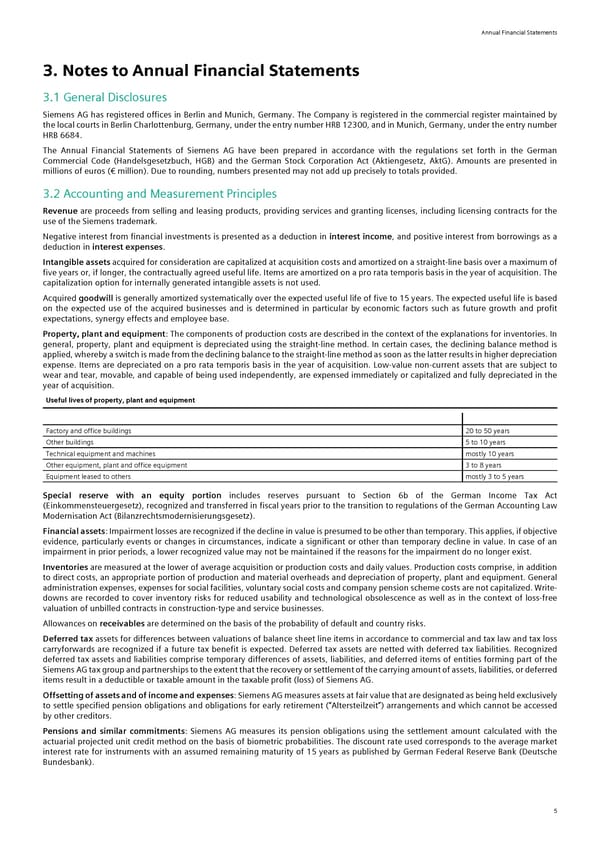

Annual Financial Statements 3. Notes to Annual Financial Statements 3.1 General Disclosures Siemens AG has registered offices in Berlin and Munich, Germany. The Company is registered in the commercial register maintained by the local courts in Berlin Charlottenburg, Germany, under the entry number HRB 12300, and in Munich, Germany, under the entry number HRB 6684. The Annual Financial Statements of Siemens AG have been prepared in accordance with the regulations set forth in the German Commercial Code (Handelsgesetzbuch, HGB) and the German Stock Corporation Act (Aktiengesetz, AktG). Amounts are presented in millions of euros (€ million). Due to rounding, numbers presented may not add up precisely to totals provided. 3.2 Accounting and Measurement Principles Revenue are proceeds from selling and leasing products, providing services and granting licenses, including licensing contracts for the use of the Siemens trademark. Negative interest from financial investments is presented as a deduction in interest income, and positive interest from borrowings as a deduction in interest expenses. Intangible assets acquired for consideration are capitalized at acquisition costs and amortized on a straight-line basis over a maximum of five years or, if longer, the contractually agreed useful life. Items are amortized on a pro rata temporis basis in the year of acquisition. The capitalization option for internally generated intangible assets is not used. Acquired goodwill is generally amortized systematically over the expected useful life of five to 15 years. The expected useful life is based on the expected use of the acquired businesses and is determined in particular by economic factors such as future growth and profit expectations, synergy effects and employee base. Property, plant and equipment: The components of production costs are described in the context of the explanations for inventories. In general, property, plant and equipment is depreciated using the straight-line method. In certain cases, the declining balance method is applied, whereby a switch is made from the declining balance to the straight-line method as soon as the latter results in higher depreciation expense. Items are depreciated on a pro rata temporis basis in the year of acquisition. Low-value non-current assets that are subject to wear and tear, movable, and capable of being used independently, are expensed immediately or capitalized and fully depreciated in the year of acquisition. Useful lives of property, plant and equipment Factory and office buildings 20 to 50 years Other buildings 5 to 10 years Technical equipment and machines mostly 10 years Other equipment, plant and office equipment 3 to 8 years Equipment leased to others mostly 3 to 5 years Special reserve with an equity portion includes reserves pursuant to Section 6b of the German Income Tax Act (Einkommensteuergesetz), recognized and transferred in fiscal years prior to the transition to regulations of the German Accounting Law Modernisation Act (Bilanzrechtsmodernisierungsgesetz). Financial assets: Impairment losses are recognized if the decline in value is presumed to be other than temporary. This applies, if objective evidence, particularly events or changes in circumstances, indicate a significant or other than temporary decline in value. In case of an impairment in prior periods, a lower recognized value may not be maintained if the reasons for the impairment do no longer exist. Inventories are measured at the lower of average acquisition or production costs and daily values. Production costs comprise, in addition to direct costs, an appropriate portion of production and material overheads and depreciation of property, plant and equipment. General administration expenses, expenses for social facilities, voluntary social costs and company pension scheme costs are not capitalized. Write- downs are recorded to cover inventory risks for reduced usability and technological obsolescence as well as in the context of loss-free valuation of unbilled contracts in construction-type and service businesses. Allowances on receivables are determined on the basis of the probability of default and country risks. Deferred tax assets for differences between valuations of balance sheet line items in accordance to commercial and tax law and tax loss carryforwards are recognized if a future tax benefit is expected. Deferred tax assets are netted with deferred tax liabilities. Recognized deferred tax assets and liabilities comprise temporary differences of assets, liabilities, and deferred items of entities forming part of the Siemens AG tax group and partnerships to the extent that the recovery or settlement of the carrying amount of assets, liabilities, or deferred items result in a deductible or taxable amount in the taxable profit (loss) of Siemens AG. Offsetting of assets and of income and expenses: Siemens AG measures assets at fair value that are designated as being held exclusively to settle specified pension obligations and obligations for early retirement (“Altersteilzeit”) arrangements and which cannot be accessed by other creditors. Pensions and similar commitments: Siemens AG measures its pension obligations using the settlement amount calculated with the actuarial projected unit credit method on the basis of biometric probabilities. The discount rate used corresponds to the average market interest rate for instruments with an assumed remaining maturity of 15 years as published by German Federal Reserve Bank (Deutsche Bundesbank). 5

Siemens Report FY2023 Page 120 Page 122

Siemens Report FY2023 Page 120 Page 122