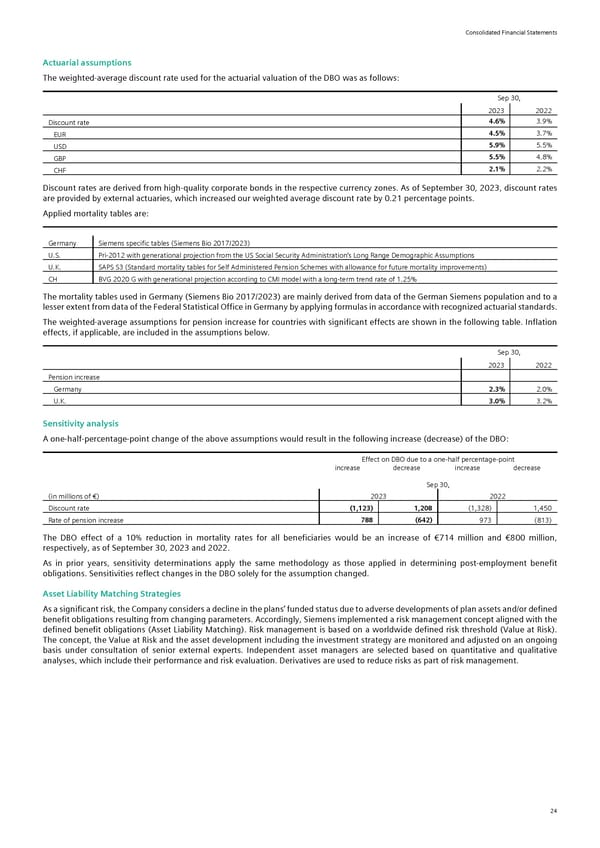

Consolidated Financial Statements Actuarial assumptions The weighted-average discount rate used for the actuarial valuation of the DBO was as follows: Sep 30, 2023 2022 Discount rate 4.6% 3.9% EUR 4.5% 3.7% USD 5.9% 5.5% GBP 5.5% 4.8% CHF 2.1% 2.2% Discount rates are derived from high-quality corporate bonds in the respective currency zones. As of September 30, 2023, discount rates are provided by external actuaries, which increased our weighted average discount rate by 0.21 percentage points. Applied mortality tables are: Germany Siemens specific tables (Siemens Bio 2017/2023) U.S. Pri-2012 with generational projection from the US Social Security Administration’s Long Range Demographic Assumptions U.K. SAPS S3 (Standard mortality tables for Self Administered Pension Schemes with allowance for future mortality improvements) CH BVG 2020 G with generational projection according to CMI model with a long-term trend rate of 1.25% The mortality tables used in Germany (Siemens Bio 2017/2023) are mainly derived from data of the German Siemens population and to a lesser extent from data of the Federal Statistical Office in Germany by applying formulas in accordance with recognized actuarial standards. The weighted-average assumptions for pension increase for countries with significant effects are shown in the following table. Inflation effects, if applicable, are included in the assumptions below. Sep 30, 2023 2022 Pension increase Germany 2.3% 2.0% U.K. 3.0% 3.2% Sensitivity analysis A one-half-percentage-point change of the above assumptions would result in the following increase (decrease) of the DBO: Effect on DBO due to a one-half percentage-point increase decrease increase decrease Sep 30, (in millions of €) 2023 2022 Discount rate (1,123) 1,208 (1,328) 1,450 Rate of pension increase 788 (642) 973 (813) The DBO effect of a 10% reduction in mortality rates for all beneficiaries would be an increase of €714 million and €800 million, respectively, as of September 30, 2023 and 2022. As in prior years, sensitivity determinations apply the same methodology as those applied in determining post-employment benefit obligations. Sensitivities reflect changes in the DBO solely for the assumption changed. Asset Liability Matching Strategies As a significant risk, the Company considers a decline in the plans’ funded status due to adverse developments of plan assets and/or defined benefit obligations resulting from changing parameters. Accordingly, Siemens implemented a risk management concept aligned with the defined benefit obligations (Asset Liability Matching). Risk management is based on a worldwide defined risk threshold (Value at Risk). The concept, the Value at Risk and the asset development including the investment strategy are monitored and adjusted on an ongoing basis under consultation of senior external experts. Independent asset managers are selected based on quantitative and qualitative analyses, which include their performance and risk evaluation. Derivatives are used to reduce risks as part of risk management. 24

Siemens Report FY2023 Page 69 Page 71

Siemens Report FY2023 Page 69 Page 71