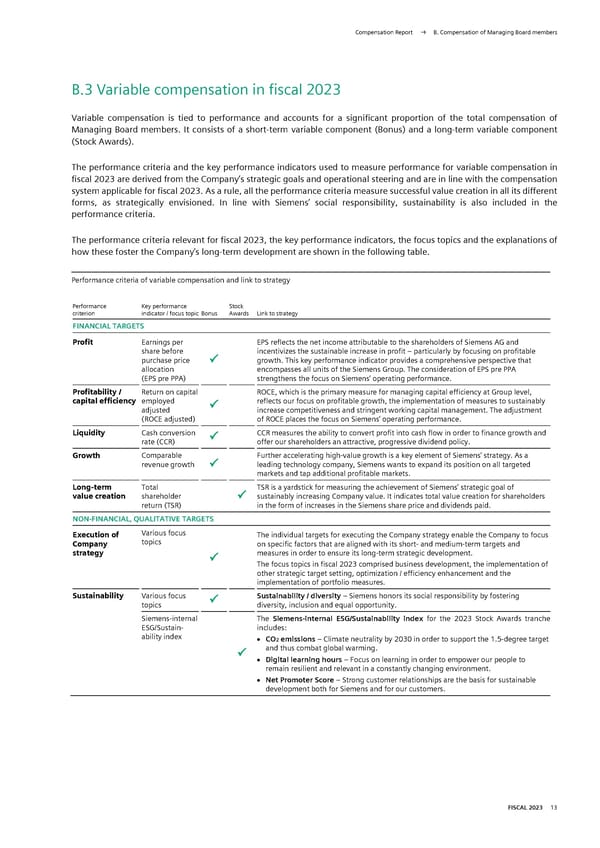

Compensation Report → B. Compensation of Managing Board members B.3 Variable compensation in fiscal 2023 Variable compensation is tied to performance and accounts for a significant proportion of the total compensation of Managing Board members. It consists of a short-term variable component (Bonus) and a long-term variable component (Stock Awards). The performance criteria and the key performance indicators used to measure performance for variable compensation in fiscal 2023 are derived from the Company’s strategic goals and operational steering and are in line with the compensation system applicable for fiscal 2023. As a rule, all the performance criteria measure successful value creation in all its different forms, as strategically envisioned. In line with Siemens’ social responsibility, sustainability is also included in the performance criteria. The performance criteria relevant for fiscal 2023, the key performance indicators, the focus topics and the explanations of how these foster the Company’s long-term development are shown in the following table. Performance criteria of variable compensation and link to strategy Performance Key performance Stock criterion indicator / focus topic Bonus Awards Link to strategy FINANCIAL TARGETS Profit Earnings per EPS reflects the net income attributable to the shareholders of Siemens AG and share before incentivizes the sustainable increase in profit – particularly by focusing on profitable purchase price growth. This key performance indicator provides a comprehensive perspective that allocation encompasses all units of the Siemens Group. The consideration of EPS pre PPA (EPS pre PPA) strengthens the focus on Siemens’ operating performance. Profitability / Return on capital ROCE, which is the primary measure for managing capital efficiency at Group level, capital efficiency employed reflects our focus on profitable growth, the implementation of measures to sustainably adjusted increase competitiveness and stringent working capital management. The adjustment (ROCE adjusted) of ROCE places the focus on Siemens’ operating performance. Liquidity Cash conversion CCR measures the ability to convert profit into cash flow in order to finance growth and rate (CCR) offer our shareholders an attractive, progressive dividend policy. Growth Comparable Further accelerating high-value growth is a key element of Siemens’ strategy. As a revenue growth leading technology company, Siemens wants to expand its position on all targeted markets and tap additional profitable markets. Long-term Total TSR is a yardstick for measuring the achievement of Siemens’ strategic goal of value creation shareholder sustainably increasing Company value. It indicates total value creation for shareholders return (TSR) in the form of increases in the Siemens share price and dividends paid. NON-FINANCIAL, QUALITATIVE TARGETS Various focus Execution of topics The individual targets for executing the Company strategy enable the Company to focus Company on specific factors that are aligned with its short- and medium-term targets and strategy measures in order to ensure its long-term strategic development. The focus topics in fiscal 2023 comprised business development, the implementation of other strategic target setting, optimization / efficiency enhancement and the implementation of portfolio measures. Sustainability Various focus Sustainability / diversity – Siemens honors its social responsibility by fostering topics diversity, inclusion and equal opportunity. Siemens-internal The Siemens-internal ESG/Sustainability index for the 2023 Stock Awards tranche ESG/Sustain- includes: ability index • CO2 emissions – Climate neutrality by 2030 in order to support the 1.5-degree target and thus combat global warming. • Digital learning hours – Focus on learning in order to empower our people to remain resilient and relevant in a constantly changing environment. • Net Promoter Score – Strong customer relationships are the basis for sustainable development both for Siemens and for our customers. FISCAL 2023 13

Siemens Report FY2023 Page 163 Page 165

Siemens Report FY2023 Page 163 Page 165