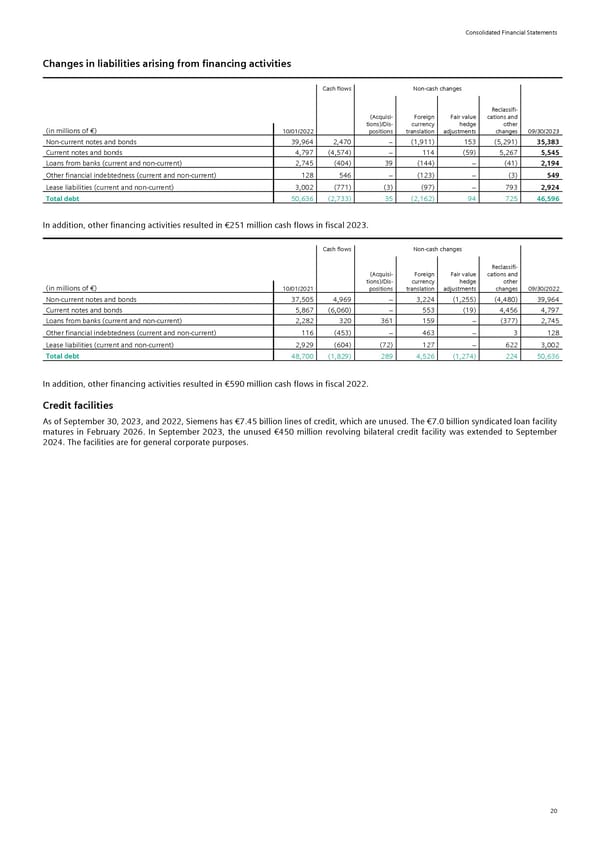

Consolidated Financial Statements Changes in liabilities arising from financing activities Cash flows Non-cash changes Reclassifi- (Acquisi- Foreign Fair value cations and tions)/Dis- currency hedge other (in millions of €) 10/01/2022 positions translation adjustments changes 09/30/2023 Non-current notes and bonds 39,964 2,470 > (1,911) 153 (5,291) 35,383 Current notes and bonds 4,797 (4,574) > 114 (59) 5,267 5,545 Loans from banks (current and non-current) 2,745 (404) 39 (144) > (41) 2,194 Other financial indebtedness (current and non-current) 128 546 > (123) > (3) 549 Lease liabilities (current and non-current) 3,002 (771) (3) (97) > 793 2,924 Total debt 50,636 (2,733) 35 (2,162) 94 725 46,596 In addition, other financing activities resulted in €251 million cash flows in fiscal 2023. Cash flows Non-cash changes Reclassifi- (Acquisi- Foreign Fair value cations and tions)/Dis- currency hedge other (in millions of €) 10/01/2021 positions translation adjustments changes 09/30/2022 Non-current notes and bonds 37,505 4,969 > 3,224 (1,255) (4,480) 39,964 Current notes and bonds 5,867 (6,060) > 553 (19) 4,456 4,797 Loans from banks (current and non-current) 2,282 320 361 159 > (377) 2,745 Other financial indebtedness (current and non-current) 116 (453) > 463 > 3 128 Lease liabilities (current and non-current) 2,929 (604) (72) 127 > 622 3,002 Total debt 48,700 (1,829) 289 4,526 (1,274) 224 50,636 In addition, other financing activities resulted in €590 million cash flows in fiscal 2022. Credit facilities As of September 30, 2023, and 2022, Siemens has €7.45 billion lines of credit, which are unused. The €7.0 billion syndicated loan facility matures in February 2026. In September 2023, the unused €450 million revolving bilateral credit facility was extended to September 2024. The facilities are for general corporate purposes. 20

Siemens Report FY2023 Page 65 Page 67

Siemens Report FY2023 Page 65 Page 67