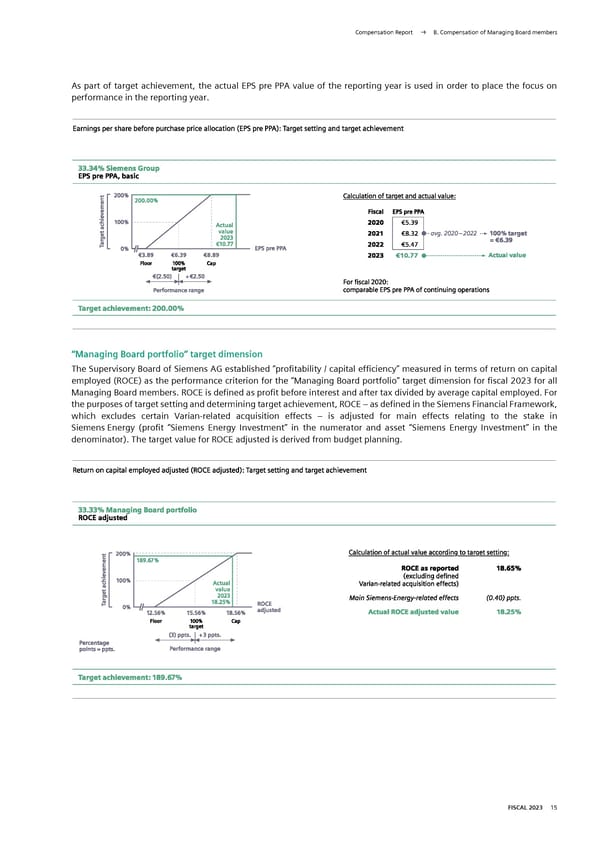

Compensation Report → B. Compensation of Managing Board members As part of target achievement, the actual EPS pre PPA value of the reporting year is used in order to place the focus on performance in the reporting year. Earnings per share before purchase price allocation (EPS pre PPA): Target setting and target achievement 33.34% Siemens Group EPS pre PPA, basic 200% Calculation of target and actual value: 200.00% Fiscal EPS pre PPA 100% Actual 2020 €5.39 achievement value 2021 €8.32 i h- avg. 2020 -2022 -► 100% target 2023 = €6.39 Target o% V/— €10.77 EPS pre PPA 2022 €5.47 €3.89 €6.39 €8.89 2023 €10.77 Actual value Floor 100% Cap target €(2.50) +d €2.50 For fiscal 2020: Performance range comparable EPS pre PPA of continuing operations Target achievement: 200.00% “Managing Board portfolio” target dimension The Supervisory Board of Siemens AG established “profitability / capital efficiency” measured in terms of return on capital employed (ROCE) as the performance criterion for the “Managing Board portfolio” target dimension for fiscal 2023 for all Managing Board members. ROCE is defined as profit before interest and after tax divided by average capital employed. For the purposes of target setting and determining target achievement, ROCE – as defined in the Siemens Financial Framework, which excludes certain Varian-related acquisition effects – is adjusted for main effects relating to the stake in Siemens Energy (profit “Siemens Energy Investment” in the numerator and asset “Siemens Energy Investment” in the denominator). The target value for ROCE adjusted is derived from budget planning. Return on capital employed adjusted (ROCE adjusted): Target setting and target achievement 33.33% Managing Board portfolio ROCE adjusted r 200% Calculation of actual value according to target setting: 189.67% ROCE as reported 18.65% 100% (excluding defined achievement Actual Varian-related acquisition effects) value 2023 Main Siemens-Energy-related effects (0.40) ppts. TargetL 18.25% ROCE 0% adjusted Actual ROCE adjusted value 18.25% 12.56% 15.56% 18.56% Floor 100% Cap target * (3) ppts. +3 ppts. * Percentage points = ppts. Performance range Target achievement: 189.67% FISCAL 2023 15

Siemens Report FY2023 Page 165 Page 167

Siemens Report FY2023 Page 165 Page 167