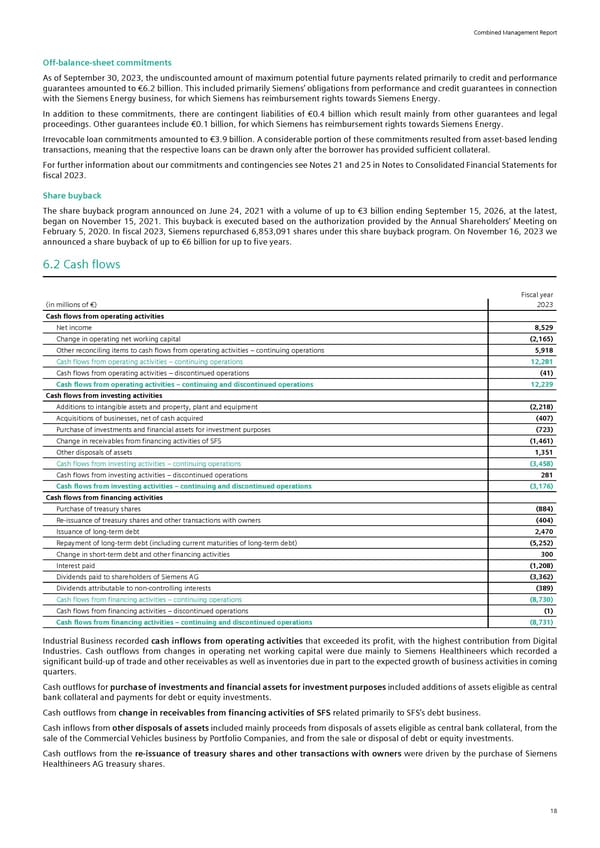

Combined Management Report Off-balance-sheet commitments As of September 30, 2023, the undiscounted amount of maximum potential future payments related primarily to credit and performance guarantees amounted to €6.2 billion. This included primarily Siemens’ obligations from performance and credit guarantees in connection with the Siemens Energy business, for which Siemens has reimbursement rights towards Siemens Energy. In addition to these commitments, there are contingent liabilities of €0.4 billion which result mainly from other guarantees and legal proceedings. Other guarantees include €0.1 billion, for which Siemens has reimbursement rights towards Siemens Energy. Irrevocable loan commitments amounted to €3.9 billion. A considerable portion of these commitments resulted from asset-based lending transactions, meaning that the respective loans can be drawn only after the borrower has provided sufficient collateral. For further information about our commitments and contingencies see Notes 21 and 25 in Notes to Consolidated Financial Statements for fiscal 2023. Share buyback The share buyback program announced on June 24, 2021 with a volume of up to €3 billion ending September 15, 2026, at the latest, began on November 15, 2021. This buyback is executed based on the authorization provided by the Annual Shareholders’ Meeting on February 5, 2020. In fiscal 2023, Siemens repurchased 6,853,091 shares under this share buyback program. On November 16, 2023 we announced a share buyback of up to €6 billion for up to five years. 6.2 Cash flows Fiscal year (in millions of €) 2023 Cash flows from operating activities Net income 8,529 Change in operating net working capital (2,165) Other reconciling items to cash flows from operating activities – continuing operations 5,918 Cash flows from operating activities – continuing operations 12,281 Cash flows from operating activities – discontinued operations (41) Cash flows from operating activities – continuing and discontinued operations 12,239 Cash flows from investing activities Additions to intangible assets and property, plant and equipment (2,218) Acquisitions of businesses, net of cash acquired (407) Purchase of investments and financial assets for investment purposes (723) Change in receivables from financing activities of SFS (1,461) Other disposals of assets 1,351 Cash flows from investing activities – continuing operations (3,458) Cash flows from investing activities – discontinued operations 281 Cash flows from investing activities – continuing and discontinued operations (3,176) Cash flows from financing activities Purchase of treasury shares (884) Re-issuance of treasury shares and other transactions with owners (404) Issuance of long-term debt 2,470 Repayment of long-term debt (including current maturities of long-term debt) (5,252) Change in short-term debt and other financing activities 300 Interest paid (1,208) Dividends paid to shareholders of Siemens AG (3,362) Dividends attributable to non-controlling interests (389) Cash flows from financing activities – continuing operations (8,730) Cash flows from financing activities – discontinued operations (1) Cash flows from financing activities – continuing and discontinued operations (8,731) Industrial Business recorded cash inflows from operating activities that exceeded its profit, with the highest contribution from Digital Industries. Cash outflows from changes in operating net working capital were due mainly to Siemens Healthineers which recorded a significant build-up of trade and other receivables as well as inventories due in part to the expected growth of business activities in coming quarters. Cash outflows for purchase of investments and financial assets for investment purposes included additions of assets eligible as central bank collateral and payments for debt or equity investments. Cash outflows from change in receivables from financing activities of SFS related primarily to SFS’s debt business. Cash inflows from other disposals of assets included mainly proceeds from disposals of assets eligible as central bank collateral, from the sale of the Commercial Vehicles business by Portfolio Companies, and from the sale or disposal of debt or equity investments. Cash outflows from the re-issuance of treasury shares and other transactions with owners were driven by the purchase of Siemens Healthineers AG treasury shares. 18

Siemens Report FY2023 Page 19 Page 21

Siemens Report FY2023 Page 19 Page 21