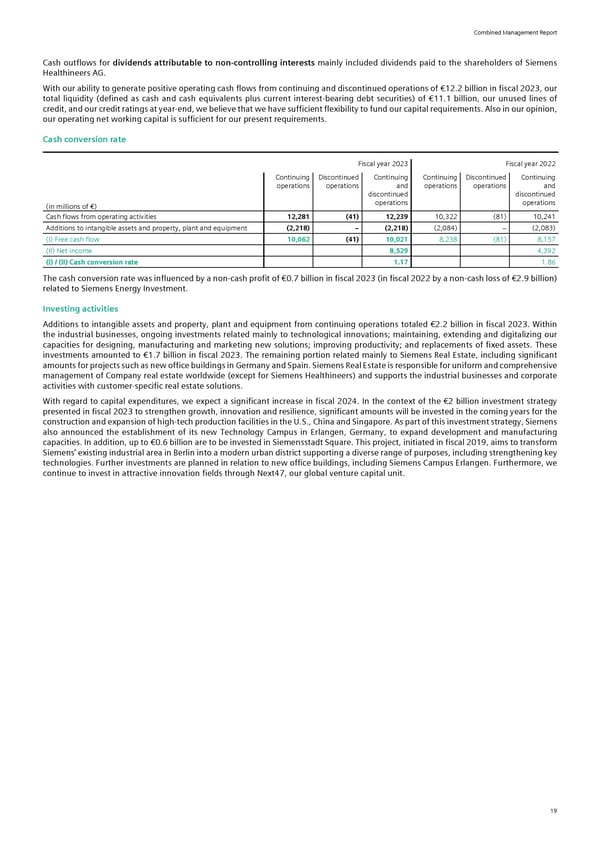

Combined Management Report Cash outflows for dividends attributable to non-controlling interests mainly included dividends paid to the shareholders of Siemens Healthineers AG. With our ability to generate positive operating cash flows from continuing and discontinued operations of €12.2 billion in fiscal 2023, our total liquidity (defined as cash and cash equivalents plus current interest-bearing debt securities) of €11.1 billion, our unused lines of credit, and our credit ratings at year-end, we believe that we have sufficient flexibility to fund our capital requirements. Also in our opinion, our operating net working capital is sufficient for our present requirements. Cash conversion rate Fiscal year 2023 Fiscal year 2022 Continuing Discontinued Continuing Continuing Discontinued Continuing operations operations and operations operations and discontinued discontinued (in millions of €) operations operations Cash flows from operating activities 12,281 (41) 12,239 10,322 (81) 10,241 Additions to intangible assets and property, plant and equipment (2,218) − (2,218) (2,084) − (2,083) (I) Free cash flow 10,062 (41) 10,021 8,238 (81) 8,157 (II) Net income 8,529 4,392 (I) / (II) Cash conversion rate 1.17 1.86 The cash conversion rate was influenced by a non-cash profit of €0.7 billion in fiscal 2023 (in fiscal 2022 by a non-cash loss of €2.9 billion) related to Siemens Energy Investment. Investing activities Additions to intangible assets and property, plant and equipment from continuing operations totaled €2.2 billion in fiscal 2023. Within the industrial businesses, ongoing investments related mainly to technological innovations; maintaining, extending and digitalizing our capacities for designing, manufacturing and marketing new solutions; improving productivity; and replacements of fixed assets. These investments amounted to €1.7 billion in fiscal 2023. The remaining portion related mainly to Siemens Real Estate, including significant amounts for projects such as new office buildings in Germany and Spain. Siemens Real Estate is responsible for uniform and comprehensive management of Company real estate worldwide (except for Siemens Healthineers) and supports the industrial businesses and corporate activities with customer-specific real estate solutions. With regard to capital expenditures, we expect a significant increase in fiscal 2024. In the context of the €2 billion investment strategy presented in fiscal 2023 to strengthen growth, innovation and resilience, significant amounts will be invested in the coming years for the construction and expansion of high-tech production facilities in the U.S., China and Singapore. As part of this investment strategy, Siemens also announced the establishment of its new Technology Campus in Erlangen, Germany, to expand development and manufacturing capacities. In addition, up to €0.6 billion are to be invested in Siemensstadt Square. This project, initiated in fiscal 2019, aims to transform Siemens’ existing industrial area in Berlin into a modern urban district supporting a diverse range of purposes, including strengthening key technologies. Further investments are planned in relation to new office buildings, including Siemens Campus Erlangen. Furthermore, we continue to invest in attractive innovation fields through Next47, our global venture capital unit. 19

Siemens Report FY2023 Page 20 Page 22

Siemens Report FY2023 Page 20 Page 22