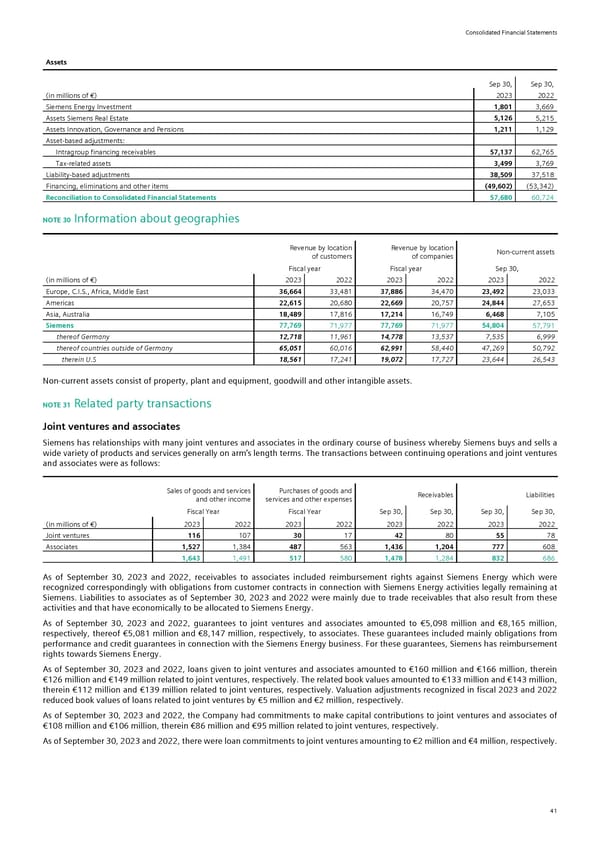

Consolidated Financial Statements Assets Sep 30, Sep 30, (in millions of €) 2023 2022 Siemens Energy Investment 1,801 3,669 Assets Siemens Real Estate 5,126 5,215 Assets Innovation, Governance and Pensions 1,211 1,129 Asset-based adjustments: Intragroup financing receivables 57,137 62,765 Tax-related assets 3,499 3,769 Liability-based adjustments 38,509 37,518 Financing, eliminations and other items (49,602) (53,342) Reconciliation to Consolidated Financial Statements 57,680 60,724 NOTE 30 Information about geographies Revenue by location Revenue by location Non-current assets of customers of companies Fiscal year Fiscal year Sep 30, (in millions of €) 2023 2022 2023 2022 2023 2022 Europe, C.I.S., Africa, Middle East 36,664 33,481 37,886 34,470 23,492 23,033 Americas 22,615 20,680 22,669 20,757 24,844 27,653 Asia, Australia 18,489 17,816 17,214 16,749 6,468 7,105 Siemens 77,769 71,977 77,769 71,977 54,804 57,791 thereof Germany 12,718 11,961 14,778 13,537 7,535 6,999 thereof countries outside of Germany 65,051 60,016 62,991 58,440 47,269 50,792 therein U.S 18,561 17,241 19,072 17,727 23,644 26,543 Non-current assets consist of property, plant and equipment, goodwill and other intangible assets. NOTE 31 Related party transactions Joint ventures and associates Siemens has relationships with many joint ventures and associates in the ordinary course of business whereby Siemens buys and sells a wide variety of products and services generally on arm’s length terms. The transactions between continuing operations and joint ventures and associates were as follows: Sales of goods and services Purchases of goods and Receivables Liabilities and other income services and other expenses Fiscal Year Fiscal Year Sep 30, Sep 30, Sep 30, Sep 30, (in millions of €) 2023 2022 2023 2022 2023 2022 2023 2022 Joint ventures 116 107 30 17 42 80 55 78 Associates 1,527 1,384 487 563 1,436 1,204 777 608 1,643 1,491 517 580 1,478 1,284 832 686 As of September 30, 2023 and 2022, receivables to associates included reimbursement rights against Siemens Energy which were recognized correspondingly with obligations from customer contracts in connection with Siemens Energy activities legally remaining at Siemens. Liabilities to associates as of September 30, 2023 and 2022 were mainly due to trade receivables that also result from these activities and that have economically to be allocated to Siemens Energy. As of September 30, 2023 and 2022, guarantees to joint ventures and associates amounted to €5,098 million and €8,165 million, respectively, thereof €5,081 million and €8,147 million, respectively, to associates. These guarantees included mainly obligations from performance and credit guarantees in connection with the Siemens Energy business. For these guarantees, Siemens has reimbursement rights towards Siemens Energy. As of September 30, 2023 and 2022, loans given to joint ventures and associates amounted to €160 million and €166 million, therein €126 million and €149 million related to joint ventures, respectively. The related book values amounted to €133 million and €143 million, therein €112 million and €139 million related to joint ventures, respectively. Valuation adjustments recognized in fiscal 2023 and 2022 reduced book values of loans related to joint ventures by €5 million and €2 million, respectively. As of September 30, 2023 and 2022, the Company had commitments to make capital contributions to joint ventures and associates of €108 million and €106 million, therein €86 million and €95 million related to joint ventures, respectively. As of September 30, 2023 and 2022, there were loan commitments to joint ventures amounting to €2 million and €4 million, respectively. 41

Siemens Report FY2023 Page 86 Page 88

Siemens Report FY2023 Page 86 Page 88