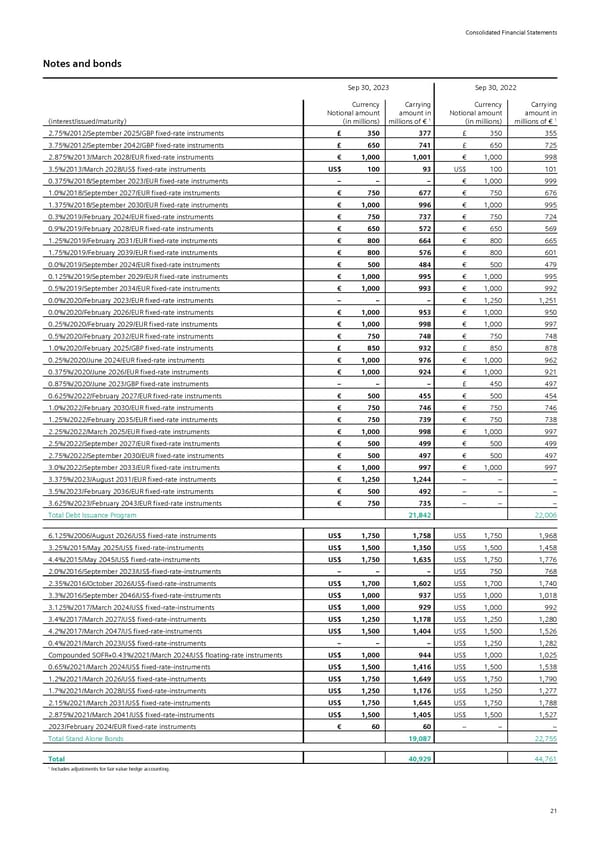

Consolidated Financial Statements Notes and bonds Sep 30, 2023 Sep 30, 2022 Currency Carrying Currency Carrying Notional amount amount in Notional amount amount in (interest/issued/maturity) (in millions) millions of € 1 (in millions) millions of € 1 2.75%/2012/September 2025/GBP fixed-rate instruments £ 350 377 £ 350 355 3.75%/2012/September 2042/GBP fixed-rate instruments £ 650 741 £ 650 725 2.875%/2013/March 2028/EUR fixed-rate instruments € 1,000 1,001 € 1,000 998 3.5%/2013/March 2028/US$ fixed-rate instruments US$ 100 93 US$ 100 101 0.375%/2018/September 2023/EUR fixed-rate instruments – – – € 1,000 999 1.0%/2018/September 2027/EUR fixed-rate instruments € 750 677 € 750 676 1.375%/2018/September 2030/EUR fixed-rate instruments € 1,000 996 € 1,000 995 0.3%/2019/February 2024/EUR fixed-rate instruments € 750 737 € 750 724 0.9%/2019/February 2028/EUR fixed-rate instruments € 650 572 € 650 569 1.25%/2019/February 2031/EUR fixed-rate instruments € 800 664 € 800 665 1.75%/2019/February 2039/EUR fixed-rate instruments € 800 576 € 800 601 0.0%/2019/September 2024/EUR fixed-rate instruments € 500 484 € 500 479 0.125%/2019/September 2029/EUR fixed-rate instruments € 1,000 995 € 1,000 995 0.5%/2019/September 2034/EUR fixed-rate instruments € 1,000 993 € 1,000 992 0.0%/2020/February 2023/EUR fixed-rate instruments – – – € 1,250 1,251 0.0%/2020/February 2026/EUR fixed-rate instruments € 1,000 953 € 1,000 950 0.25%/2020/February 2029/EUR fixed-rate instruments € 1,000 998 € 1,000 997 0.5%/2020/February 2032/EUR fixed-rate instruments € 750 748 € 750 748 1.0%/2020/February 2025/GBP fixed-rate instruments £ 850 932 £ 850 878 0.25%/2020/June 2024/EUR fixed-rate instruments € 1,000 976 € 1,000 962 0.375%/2020/June 2026/EUR fixed-rate instruments € 1,000 924 € 1,000 921 0.875%/2020/June 2023/GBP fixed-rate instruments – – – £ 450 497 0.625%/2022/February 2027/EUR fixed-rate instruments € 500 455 € 500 454 1.0%/2022/February 2030/EUR fixed-rate instruments € 750 746 € 750 746 1.25%/2022/February 2035/EUR fixed-rate instruments € 750 739 € 750 738 2.25%/2022/March 2025/EUR fixed-rate instruments € 1,000 998 € 1,000 997 2.5%/2022/September 2027/EUR fixed-rate instruments € 500 499 € 500 499 2.75%/2022/September 2030/EUR fixed-rate instruments € 500 497 € 500 497 3.0%/2022/September 2033/EUR fixed-rate instruments € 1,000 997 € 1,000 997 3.375%/2023/August 2031/EUR fixed-rate instruments € 1,250 1,244 – – – 3.5%/2023/February 2036/EUR fixed-rate instruments € 500 492 – – – 3.625%/2023/February 2043/EUR fixed-rate instruments € 750 735 – – – Total Debt Issuance Program 21,842 22,006 6.125%/2006/August 2026/US$ fixed-rate instruments US$ 1,750 1,758 US$ 1,750 1,968 3.25%/2015/May 2025/US$ fixed-rate-instruments US$ 1,500 1,350 US$ 1,500 1,458 4.4%/2015/May 2045/US$ fixed-rate-instruments US$ 1,750 1,635 US$ 1,750 1,776 2.0%/2016/September 2023/US$-fixed-rate-instruments – – – US$ 750 768 2.35%/2016/October 2026/US$-fixed-rate-instruments US$ 1,700 1,602 US$ 1,700 1,740 3.3%/2016/September 2046/US$-fixed-rate-instruments US$ 1,000 937 US$ 1,000 1,018 3.125%/2017/March 2024/US$ fixed-rate-instruments US$ 1,000 929 US$ 1,000 992 3.4%/2017/March 2027/US$ fixed-rate-instruments US$ 1,250 1,178 US$ 1,250 1,280 4.2%/2017/March 2047/US fixed-rate-instruments US$ 1,500 1,404 US$ 1,500 1,526 0.4%/2021/March 2023/US$ fixed-rate-instruments – – – US$ 1,250 1,282 Compounded SOFR+0.43%/2021/March 2024/US$ floating-rate instruments US$ 1,000 944 US$ 1,000 1,025 0.65%/2021/March 2024/US$ fixed-rate-instruments US$ 1,500 1,416 US$ 1,500 1,538 1.2%/2021/March 2026/US$ fixed-rate-instruments US$ 1,750 1,649 US$ 1,750 1,790 1.7%/2021/March 2028/US$ fixed-rate-instruments US$ 1,250 1,176 US$ 1,250 1,277 2.15%/2021/March 2031/US$ fixed-rate-instruments US$ 1,750 1,645 US$ 1,750 1,788 2.875%/2021/March 2041/US$ fixed-rate-instruments US$ 1,500 1,405 US$ 1,500 1,527 2023/February 2024/EUR fixed-rate instruments € 60 60 – – – Total Stand Alone Bonds 19,087 22,755 Total 40,929 44,761 1 Includes adjustments for fair value hedge accounting. 21

Siemens Report FY2023 Page 66 Page 68

Siemens Report FY2023 Page 66 Page 68