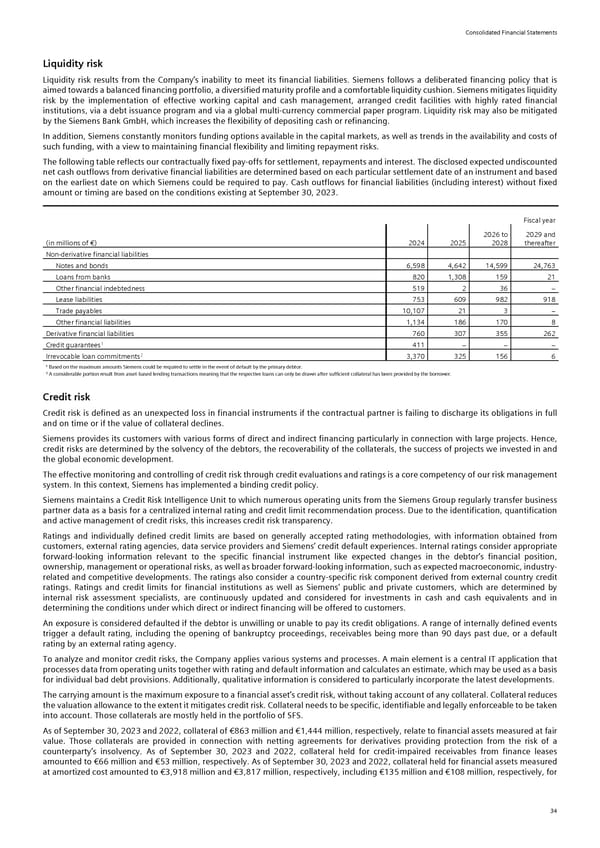

Consolidated Financial Statements Liquidity risk Liquidity risk results from the Company’s inability to meet its financial liabilities. Siemens follows a deliberated financing policy that is aimed towards a balanced financing portfolio, a diversified maturity profile and a comfortable liquidity cushion. Siemens mitigates liquidity risk by the implementation of effective working capital and cash management, arranged credit facilities with highly rated financial institutions, via a debt issuance program and via a global multi-currency commercial paper program. Liquidity risk may also be mitigated by the Siemens Bank GmbH, which increases the flexibility of depositing cash or refinancing. In addition, Siemens constantly monitors funding options available in the capital markets, as well as trends in the availability and costs of such funding, with a view to maintaining financial flexibility and limiting repayment risks. The following table reflects our contractually fixed pay-offs for settlement, repayments and interest. The disclosed expected undiscounted net cash outflows from derivative financial liabilities are determined based on each particular settlement date of an instrument and based on the earliest date on which Siemens could be required to pay. Cash outflows for financial liabilities (including interest) without fixed amount or timing are based on the conditions existing at September 30, 2023. Fiscal year 2026 to 2029 and (in millions of €) 2024 2025 2028 thereafter Non-derivative financial liabilities Notes and bonds 6,598 4,642 14,599 24,763 Loans from banks 820 1,308 159 21 Other financial indebtedness 519 2 36 > Lease liabilities 753 609 982 918 Trade payables 10,107 21 3 > Other financial liabilities 1,134 186 170 8 Derivative financial liabilities 760 307 355 262 1 Credit guarantees 411 > > > 2 Irrevocable loan commitments 3,370 325 156 6 ¹ Based on the maximum amounts Siemens could be required to settle in the event of default by the primary debtor. ² A considerable portion result from asset-based lending transactions meaning that the respective loans can only be drawn after sufficient collateral has been provided by the borrower. Credit risk Credit risk is defined as an unexpected loss in financial instruments if the contractual partner is failing to discharge its obligations in full and on time or if the value of collateral declines. Siemens provides its customers with various forms of direct and indirect financing particularly in connection with large projects. Hence, credit risks are determined by the solvency of the debtors, the recoverability of the collaterals, the success of projects we invested in and the global economic development. The effective monitoring and controlling of credit risk through credit evaluations and ratings is a core competency of our risk management system. In this context, Siemens has implemented a binding credit policy. Siemens maintains a Credit Risk Intelligence Unit to which numerous operating units from the Siemens Group regularly transfer business partner data as a basis for a centralized internal rating and credit limit recommendation process. Due to the identification, quantification and active management of credit risks, this increases credit risk transparency. Ratings and individually defined credit limits are based on generally accepted rating methodologies, with information obtained from customers, external rating agencies, data service providers and Siemens’ credit default experiences. Internal ratings consider appropriate forward-looking information relevant to the specific financial instrument like expected changes in the debtor’s financial position, ownership, management or operational risks, as well as broader forward-looking information, such as expected macroeconomic, industry- related and competitive developments. The ratings also consider a country-specific risk component derived from external country credit ratings. Ratings and credit limits for financial institutions as well as Siemens' public and private customers, which are determined by internal risk assessment specialists, are continuously updated and considered for investments in cash and cash equivalents and in determining the conditions under which direct or indirect financing will be offered to customers. An exposure is considered defaulted if the debtor is unwilling or unable to pay its credit obligations. A range of internally defined events trigger a default rating, including the opening of bankruptcy proceedings, receivables being more than 90 days past due, or a default rating by an external rating agency. To analyze and monitor credit risks, the Company applies various systems and processes. A main element is a central IT application that processes data from operating units together with rating and default information and calculates an estimate, which may be used as a basis for individual bad debt provisions. Additionally, qualitative information is considered to particularly incorporate the latest developments. The carrying amount is the maximum exposure to a financial asset’s credit risk, without taking account of any collateral. Collateral reduces the valuation allowance to the extent it mitigates credit risk. Collateral needs to be specific, identifiable and legally enforceable to be taken into account. Those collaterals are mostly held in the portfolio of SFS. As of September 30, 2023 and 2022, collateral of €863 million and €1,444 million, respectively, relate to financial assets measured at fair value. Those collaterals are provided in connection with netting agreements for derivatives providing protection from the risk of a counterparty’s insolvency. As of September 30, 2023 and 2022, collateral held for credit-impaired receivables from finance leases amounted to €66 million and €53 million, respectively. As of September 30, 2023 and 2022, collateral held for financial assets measured at amortized cost amounted to €3,918 million and €3,817 million, respectively, including €135 million and €108 million, respectively, for 34

Siemens Report FY2023 Page 79 Page 81

Siemens Report FY2023 Page 79 Page 81