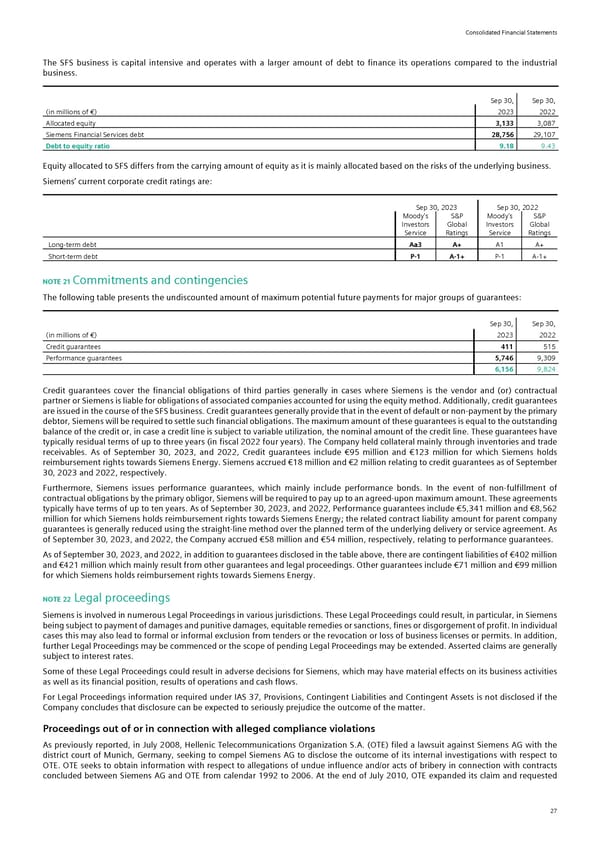

Consolidated Financial Statements The SFS business is capital intensive and operates with a larger amount of debt to finance its operations compared to the industrial business. Sep 30, Sep 30, (in millions of €) 2023 2022 Allocated equity 3,133 3,087 Siemens Financial Services debt 28,756 29,107 Debt to equity ratio 9.18 9.43 Equity allocated to SFS differs from the carrying amount of equity as it is mainly allocated based on the risks of the underlying business. Siemens’ current corporate credit ratings are: Sep 30, 2023 Sep 30, 2022 Moody's S&P Moody's S&P Investors Global Investors Global Service Ratings Service Ratings Long-term debt Aa3 A+ A1 A+ Short-term debt P-1 A-1+ P-1 A-1+ NOTE 21 Commitments and contingencies The following table presents the undiscounted amount of maximum potential future payments for major groups of guarantees: Sep 30, Sep 30, (in millions of €) 2023 2022 Credit guarantees 411 515 Performance guarantees 5,746 9,309 6,156 9,824 Credit guarantees cover the financial obligations of third parties generally in cases where Siemens is the vendor and (or) contractual partner or Siemens is liable for obligations of associated companies accounted for using the equity method. Additionally, credit guarantees are issued in the course of the SFS business. Credit guarantees generally provide that in the event of default or non-payment by the primary debtor, Siemens will be required to settle such financial obligations. The maximum amount of these guarantees is equal to the outstanding balance of the credit or, in case a credit line is subject to variable utilization, the nominal amount of the credit line. These guarantees have typically residual terms of up to three years (in fiscal 2022 four years). The Company held collateral mainly through inventories and trade receivables. As of September 30, 2023, and 2022, Credit guarantees include €95 million and €123 million for which Siemens holds reimbursement rights towards Siemens Energy. Siemens accrued €18 million and €2 million relating to credit guarantees as of September 30, 2023 and 2022, respectively. Furthermore, Siemens issues performance guarantees, which mainly include performance bonds. In the event of non-fulfillment of contractual obligations by the primary obligor, Siemens will be required to pay up to an agreed-upon maximum amount. These agreements typically have terms of up to ten years. As of September 30, 2023, and 2022, Performance guarantees include €5,341 million and €8,562 million for which Siemens holds reimbursement rights towards Siemens Energy; the related contract liability amount for parent company guarantees is generally reduced using the straight-line method over the planned term of the underlying delivery or service agreement. As of September 30, 2023, and 2022, the Company accrued €58 million and €54 million, respectively, relating to performance guarantees. As of September 30, 2023, and 2022, in addition to guarantees disclosed in the table above, there are contingent liabilities of €402 million and €421 million which mainly result from other guarantees and legal proceedings. Other guarantees include €71 million and €99 million for which Siemens holds reimbursement rights towards Siemens Energy. NOTE 22 Legal proceedings Siemens is involved in numerous Legal Proceedings in various jurisdictions. These Legal Proceedings could result, in particular, in Siemens being subject to payment of damages and punitive damages, equitable remedies or sanctions, fines or disgorgement of profit. In individual cases this may also lead to formal or informal exclusion from tenders or the revocation or loss of business licenses or permits. In addition, further Legal Proceedings may be commenced or the scope of pending Legal Proceedings may be extended. Asserted claims are generally subject to interest rates. Some of these Legal Proceedings could result in adverse decisions for Siemens, which may have material effects on its business activities as well as its financial position, results of operations and cash flows. For Legal Proceedings information required under IAS 37, Provisions, Contingent Liabilities and Contingent Assets is not disclosed if the Company concludes that disclosure can be expected to seriously prejudice the outcome of the matter. Proceedings out of or in connection with alleged compliance violations As previously reported, in July 2008, Hellenic Telecommunications Organization S.A. (OTE) filed a lawsuit against Siemens AG with the district court of Munich, Germany, seeking to compel Siemens AG to disclose the outcome of its internal investigations with respect to OTE. OTE seeks to obtain information with respect to allegations of undue influence and/or acts of bribery in connection with contracts concluded between Siemens AG and OTE from calendar 1992 to 2006. At the end of July 2010, OTE expanded its claim and requested 27

Siemens Report FY2023 Page 72 Page 74

Siemens Report FY2023 Page 72 Page 74