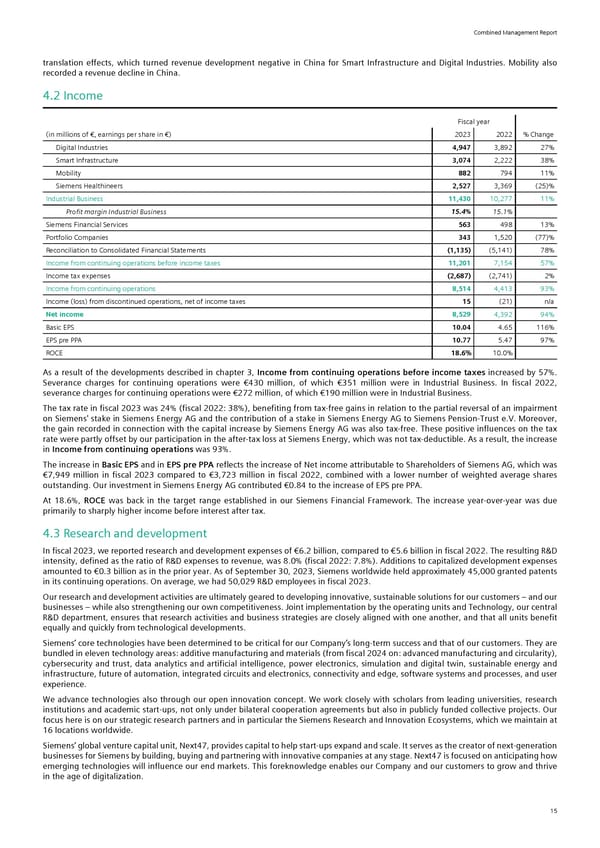

Combined Management Report translation effects, which turned revenue development negative in China for Smart Infrastructure and Digital Industries. Mobility also recorded a revenue decline in China. 4.2 Income Fiscal year (in millions of €, earnings per share in €) 2023 2022 % Change Digital Industries 4,947 3,892 27% Smart Infrastructure 3,074 2,222 38% Mobility 882 794 11% Siemens Healthineers 2,527 3,369 (25)% Industrial Business 11,430 10,277 11% Profit margin Industrial Business 15.4% 15.1% Siemens Financial Services 563 498 13% Portfolio Companies 343 1,520 (77)% Reconciliation to Consolidated Financial Statements (1,135) (5,141) 78% Income from continuing operations before income taxes 11,201 7,154 57% Income tax expenses (2,687) (2,741) 2% Income from continuing operations 8,514 4,413 93% Income (loss) from discontinued operations, net of income taxes 15 (21) n/a Net income 8,529 4,392 94% Basic EPS 10.04 4.65 116% EPS pre PPA 10.77 5.47 97% ROCE 18.6% 10.0% As a result of the developments described in chapter 3, Income from continuing operations before income taxes increased by 57%. Severance charges for continuing operations were €430 million, of which €351 million were in Industrial Business. In fiscal 2022, severance charges for continuing operations were €272 million, of which €190 million were in Industrial Business. The tax rate in fiscal 2023 was 24% (fiscal 2022: 38%), benefiting from tax-free gains in relation to the partial reversal of an impairment on Siemens' stake in Siemens Energy AG and the contribution of a stake in Siemens Energy AG to Siemens Pension-Trust e.V. Moreover, the gain recorded in connection with the capital increase by Siemens Energy AG was also tax-free. These positive influences on the tax rate were partly offset by our participation in the after-tax loss at Siemens Energy, which was not tax-deductible. As a result, the increase in Income from continuing operations was 93%. The increase in Basic EPS and in EPS pre PPA reflects the increase of Net income attributable to Shareholders of Siemens AG, which was €7,949 million in fiscal 2023 compared to €3,723 million in fiscal 2022, combined with a lower number of weighted average shares outstanding. Our investment in Siemens Energy AG contributed €0.84 to the increase of EPS pre PPA. At 18.6%, ROCE was back in the target range established in our Siemens Financial Framework. The increase year-over-year was due primarily to sharply higher income before interest after tax. 4.3 Research and development In fiscal 2023, we reported research and development expenses of €6.2 billion, compared to €5.6 billion in fiscal 2022. The resulting R&D intensity, defined as the ratio of R&D expenses to revenue, was 8.0% (fiscal 2022: 7.8%). Additions to capitalized development expenses amounted to €0.3 billion as in the prior year. As of September 30, 2023, Siemens worldwide held approximately 45,000 granted patents in its continuing operations. On average, we had 50,029 R&D employees in fiscal 2023. Our research and development activities are ultimately geared to developing innovative, sustainable solutions for our customers – and our businesses – while also strengthening our own competitiveness. Joint implementation by the operating units and Technology, our central R&D department, ensures that research activities and business strategies are closely aligned with one another, and that all units benefit equally and quickly from technological developments. Siemens’ core technologies have been determined to be critical for our Company’s long-term success and that of our customers. They are bundled in eleven technology areas: additive manufacturing and materials (from fiscal 2024 on: advanced manufacturing and circularity), cybersecurity and trust, data analytics and artificial intelligence, power electronics, simulation and digital twin, sustainable energy and infrastructure, future of automation, integrated circuits and electronics, connectivity and edge, software systems and processes, and user experience. We advance technologies also through our open innovation concept. We work closely with scholars from leading universities, research institutions and academic start-ups, not only under bilateral cooperation agreements but also in publicly funded collective projects. Our focus here is on our strategic research partners and in particular the Siemens Research and Innovation Ecosystems, which we maintain at 16 locations worldwide. Siemens’ global venture capital unit, Next47, provides capital to help start-ups expand and scale. It serves as the creator of next-generation businesses for Siemens by building, buying and partnering with innovative companies at any stage. Next47 is focused on anticipating how emerging technologies will influence our end markets. This foreknowledge enables our Company and our customers to grow and thrive in the age of digitalization. 15

Siemens Report FY2023 Page 16 Page 18

Siemens Report FY2023 Page 16 Page 18