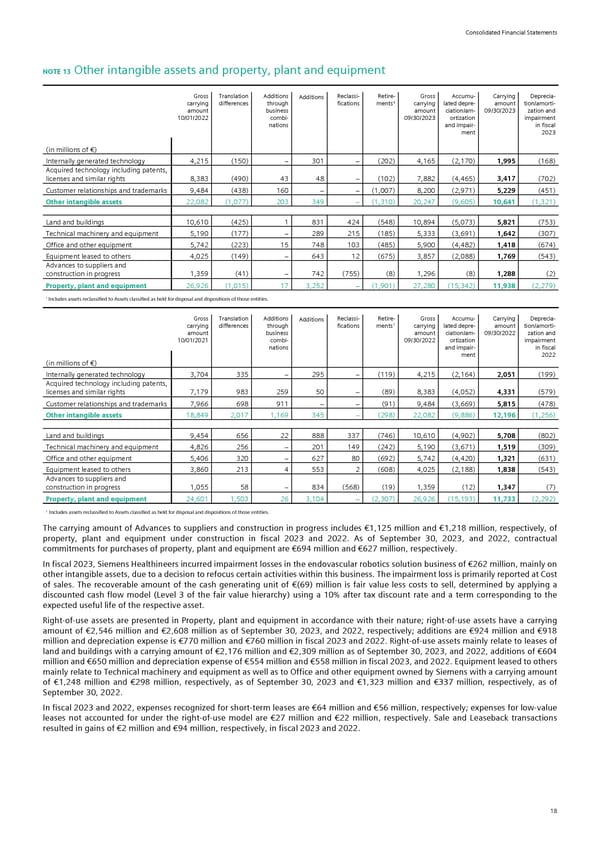

Consolidated Financial Statements NOTE 13 Other intangible assets and property, plant and equipment Gross Translation Additions Additions Reclassi- Retire- Gross Accumu- Carrying Deprecia- carrying differences through fications ments¹ carrying lated depre- amount tion/amorti- amount business amount ciation/am- 09/30/2023 zation and 10/01/2022 combi- 09/30/2023 ortization impairment nations and impair- in fiscal ment 2023 (in millions of €) Internally generated technology 4,215 (150) > 301 > (202) 4,165 (2,170) 1,995 (168) Acquired technology including patents, licenses and similar rights 8,383 (490) 43 48 > (102) 7,882 (4,465) 3,417 (702) Customer relationships and trademarks 9,484 (438) 160 > > (1,007) 8,200 (2,971) 5,229 (451) Other intangible assets 22,082 (1,077) 203 349 > (1,310) 20,247 (9,605) 10,641 (1,321) Land and buildings 10,610 (425) 1 831 424 (548) 10,894 (5,073) 5,821 (753) Technical machinery and equipment 5,190 (177) > 289 215 (185) 5,333 (3,691) 1,642 (307) Office and other equipment 5,742 (223) 15 748 103 (485) 5,900 (4,482) 1,418 (674) Equipment leased to others 4,025 (149) > 643 12 (675) 3,857 (2,088) 1,769 (543) Advances to suppliers and construction in progress 1,359 (41) > 742 (755) (8) 1,296 (8) 1,288 (2) Property, plant and equipment 26,926 (1,015) 17 3,252 > (1,901) 27,280 (15,342) 11,938 (2,279) 1 Includes assets reclassified to Assets classified as held for disposal and dispositions of those entities. Gross Translation Additions Additions Reclassi- Retire- Gross Accumu- Carrying Deprecia- 1 carrying differences through fications ments carrying lated depre- amount tion/amorti- amount business amount ciation/am- 09/30/2022 zation and 10/01/2021 combi- 09/30/2022 ortization impairment nations and impair- in fiscal ment 2022 (in millions of €) Internally generated technology 3,704 335 > 295 > (119) 4,215 (2,164) 2,051 (199) Acquired technology including patents, licenses and similar rights 7,179 983 259 50 > (89) 8,383 (4,052) 4,331 (579) Customer relationships and trademarks 7,966 698 911 > > (91) 9,484 (3,669) 5,815 (478) Other intangible assets 18,849 2,017 1,169 345 > (298) 22,082 (9,886) 12,196 (1,256) Land and buildings 9,454 656 22 888 337 (746) 10,610 (4,902) 5,708 (802) Technical machinery and equipment 4,826 256 > 201 149 (242) 5,190 (3,671) 1,519 (309) Office and other equipment 5,406 320 > 627 80 (692) 5,742 (4,420) 1,321 (631) Equipment leased to others 3,860 213 4 553 2 (608) 4,025 (2,188) 1,838 (543) Advances to suppliers and construction in progress 1,055 58 > 834 (568) (19) 1,359 (12) 1,347 (7) Property, plant and equipment 24,601 1,503 26 3,104 > (2,307) 26,926 (15,193) 11,733 (2,292) 1 Includes assets reclassified to Assets classified as held for disposal and dispositions of those entities. The carrying amount of Advances to suppliers and construction in progress includes €1,125 million and €1,218 million, respectively, of property, plant and equipment under construction in fiscal 2023 and 2022. As of September 30, 2023, and 2022, contractual commitments for purchases of property, plant and equipment are €694 million and €627 million, respectively. In fiscal 2023, Siemens Healthineers incurred impairment losses in the endovascular robotics solution business of €262 million, mainly on other intangible assets, due to a decision to refocus certain activities within this business. The impairment loss is primarily reported at Cost of sales. The recoverable amount of the cash generating unit of €(69) million is fair value less costs to sell, determined by applying a discounted cash flow model (Level 3 of the fair value hierarchy) using a 10% after tax discount rate and a term corresponding to the expected useful life of the respective asset. Right-of-use assets are presented in Property, plant and equipment in accordance with their nature; right-of-use assets have a carrying amount of €2,546 million and €2,608 million as of September 30, 2023, and 2022, respectively; additions are €924 million and €918 million and depreciation expense is €770 million and €760 million in fiscal 2023 and 2022. Right-of-use assets mainly relate to leases of land and buildings with a carrying amount of €2,176 million and €2,309 million as of September 30, 2023, and 2022, additions of €604 million and €650 million and depreciation expense of €554 million and €558 million in fiscal 2023, and 2022. Equipment leased to others mainly relate to Technical machinery and equipment as well as to Office and other equipment owned by Siemens with a carrying amount of €1,248 million and €298 million, respectively, as of September 30, 2023 and €1,323 million and €337 million, respectively, as of September 30, 2022. In fiscal 2023 and 2022, expenses recognized for short-term leases are €64 million and €56 million, respectively; expenses for low-value leases not accounted for under the right-of-use model are €27 million and €22 million, respectively. Sale and Leaseback transactions resulted in gains of €2 million and €94 million, respectively, in fiscal 2023 and 2022. 18

Siemens Report FY2023 Page 63 Page 65

Siemens Report FY2023 Page 63 Page 65