10% 15% therein: China 8,798 10,831 (19)% (15)% Siemens (continuing operations) 92,305 89,010 4% 7% On a worldwide basis, growth in orders related to external customers came on a sharp increase at Mobility and clear order growth at Smart Infrastructure; both businesses reported higher order intake across all regions year-over-year. Digital Industries and, to a lesser extent, Siemens Healthineers recorded order declines from high bases of comparison. Siemens Healthineers again had the highest order contribution. In the Europe, C.I.S., Africa, Middle East region, order intake increased by double digits at Mobility, including a €2.5 billion order for the first line of a turnkey rail system in Egypt and a €2.1 billion order for suburban trains in Germany. Smart Infrastructure recorded clear order growth, whereas Digital Industries showed a double-digit decline year-over-year from a high base of comparison, due to its automation businesses. Orders at Siemens Healthineers declined year-over-year primarily due to lower demand for rapid coronavirus antigen tests in the diagnostics business. Within the region, Germany showed a pattern similar to the region overall. Order intake rose in both the Americas region and in the U.S. on double-digit increases at Mobility and Smart Infrastructure, whereas Siemens Healthineers recorded a moderate order decline. In the Asia, Australia region, order intake was up on a sharp increase at Mobility, including a €2.9 billion order for locomotives and associated maintenance in India, combined with slight order growth at Smart Infrastructure. Orders declined at Digital Industries and Siemens Healthineers. Within the region in China, order declines were reported in most of the industrial businesses, except at Mobility with significant growth. Overall, order intake both in the region and in China was strongly burdened by negative currency translation effects. Revenue (location of customer) Fiscal year % Change (in millions of €) 2023 2022 Actual Comp. Europe, C.I.S., Africa, Middle East 36,664 33,481 10% 12% therein: Germany 12,718 11,961 6% 9% Americas 22,615 20,680 9% 9% therein: U.S. 18,561 17,241 8% 7% Asia, Australia 18,489 17,816 4% 10% therein: China 9,367 9,557 (2)% 4% Siemens (continuing operations) 77,769 71,977 8% 11% Worldwide, revenue related to external customers rose significantly at Smart Infrastructure and Digital Industries, while Mobility posted clearly higher revenue growth year-over-year. Revenue at Siemens Healthineers came in level with fiscal 2022 and was again the highest among industrial businesses. Revenue in Europe, C.I.S., Africa, Middle East increased with double-digit growth contributions from Digital Industries and Smart Infrastructure. Mobility reported clear revenue growth, which was held back by portfolio effects stemming from the sale of Yunex traffic in fiscal 2022. Revenues at Siemens Healthineers decreased slightly. Within the region in Germany, the same pattern applied for Digital Industries and Smart Infrastructure, while revenues at Mobility came in flat. A decline in Germany at Siemens Healthineers was primarily due to lower demand for rapid coronavirus antigen tests in the diagnostics business. In the Americas region, revenue was up in all four industrial businesses led by Smart Infrastructure with double-digit growth. Within the region in the U.S., Mobility and Siemens Healthineers reported slight revenue decreases. In the Asia, Australia region, revenue was up by on double-digit increase at Mobility, followed by revenue growth at Digital Industries and Smart Infrastructure. As with orders, revenue development both in the region and in China was held back by strong negative currency 14

Siemens Report FY2023 Page 15 Page 17

Siemens Report FY2023 Page 15 Page 17