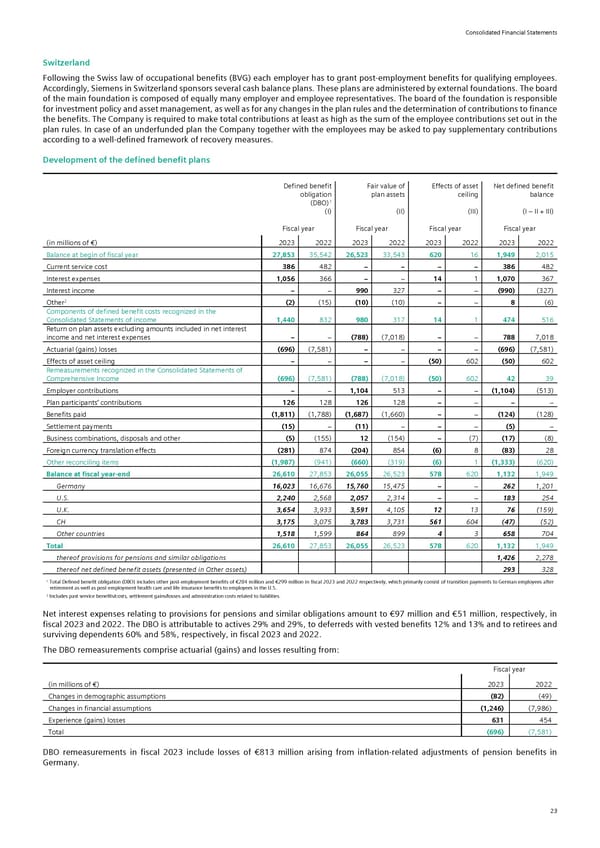

Consolidated Financial Statements Switzerland Following the Swiss law of occupational benefits (BVG) each employer has to grant post-employment benefits for qualifying employees. Accordingly, Siemens in Switzerland sponsors several cash balance plans. These plans are administered by external foundations. The board of the main foundation is composed of equally many employer and employee representatives. The board of the foundation is responsible for investment policy and asset management, as well as for any changes in the plan rules and the determination of contributions to finance the benefits. The Company is required to make total contributions at least as high as the sum of the employee contributions set out in the plan rules. In case of an underfunded plan the Company together with the employees may be asked to pay supplementary contributions according to a well-defined framework of recovery measures. Development of the defined benefit plans Defined benefit Fair value of Effects of asset Net defined benefit obligation plan assets ceiling balance 1 (DBO) (I) (II) (III) (I – II + III) Fiscal year Fiscal year Fiscal year Fiscal year (in millions of €) 2023 2022 2023 2022 2023 2022 2023 2022 Balance at begin of fiscal year 27,853 35,542 26,523 33,543 620 16 1,949 2,015 Current service cost 386 482 − − − − 386 482 Interest expenses 1,056 366 − > 14 1 1,070 367 Interest income − > 990 327 − > (990) (327) 2 (2) (10) − 8 Other (15) (10) > (6) Components of defined benefit costs recognized in the Consolidated Statements of income 1,440 832 980 317 14 1 474 516 Return on plan assets excluding amounts included in net interest income and net interest expenses − > (788) (7,018) − > 788 7,018 Actuarial (gains) losses (696) (7,581) − > − > (696) (7,581) Effects of asset ceiling − > − > (50) 602 (50) 602 Remeasurements recognized in the Consolidated Statements of Comprehensive Income (696) (7,581) (788) (7,018) (50) 602 42 39 Employer contributions − > 1,104 513 − > (1,104) (513) Plan participants’ contributions 126 128 126 128 − > − > Benefits paid (1,811) (1,788) (1,687) (1,660) − > (124) (128) Settlement payments (15) > (11) > − > (5) > Business combinations, disposals and other (5) (155) 12 (154) − (7) (17) (8) Foreign currency translation effects (281) 874 (204) 854 (6) 8 (83) 28 Other reconciling items (1,987) (941) (660) (319) (6) 1 (1,333) (620) Balance at fiscal year-end 26,610 27,853 26,055 26,523 578 620 1,132 1,949 Germany 16,023 16,676 15,760 15,475 − > 262 1,201 U.S. 2,240 2,568 2,057 2,314 − − 183 254 U.K. 3,654 3,933 3,591 4,105 12 13 76 (159) CH 3,175 3,075 3,783 3,731 561 604 (47) (52) Other countries 1,518 1,599 864 899 4 3 658 704 Total 26,610 27,853 26,055 26,523 578 620 1,132 1,949 thereof provisions for pensions and similar obligations 1,426 2,278 thereof net defined benefit assets (presented in Other assets) 293 328 1 Total Defined benefit obligation (DBO) includes other post-employment benefits of €284 million and €299 million in fiscal 2023 and 2022 respectively, which primarily consist of transition payments to German employees after retirement as well as post-employment health care and life insurance benefits to employees in the U.S. 2 Includes past service benefits/costs, settlement gains/losses and administration costs related to liabilities. Net interest expenses relating to provisions for pensions and similar obligations amount to €97 million and €51 million, respectively, in fiscal 2023 and 2022. The DBO is attributable to actives 29% and 29%, to deferreds with vested benefits 12% and 13% and to retirees and surviving dependents 60% and 58%, respectively, in fiscal 2023 and 2022. The DBO remeasurements comprise actuarial (gains) and losses resulting from: Fiscal year (in millions of €) 2023 2022 Changes in demographic assumptions (82) (49) Changes in financial assumptions (1,246) (7,986) Experience (gains) losses 631 454 Total (696) (7,581) DBO remeasurements in fiscal 2023 include losses of €813 million arising from inflation-related adjustments of pension benefits in Germany. 23

Siemens Report FY2023 Page 68 Page 70

Siemens Report FY2023 Page 68 Page 70