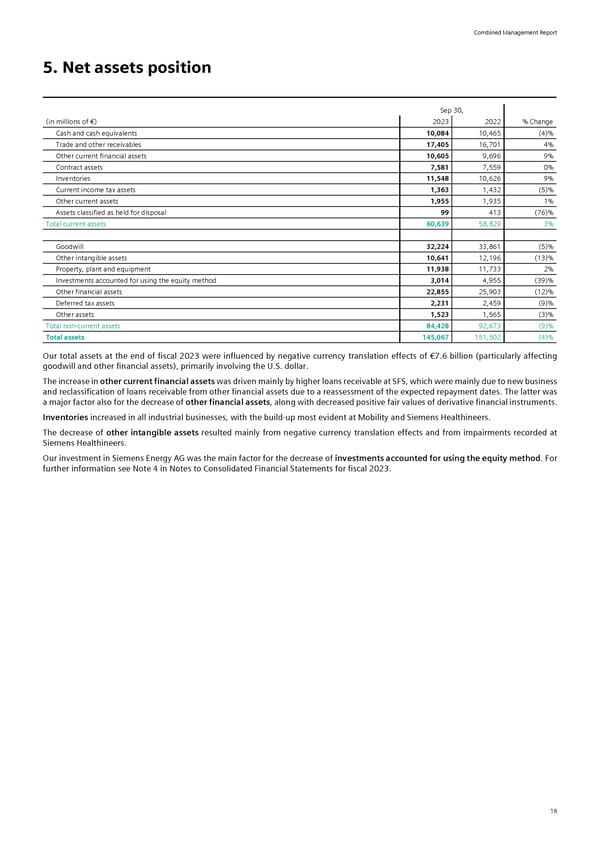

Combined Management Report 5. Net assets position Sep 30, (in millions of €) 2023 2022 % Change Cash and cash equivalents 10,084 10,465 (4)% Trade and other receivables 17,405 16,701 4% Other current financial assets 10,605 9,696 9% Contract assets 7,581 7,559 0% Inventories 11,548 10,626 9% Current income tax assets 1,363 1,432 (5)% Other current assets 1,955 1,935 1% Assets classified as held for disposal 99 413 (76)% Total current assets 60,639 58,829 3% Goodwill 32,224 33,861 (5)% Other intangible assets 10,641 12,196 (13)% Property, plant and equipment 11,938 11,733 2% Investments accounted for using the equity method 3,014 4,955 (39)% Other financial assets 22,855 25,903 (12)% Deferred tax assets 2,231 2,459 (9)% Other assets 1,523 1,565 (3)% Total non-current assets 84,428 92,673 (9)% Total assets 145,067 151,502 (4)% Our total assets at the end of fiscal 2023 were influenced by negative currency translation effects of €7.6 billion (particularly affecting goodwill and other financial assets), primarily involving the U.S. dollar. The increase in other current financial assets was driven mainly by higher loans receivable at SFS, which were mainly due to new business and reclassification of loans receivable from other financial assets due to a reassessment of the expected repayment dates. The latter was a major factor also for the decrease of other financial assets, along with decreased positive fair values of derivative financial instruments. Inventories increased in all industrial businesses, with the build-up most evident at Mobility and Siemens Healthineers. The decrease of other intangible assets resulted mainly from negative currency translation effects and from impairments recorded at Siemens Healthineers. Our investment in Siemens Energy AG was the main factor for the decrease of investments accounted for using the equity method. For further information see Note 4 in Notes to Consolidated Financial Statements for fiscal 2023. 16

Siemens Report FY2023 Page 17 Page 19

Siemens Report FY2023 Page 17 Page 19