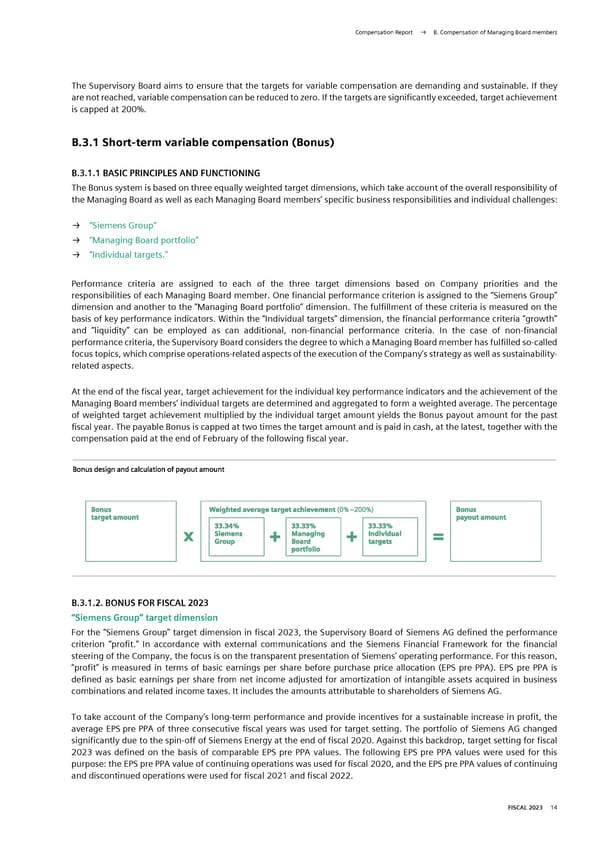

Compensation Report → B. Compensation of Managing Board members The Supervisory Board aims to ensure that the targets for variable compensation are demanding and sustainable. If they are not reached, variable compensation can be reduced to zero. If the targets are significantly exceeded, target achievement is capped at 200%. B.3.1 Short-term variable compensation (Bonus) B.3.1.1 BASIC PRINCIPLES AND FUNCTIONING The Bonus system is based on three equally weighted target dimensions, which take account of the overall responsibility of the Managing Board as well as each Managing Board members’ specific business responsibilities and individual challenges: → “Siemens Group” → “Managing Board portfolio” → “Individual targets.” Performance criteria are assigned to each of the three target dimensions based on Company priorities and the responsibilities of each Managing Board member. One financial performance criterion is assigned to the “Siemens Group” dimension and another to the “Managing Board portfolio” dimension. The fulfillment of these criteria is measured on the basis of key performance indicators. Within the “Individual targets” dimension, the financial performance criteria “growth” and “liquidity” can be employed as can additional, non-financial performance criteria. In the case of non-financial performance criteria, the Supervisory Board considers the degree to which a Managing Board member has fulfilled so-called focus topics, which comprise operations-related aspects of the execution of the Company’s strategy as well as sustainability- related aspects. At the end of the fiscal year, target achievement for the individual key performance indicators and the achievement of the Managing Board members’ individual targets are determined and aggregated to form a weighted average. The percentage of weighted target achievement multiplied by the individual target amount yields the Bonus payout amount for the past fiscal year. The payable Bonus is capped at two times the target amount and is paid in cash, at the latest, together with the compensation paid at the end of February of the following fiscal year. Bonus design and calculation of payout amount Bonus Weighted average target achievement (0%-200%) Bonus target amount payout amount 33.34% 33.33% 33.33% Siemens Managing Individual Group Board targets portfolio B.3.1.2. BONUS FOR FISCAL 2023 “Siemens Group” target dimension For the “Siemens Group” target dimension in fiscal 2023, the Supervisory Board of Siemens AG defined the performance criterion “profit.” In accordance with external communications and the Siemens Financial Framework for the financial steering of the Company, the focus is on the transparent presentation of Siemens’ operating performance. For this reason, “profit” is measured in terms of basic earnings per share before purchase price allocation (EPS pre PPA). EPS pre PPA is defined as basic earnings per share from net income adjusted for amortization of intangible assets acquired in business combinations and related income taxes. It includes the amounts attributable to shareholders of Siemens AG. To take account of the Company’s long-term performance and provide incentives for a sustainable increase in profit, the average EPS pre PPA of three consecutive fiscal years was used for target setting. The portfolio of Siemens AG changed significantly due to the spin-off of Siemens Energy at the end of fiscal 2020. Against this backdrop, target setting for fiscal 2023 was defined on the basis of comparable EPS pre PPA values. The following EPS pre PPA values were used for this purpose: the EPS pre PPA value of continuing operations was used for fiscal 2020, and the EPS pre PPA values of continuing and discontinued operations were used for fiscal 2021 and fiscal 2022. FISCAL 2023 14

Siemens Report FY2023 Page 164 Page 166

Siemens Report FY2023 Page 164 Page 166