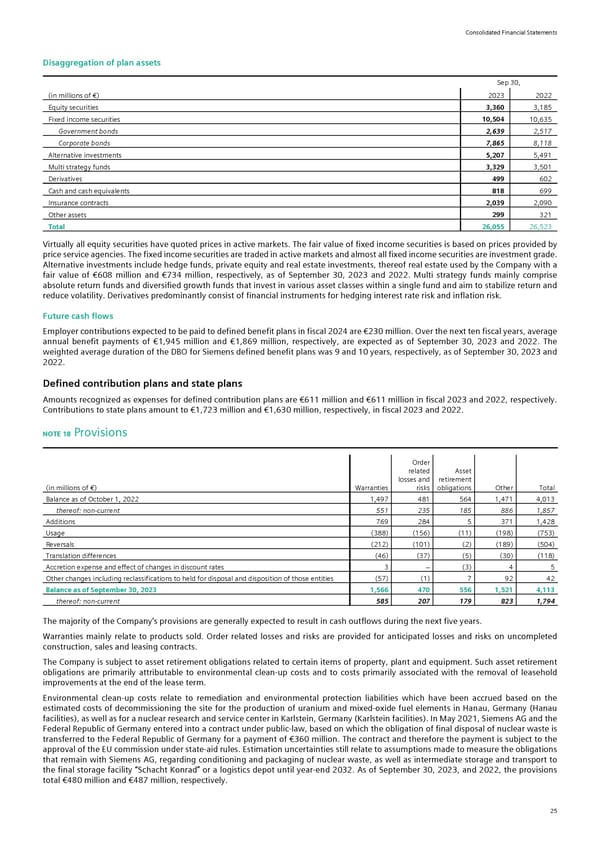

Consolidated Financial Statements Disaggregation of plan assets Sep 30, (in millions of €) 2023 2022 Equity securities 3,360 3,185 Fixed income securities 10,504 10,635 Government bonds 2,639 2,517 Corporate bonds 7,865 8,118 Alternative investments 5,207 5,491 Multi strategy funds 3,329 3,501 Derivatives 499 602 Cash and cash equivalents 818 699 Insurance contracts 2,039 2,090 Other assets 299 321 Total 26,055 26,523 Virtually all equity securities have quoted prices in active markets. The fair value of fixed income securities is based on prices provided by price service agencies. The fixed income securities are traded in active markets and almost all fixed income securities are investment grade. Alternative investments include hedge funds, private equity and real estate investments, thereof real estate used by the Company with a fair value of €608 million and €734 million, respectively, as of September 30, 2023 and 2022. Multi strategy funds mainly comprise absolute return funds and diversified growth funds that invest in various asset classes within a single fund and aim to stabilize return and reduce volatility. Derivatives predominantly consist of financial instruments for hedging interest rate risk and inflation risk. Future cash flows Employer contributions expected to be paid to defined benefit plans in fiscal 2024 are €230 million. Over the next ten fiscal years, average annual benefit payments of €1,945 million and €1,869 million, respectively, are expected as of September 30, 2023 and 2022. The weighted average duration of the DBO for Siemens defined benefit plans was 9 and 10 years, respectively, as of September 30, 2023 and 2022. Defined contribution plans and state plans Amounts recognized as expenses for defined contribution plans are €611 million and €611 million in fiscal 2023 and 2022, respectively. Contributions to state plans amount to €1,723 million and €1,630 million, respectively, in fiscal 2023 and 2022. NOTE 18 Provisions Order related Asset losses and retirement (in millions of €) Warranties risks obligations Other Total Balance as of October 1, 2022 1,497 481 564 1,471 4,013 thereof: non-current 551 235 185 886 1,857 Additions 769 284 5 371 1,428 Usage (388) (156) (11) (198) (753) Reversals (212) (101) (2) (189) (504) Translation differences (46) (37) (5) (30) (118) Accretion expense and effect of changes in discount rates 3 > (3) 4 5 Other changes including reclassifications to held for disposal and disposition of those entities (57) (1) 7 92 42 Balance as of September 30, 2023 1,566 470 556 1,521 4,113 thereof: non-current 585 207 179 823 1,794 The majority of the Company’s provisions are generally expected to result in cash outflows during the next five years. Warranties mainly relate to products sold. Order related losses and risks are provided for anticipated losses and risks on uncompleted construction, sales and leasing contracts. The Company is subject to asset retirement obligations related to certain items of property, plant and equipment. Such asset retirement obligations are primarily attributable to environmental clean-up costs and to costs primarily associated with the removal of leasehold improvements at the end of the lease term. Environmental clean-up costs relate to remediation and environmental protection liabilities which have been accrued based on the estimated costs of decommissioning the site for the production of uranium and mixed-oxide fuel elements in Hanau, Germany (Hanau facilities), as well as for a nuclear research and service center in Karlstein, Germany (Karlstein facilities). In May 2021, Siemens AG and the Federal Republic of Germany entered into a contract under public-law, based on which the obligation of final disposal of nuclear waste is transferred to the Federal Republic of Germany for a payment of €360 million. The contract and therefore the payment is subject to the approval of the EU commission under state-aid rules. Estimation uncertainties still relate to assumptions made to measure the obligations that remain with Siemens AG, regarding conditioning and packaging of nuclear waste, as well as intermediate storage and transport to the final storage facility “Schacht Konrad” or a logistics depot until year-end 2032. As of September 30, 2023, and 2022, the provisions total €480 million and €487 million, respectively. 25

Siemens Report FY2023 Page 70 Page 72

Siemens Report FY2023 Page 70 Page 72