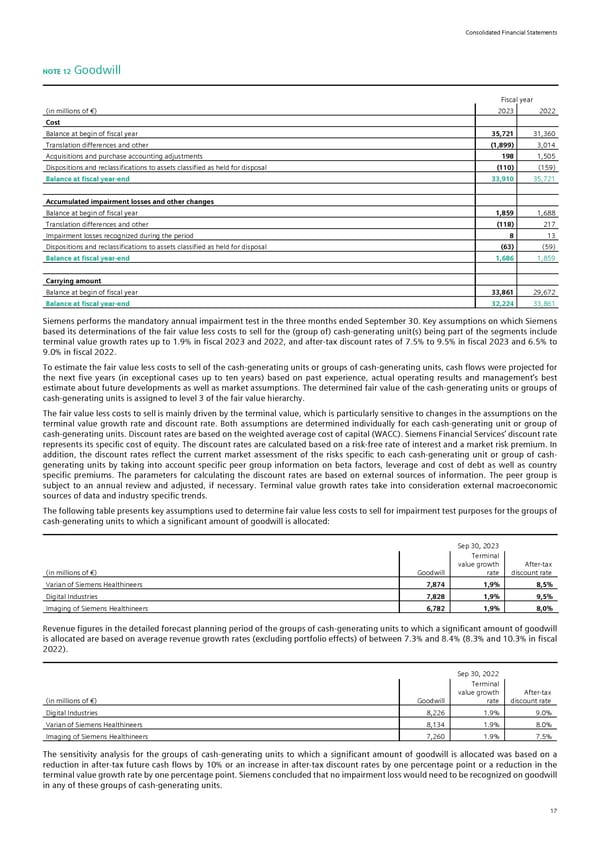

Consolidated Financial Statements NOTE 12 Goodwill Fiscal year (in millions of €) 2023 2022 Cost Balance at begin of fiscal year 35,721 31,360 Translation differences and other (1,899) 3,014 Acquisitions and purchase accounting adjustments 198 1,505 Dispositions and reclassifications to assets classified as held for disposal (110) (159) Balance at fiscal year-end 33,910 35,721 Accumulated impairment losses and other changes Balance at begin of fiscal year 1,859 1,688 Translation differences and other (118) 217 Impairment losses recognized during the period 8 13 Dispositions and reclassifications to assets classified as held for disposal (63) (59) Balance at fiscal year-end 1,686 1,859 Carrying amount Balance at begin of fiscal year 33,861 29,672 Balance at fiscal year-end 32,224 33,861 Siemens performs the mandatory annual impairment test in the three months ended September 30. Key assumptions on which Siemens based its determinations of the fair value less costs to sell for the (group of) cash-generating unit(s) being part of the segments include terminal value growth rates up to 1.9% in fiscal 2023 and 2022, and after-tax discount rates of 7.5% to 9.5% in fiscal 2023 and 6.5% to 9.0% in fiscal 2022. To estimate the fair value less costs to sell of the cash-generating units or groups of cash-generating units, cash flows were projected for the next five years (in exceptional cases up to ten years) based on past experience, actual operating results and management’s best estimate about future developments as well as market assumptions. The determined fair value of the cash-generating units or groups of cash-generating units is assigned to level 3 of the fair value hierarchy. The fair value less costs to sell is mainly driven by the terminal value, which is particularly sensitive to changes in the assumptions on the terminal value growth rate and discount rate. Both assumptions are determined individually for each cash-generating unit or group of cash-generating units. Discount rates are based on the weighted average cost of capital (WACC). Siemens Financial Services’ discount rate represents its specific cost of equity. The discount rates are calculated based on a risk-free rate of interest and a market risk premium. In addition, the discount rates reflect the current market assessment of the risks specific to each cash-generating unit or group of cash- generating units by taking into account specific peer group information on beta factors, leverage and cost of debt as well as country specific premiums. The parameters for calculating the discount rates are based on external sources of information. The peer group is subject to an annual review and adjusted, if necessary. Terminal value growth rates take into consideration external macroeconomic sources of data and industry specific trends. The following table presents key assumptions used to determine fair value less costs to sell for impairment test purposes for the groups of cash-generating units to which a significant amount of goodwill is allocated: Sep 30, 2023 Terminal value growth After-tax (in millions of €) Goodwill rate discount rate Varian of Siemens Healthineers 7,874 1,9% 8,5% Digital Industries 7,828 1,9% 9,5% Imaging of Siemens Healthineers 6,782 1,9% 8,0% Revenue figures in the detailed forecast planning period of the groups of cash-generating units to which a significant amount of goodwill is allocated are based on average revenue growth rates (excluding portfolio effects) of between 7.3% and 8.4% (8.3% and 10.3% in fiscal 2022). Sep 30, 2022 Terminal value growth After-tax (in millions of €) Goodwill rate discount rate Digital Industries 8,226 1.9% 9.0% Varian of Siemens Healthineers 8,134 1.9% 8.0% Imaging of Siemens Healthineers 7,260 1.9% 7.5% The sensitivity analysis for the groups of cash-generating units to which a significant amount of goodwill is allocated was based on a reduction in after-tax future cash flows by 10% or an increase in after-tax discount rates by one percentage point or a reduction in the terminal value growth rate by one percentage point. Siemens concluded that no impairment loss would need to be recognized on goodwill in any of these groups of cash-generating units. 17

Siemens Report FY2023 Page 62 Page 64

Siemens Report FY2023 Page 62 Page 64