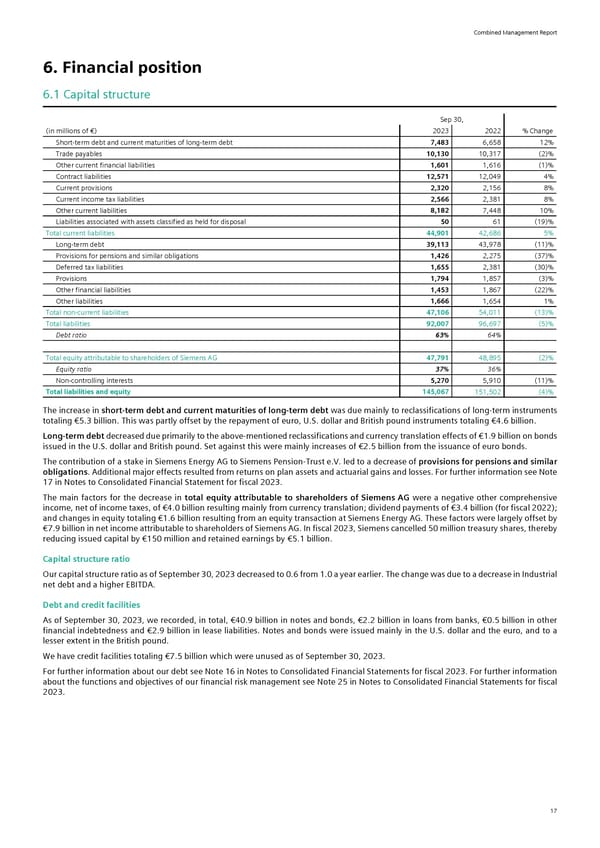

Combined Management Report 6. Financial position 6.1 Capital structure Sep 30, (in millions of €) 2023 2022 % Change Short-term debt and current maturities of long-term debt 7,483 6,658 12% Trade payables 10,130 10,317 (2)% Other current financial liabilities 1,601 1,616 (1)% Contract liabilities 12,571 12,049 4% Current provisions 2,320 2,156 8% Current income tax liabilities 2,566 2,381 8% Other current liabilities 8,182 7,448 10% Liabilities associated with assets classified as held for disposal 50 61 (19)% Total current liabilities 44,901 42,686 5% Long-term debt 39,113 43,978 (11)% Provisions for pensions and similar obligations 1,426 2,275 (37)% Deferred tax liabilities 1,655 2,381 (30)% Provisions 1,794 1,857 (3)% Other financial liabilities 1,453 1,867 (22)% Other liabilities 1,666 1,654 1% Total non-current liabilities 47,106 54,011 (13)% Total liabilities 92,007 96,697 (5)% Debt ratio 63% 64% Total equity attributable to shareholders of Siemens AG 47,791 48,895 (2)% Equity ratio 37% 36% Non-controlling interests 5,270 5,910 (11)% Total liabilities and equity 145,067 151,502 (4)% The increase in short-term debt and current maturities of long-term debt was due mainly to reclassifications of long-term instruments totaling €5.3 billion. This was partly offset by the repayment of euro, U.S. dollar and British pound instruments totaling €4.6 billion. Long-term debt decreased due primarily to the above-mentioned reclassifications and currency translation effects of €1.9 billion on bonds issued in the U.S. dollar and British pound. Set against this were mainly increases of €2.5 billion from the issuance of euro bonds. The contribution of a stake in Siemens Energy AG to Siemens Pension-Trust e.V. led to a decrease of provisions for pensions and similar obligations. Additional major effects resulted from returns on plan assets and actuarial gains and losses. For further information see Note 17 in Notes to Consolidated Financial Statement for fiscal 2023. The main factors for the decrease in total equity attributable to shareholders of Siemens AG were a negative other comprehensive income, net of income taxes, of €4.0 billion resulting mainly from currency translation; dividend payments of €3.4 billion (for fiscal 2022); and changes in equity totaling €1.6 billion resulting from an equity transaction at Siemens Energy AG. These factors were largely offset by €7.9 billion in net income attributable to shareholders of Siemens AG. In fiscal 2023, Siemens cancelled 50 million treasury shares, thereby reducing issued capital by €150 million and retained earnings by €5.1 billion. Capital structure ratio Our capital structure ratio as of September 30, 2023 decreased to 0.6 from 1.0 a year earlier. The change was due to a decrease in Industrial net debt and a higher EBITDA. Debt and credit facilities As of September 30, 2023, we recorded, in total, €40.9 billion in notes and bonds, €2.2 billion in loans from banks, €0.5 billion in other financial indebtedness and €2.9 billion in lease liabilities. Notes and bonds were issued mainly in the U.S. dollar and the euro, and to a lesser extent in the British pound. We have credit facilities totaling €7.5 billion which were unused as of September 30, 2023. For further information about our debt see Note 16 in Notes to Consolidated Financial Statements for fiscal 2023. For further information about the functions and objectives of our financial risk management see Note 25 in Notes to Consolidated Financial Statements for fiscal 2023. 17

Siemens Report FY2023 Page 18 Page 20

Siemens Report FY2023 Page 18 Page 20