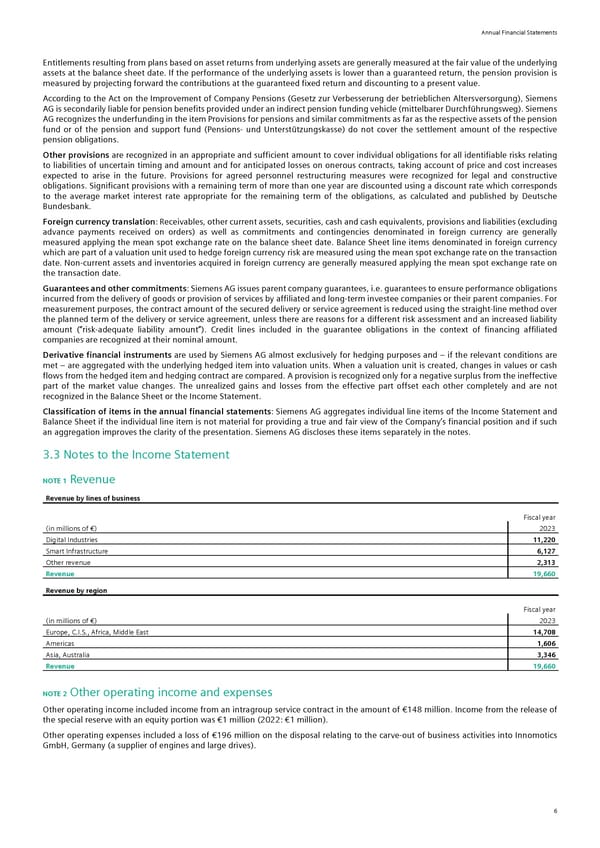

Annual Financial Statements Entitlements resulting from plans based on asset returns from underlying assets are generally measured at the fair value of the underlying assets at the balance sheet date. If the performance of the underlying assets is lower than a guaranteed return, the pension provision is measured by projecting forward the contributions at the guaranteed fixed return and discounting to a present value. According to the Act on the Improvement of Company Pensions (Gesetz zur Verbesserung der betrieblichen Altersversorgung), Siemens AG is secondarily liable for pension benefits provided under an indirect pension funding vehicle (mittelbarer Durchführungsweg). Siemens AG recognizes the underfunding in the item Provisions for pensions and similar commitments as far as the respective assets of the pension fund or of the pension and support fund (Pensions- und Unterstützungskasse) do not cover the settlement amount of the respective pension obligations. Other provisions are recognized in an appropriate and sufficient amount to cover individual obligations for all identifiable risks relating to liabilities of uncertain timing and amount and for anticipated losses on onerous contracts, taking account of price and cost increases expected to arise in the future. Provisions for agreed personnel restructuring measures were recognized for legal and constructive obligations. Significant provisions with a remaining term of more than one year are discounted using a discount rate which corresponds to the average market interest rate appropriate for the remaining term of the obligations, as calculated and published by Deutsche Bundesbank. Foreign currency translation: Receivables, other current assets, securities, cash and cash equivalents, provisions and liabilities (excluding advance payments received on orders) as well as commitments and contingencies denominated in foreign currency are generally measured applying the mean spot exchange rate on the balance sheet date. Balance Sheet line items denominated in foreign currency which are part of a valuation unit used to hedge foreign currency risk are measured using the mean spot exchange rate on the transaction date. Non-current assets and inventories acquired in foreign currency are generally measured applying the mean spot exchange rate on the transaction date. Guarantees and other commitments: Siemens AG issues parent company guarantees, i.e. guarantees to ensure performance obligations incurred from the delivery of goods or provision of services by affiliated and long-term investee companies or their parent companies. For measurement purposes, the contract amount of the secured delivery or service agreement is reduced using the straight-line method over the planned term of the delivery or service agreement, unless there are reasons for a different risk assessment and an increased liability amount (“risk-adequate liability amount”). Credit lines included in the guarantee obligations in the context of financing affiliated companies are recognized at their nominal amount. Derivative financial instruments are used by Siemens AG almost exclusively for hedging purposes and – if the relevant conditions are met – are aggregated with the underlying hedged item into valuation units. When a valuation unit is created, changes in values or cash flows from the hedged item and hedging contract are compared. A provision is recognized only for a negative surplus from the ineffective part of the market value changes. The unrealized gains and losses from the effective part offset each other completely and are not recognized in the Balance Sheet or the Income Statement. Classification of items in the annual financial statements: Siemens AG aggregates individual line items of the Income Statement and Balance Sheet if the individual line item is not material for providing a true and fair view of the Company’s financial position and if such an aggregation improves the clarity of the presentation. Siemens AG discloses these items separately in the notes. 3.3 Notes to the Income Statement NOTE 1 Revenue Revenue by lines of business Fiscal year (in millions of €) 2023 Digital Industries 11,220 Smart Infrastructure 6,127 Other revenue 2,313 Revenue 19,660 Revenue by region Fiscal year (in millions of €) 2023 Europe, C.I.S., Africa, Middle East 14,708 Americas 1,606 Asia, Australia 3,346 Revenue 19,660 NOTE 2 Other operating income and expenses Other operating income included income from an intragroup service contract in the amount of €148 million. Income from the release of the special reserve with an equity portion was €1 million (2022: €1 million). Other operating expenses included a loss of €196 million on the disposal relating to the carve-out of business activities into Innomotics GmbH, Germany (a supplier of engines and large drives). 6

Siemens Report FY2023 Page 121 Page 123

Siemens Report FY2023 Page 121 Page 123