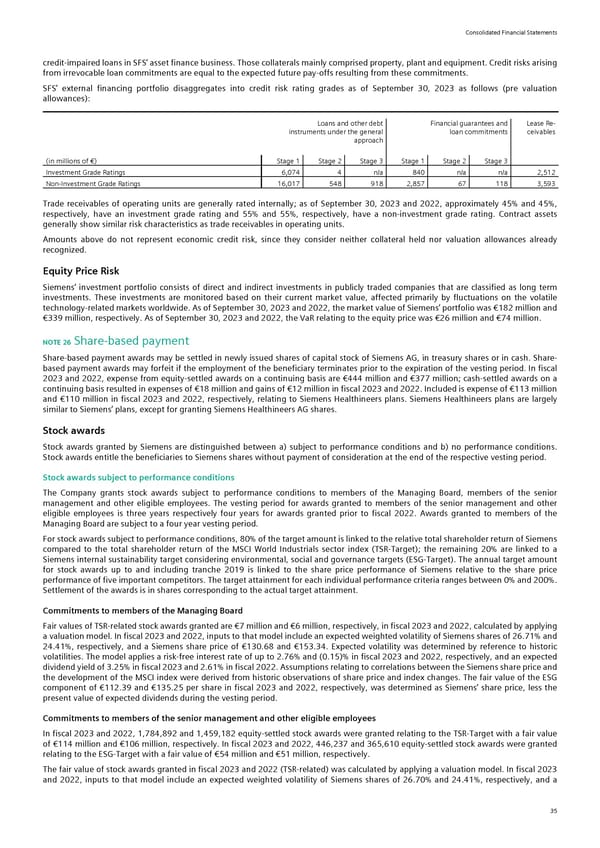

Consolidated Financial Statements credit-impaired loans in SFS’ asset finance business. Those collaterals mainly comprised property, plant and equipment. Credit risks arising from irrevocable loan commitments are equal to the expected future pay-offs resulting from these commitments. SFS’ external financing portfolio disaggregates into credit risk rating grades as of September 30, 2023 as follows (pre valuation allowances): Loans and other debt Financial guarantees and Lease Re- instruments under the general loan commitments ceivables approach (in millions of €) Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 Investment Grade Ratings 6,074 4 n/a 840 n/a n/a 2,512 Non-Investment Grade Ratings 16,017 548 918 2,857 67 118 3,593 Trade receivables of operating units are generally rated internally; as of September 30, 2023 and 2022, approximately 45% and 45%, respectively, have an investment grade rating and 55% and 55%, respectively, have a non-investment grade rating. Contract assets generally show similar risk characteristics as trade receivables in operating units. Amounts above do not represent economic credit risk, since they consider neither collateral held nor valuation allowances already recognized. Equity Price Risk Siemens‘ investment portfolio consists of direct and indirect investments in publicly traded companies that are classified as long term investments. These investments are monitored based on their current market value, affected primarily by fluctuations on the volatile technology-related markets worldwide. As of September 30, 2023 and 2022, the market value of Siemens’ portfolio was €182 million and €339 million, respectively. As of September 30, 2023 and 2022, the VaR relating to the equity price was €26 million and €74 million. NOTE 26 Share-based payment Share-based payment awards may be settled in newly issued shares of capital stock of Siemens AG, in treasury shares or in cash. Share- based payment awards may forfeit if the employment of the beneficiary terminates prior to the expiration of the vesting period. In fiscal 2023 and 2022, expense from equity-settled awards on a continuing basis are €444 million and €377 million; cash-settled awards on a continuing basis resulted in expenses of €18 million and gains of €12 million in fiscal 2023 and 2022. Included is expense of €113 million and €110 million in fiscal 2023 and 2022, respectively, relating to Siemens Healthineers plans. Siemens Healthineers plans are largely similar to Siemens’ plans, except for granting Siemens Healthineers AG shares. Stock awards Stock awards granted by Siemens are distinguished between a) subject to performance conditions and b) no performance conditions. Stock awards entitle the beneficiaries to Siemens shares without payment of consideration at the end of the respective vesting period. Stock awards subject to performance conditions The Company grants stock awards subject to performance conditions to members of the Managing Board, members of the senior management and other eligible employees. The vesting period for awards granted to members of the senior management and other eligible employees is three years respectively four years for awards granted prior to fiscal 2022. Awards granted to members of the Managing Board are subject to a four year vesting period. For stock awards subject to performance conditions, 80% of the target amount is linked to the relative total shareholder return of Siemens compared to the total shareholder return of the MSCI World Industrials sector index (TSR-Target); the remaining 20% are linked to a Siemens internal sustainability target considering environmental, social and governance targets (ESG-Target). The annual target amount for stock awards up to and including tranche 2019 is linked to the share price performance of Siemens relative to the share price performance of five important competitors. The target attainment for each individual performance criteria ranges between 0% and 200%. Settlement of the awards is in shares corresponding to the actual target attainment. Commitments to members of the Managing Board Fair values of TSR-related stock awards granted are €7 million and €6 million, respectively, in fiscal 2023 and 2022, calculated by applying a valuation model. In fiscal 2023 and 2022, inputs to that model include an expected weighted volatility of Siemens shares of 26.71% and 24.41%, respectively, and a Siemens share price of €130.68 and €153.34. Expected volatility was determined by reference to historic volatilities. The model applies a risk-free interest rate of up to 2.76% and (0.15)% in fiscal 2023 and 2022, respectively, and an expected dividend yield of 3.25% in fiscal 2023 and 2.61% in fiscal 2022. Assumptions relating to correlations between the Siemens share price and the development of the MSCI index were derived from historic observations of share price and index changes. The fair value of the ESG component of €112.39 and €135.25 per share in fiscal 2023 and 2022, respectively, was determined as Siemens’ share price, less the present value of expected dividends during the vesting period. Commitments to members of the senior management and other eligible employees In fiscal 2023 and 2022, 1,784,892 and 1,459,182 equity-settled stock awards were granted relating to the TSR-Target with a fair value of €114 million and €106 million, respectively. In fiscal 2023 and 2022, 446,237 and 365,610 equity-settled stock awards were granted relating to the ESG-Target with a fair value of €54 million and €51 million, respectively. The fair value of stock awards granted in fiscal 2023 and 2022 (TSR-related) was calculated by applying a valuation model. In fiscal 2023 and 2022, inputs to that model include an expected weighted volatility of Siemens shares of 26.70% and 24.41%, respectively, and a 35

Siemens Report FY2023 Page 80 Page 82

Siemens Report FY2023 Page 80 Page 82