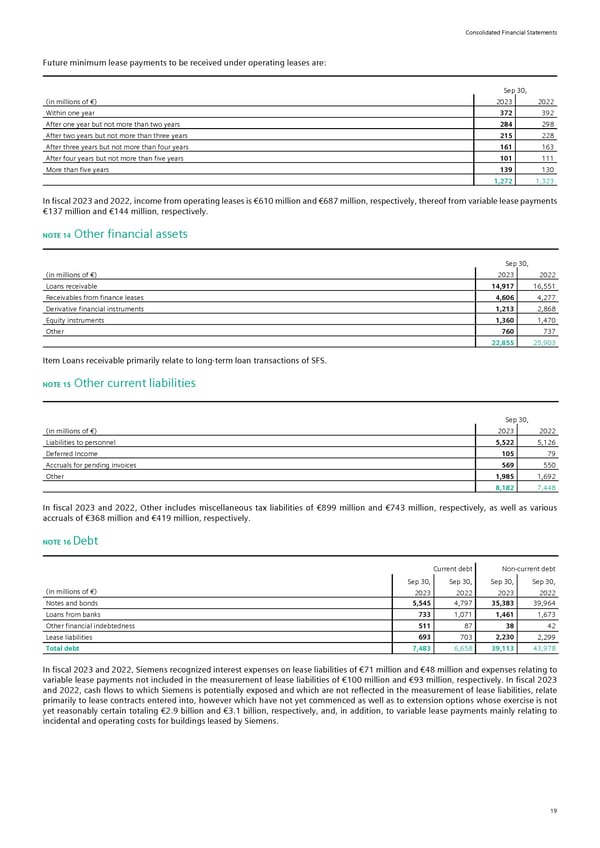

Consolidated Financial Statements Future minimum lease payments to be received under operating leases are: Sep 30, (in millions of €) 2023 2022 Within one year 372 392 After one year but not more than two years 284 298 After two years but not more than three years 215 228 After three years but not more than four years 161 163 After four years but not more than five years 101 111 More than five years 139 130 1,272 1,323 In fiscal 2023 and 2022, income from operating leases is €610 million and €687 million, respectively, thereof from variable lease payments €137 million and €144 million, respectively. NOTE 14 Other financial assets Sep 30, (in millions of €) 2023 2022 Loans receivable 14,917 16,551 Receivables from finance leases 4,606 4,277 Derivative financial instruments 1,213 2,868 Equity instruments 1,360 1,470 Other 760 737 22,855 25,903 Item Loans receivable primarily relate to long-term loan transactions of SFS. NOTE 15 Other current liabilities Sep 30, (in millions of €) 2023 2022 Liabilities to personnel 5,522 5,126 Deferred Income 105 79 Accruals for pending invoices 569 550 Other 1,985 1,692 8,182 7,448 In fiscal 2023 and 2022, Other includes miscellaneous tax liabilities of €899 million and €743 million, respectively, as well as various accruals of €368 million and €419 million, respectively. NOTE 16 Debt Current debt Non-current debt Sep 30, Sep 30, Sep 30, Sep 30, (in millions of €) 2023 2022 2023 2022 Notes and bonds 5,545 4,797 35,383 39,964 Loans from banks 733 1,071 1,461 1,673 Other financial indebtedness 511 87 38 42 Lease liabilities 693 703 2,230 2,299 Total debt 7,483 6,658 39,113 43,978 In fiscal 2023 and 2022, Siemens recognized interest expenses on lease liabilities of €71 million and €48 million and expenses relating to variable lease payments not included in the measurement of lease liabilities of €100 million and €93 million, respectively. In fiscal 2023 and 2022, cash flows to which Siemens is potentially exposed and which are not reflected in the measurement of lease liabilities, relate primarily to lease contracts entered into, however which have not yet commenced as well as to extension options whose exercise is not yet reasonably certain totaling €2.9 billion and €3.1 billion, respectively, and, in addition, to variable lease payments mainly relating to incidental and operating costs for buildings leased by Siemens. 19

Siemens Report FY2023 Page 64 Page 66

Siemens Report FY2023 Page 64 Page 66