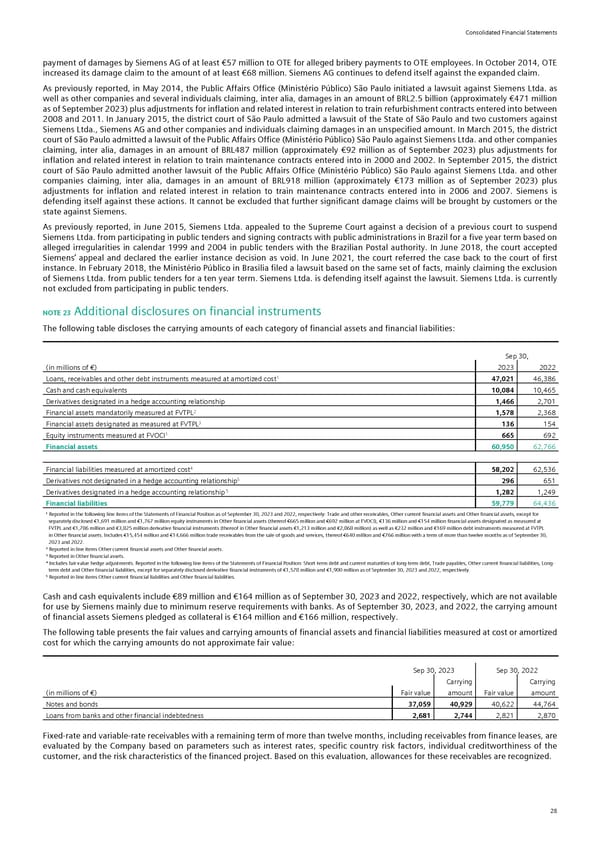

Consolidated Financial Statements payment of damages by Siemens AG of at least €57 million to OTE for alleged bribery payments to OTE employees. In October 2014, OTE increased its damage claim to the amount of at least €68 million. Siemens AG continues to defend itself against the expanded claim. As previously reported, in May 2014, the Public Affairs Office (Ministério Público) São Paulo initiated a lawsuit against Siemens Ltda. as well as other companies and several individuals claiming, inter alia, damages in an amount of BRL2.5 billion (approximately €471 million as of September 2023) plus adjustments for inflation and related interest in relation to train refurbishment contracts entered into between 2008 and 2011. In January 2015, the district court of São Paulo admitted a lawsuit of the State of São Paulo and two customers against Siemens Ltda., Siemens AG and other companies and individuals claiming damages in an unspecified amount. In March 2015, the district court of São Paulo admitted a lawsuit of the Public Affairs Office (Ministério Público) São Paulo against Siemens Ltda. and other companies claiming, inter alia, damages in an amount of BRL487 million (approximately €92 million as of September 2023) plus adjustments for inflation and related interest in relation to train maintenance contracts entered into in 2000 and 2002. In September 2015, the district court of São Paulo admitted another lawsuit of the Public Affairs Office (Ministério Público) São Paulo against Siemens Ltda. and other companies claiming, inter alia, damages in an amount of BRL918 million (approximately €173 million as of September 2023) plus adjustments for inflation and related interest in relation to train maintenance contracts entered into in 2006 and 2007. Siemens is defending itself against these actions. It cannot be excluded that further significant damage claims will be brought by customers or the state against Siemens. As previously reported, in June 2015, Siemens Ltda. appealed to the Supreme Court against a decision of a previous court to suspend Siemens Ltda. from participating in public tenders and signing contracts with public administrations in Brazil for a five year term based on alleged irregularities in calendar 1999 and 2004 in public tenders with the Brazilian Postal authority. In June 2018, the court accepted Siemens’ appeal and declared the earlier instance decision as void. In June 2021, the court referred the case back to the court of first instance. In February 2018, the Ministério Público in Brasilia filed a lawsuit based on the same set of facts, mainly claiming the exclusion of Siemens Ltda. from public tenders for a ten year term. Siemens Ltda. is defending itself against the lawsuit. Siemens Ltda. is currently not excluded from participating in public tenders. NOTE 23 Additional disclosures on financial instruments The following table discloses the carrying amounts of each category of financial assets and financial liabilities: Sep 30, (in millions of €) 2023 2022 1 47,021 Loans, receivables and other debt instruments measured at amortized cost 46,386 Cash and cash equivalents 10,084 10,465 Derivatives designated in a hedge accounting relationship 1,466 2,701 Financial assets mandatorily measured at FVTPL2 1,578 2,368 Financial assets designated as measured at FVTPL3 136 154 1 665 Equity instruments measured at FVOCI 692 Financial assets 60,950 62,766 Financial liabilities measured at amortized cost4 58,202 62,536 Derivatives not designated in a hedge accounting relationship5 296 651 5 1,282 Derivatives designated in a hedge accounting relationship 1,249 Financial liabilities 59,779 64,436 ¹ Reported in the following line items of the Statements of Financial Position as of September 30, 2023 and 2022, respectively: Trade and other receivables, Other current financial assets and Other financial assets, except for separately disclosed €1,691 million and €1,767 million equity instruments in Other financial assets (thereof €665 million and €692 million at FVOCI), €136 million and €154 million financial assets designated as measured at FVTPL and €1,786 million and €3,825 million derivative financial instruments (thereof in Other financial assets €1,213 million and €2,868 million) as well as €232 million and €169 million debt instruments measured at FVTPL in Other financial assets. Includes €15,454 million and €14,666 million trade receivables from the sale of goods and services, thereof €640 million and €766 million with a term of more than twelve months as of September 30, 2023 and 2022. ² Reported in line items Other current financial assets and Other financial assets. ³ Reported in Other financial assets. X Includes fair value hedge adjustments. Reported in the following line items of the Statements of Financial Position: Short-term debt and current maturities of long-term debt, Trade payables, Other current financial liabilities, Long- term debt and Other financial liabilities, except for separately disclosed derivative financial instruments of €1,578 million and €1,900 million as of September 30, 2023 and 2022, respectively. Y Reported in line items Other current financial liabilities and Other financial liabilities. Cash and cash equivalents include €89 million and €164 million as of September 30, 2023 and 2022, respectively, which are not available for use by Siemens mainly due to minimum reserve requirements with banks. As of September 30, 2023, and 2022, the carrying amount of financial assets Siemens pledged as collateral is €164 million and €166 million, respectively. The following table presents the fair values and carrying amounts of financial assets and financial liabilities measured at cost or amortized cost for which the carrying amounts do not approximate fair value: Sep 30, 2023 Sep 30, 2022 Carrying Carrying (in millions of €) Fair value amount Fair value amount Notes and bonds 37,059 40,929 40,622 44,764 Loans from banks and other financial indebtedness 2,681 2,744 2,821 2,870 Fixed-rate and variable-rate receivables with a remaining term of more than twelve months, including receivables from finance leases, are evaluated by the Company based on parameters such as interest rates, specific country risk factors, individual creditworthiness of the customer, and the risk characteristics of the financed project. Based on this evaluation, allowances for these receivables are recognized. 28

Siemens Report FY2023 Page 73 Page 75

Siemens Report FY2023 Page 73 Page 75