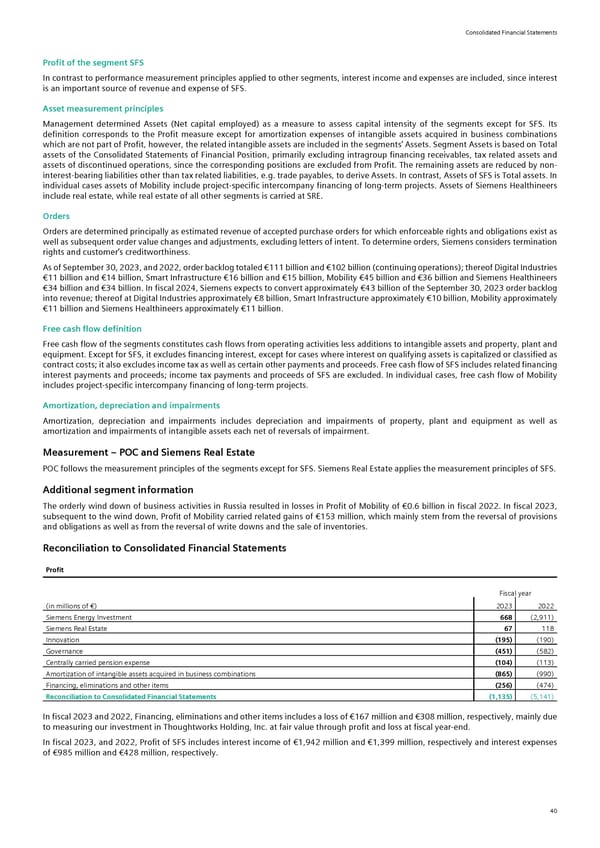

Consolidated Financial Statements Profit of the segment SFS In contrast to performance measurement principles applied to other segments, interest income and expenses are included, since interest is an important source of revenue and expense of SFS. Asset measurement principles Management determined Assets (Net capital employed) as a measure to assess capital intensity of the segments except for SFS. Its definition corresponds to the Profit measure except for amortization expenses of intangible assets acquired in business combinations which are not part of Profit, however, the related intangible assets are included in the segments’ Assets. Segment Assets is based on Total assets of the Consolidated Statements of Financial Position, primarily excluding intragroup financing receivables, tax related assets and assets of discontinued operations, since the corresponding positions are excluded from Profit. The remaining assets are reduced by non- interest-bearing liabilities other than tax related liabilities, e.g. trade payables, to derive Assets. In contrast, Assets of SFS is Total assets. In individual cases assets of Mobility include project-specific intercompany financing of long-term projects. Assets of Siemens Healthineers include real estate, while real estate of all other segments is carried at SRE. Orders Orders are determined principally as estimated revenue of accepted purchase orders for which enforceable rights and obligations exist as well as subsequent order value changes and adjustments, excluding letters of intent. To determine orders, Siemens considers termination rights and customer’s creditworthiness. As of September 30, 2023, and 2022, order backlog totaled €111 billion and €102 billion (continuing operations); thereof Digital Industries €11 billion and €14 billion, Smart Infrastructure €16 billion and €15 billion, Mobility €45 billion and €36 billion and Siemens Healthineers €34 billion and €34 billion. In fiscal 2024, Siemens expects to convert approximately €43 billion of the September 30, 2023 order backlog into revenue; thereof at Digital Industries approximately €8 billion, Smart Infrastructure approximately €10 billion, Mobility approximately €11 billion and Siemens Healthineers approximately €11 billion. Free cash flow definition Free cash flow of the segments constitutes cash flows from operating activities less additions to intangible assets and property, plant and equipment. Except for SFS, it excludes financing interest, except for cases where interest on qualifying assets is capitalized or classified as contract costs; it also excludes income tax as well as certain other payments and proceeds. Free cash flow of SFS includes related financing interest payments and proceeds; income tax payments and proceeds of SFS are excluded. In individual cases, free cash flow of Mobility includes project-specific intercompany financing of long-term projects. Amortization, depreciation and impairments Amortization, depreciation and impairments includes depreciation and impairments of property, plant and equipment as well as amortization and impairments of intangible assets each net of reversals of impairment. Measurement – POC and Siemens Real Estate POC follows the measurement principles of the segments except for SFS. Siemens Real Estate applies the measurement principles of SFS. Additional segment information The orderly wind down of business activities in Russia resulted in losses in Profit of Mobility of €0.6 billion in fiscal 2022. In fiscal 2023, subsequent to the wind down, Profit of Mobility carried related gains of €153 million, which mainly stem from the reversal of provisions and obligations as well as from the reversal of write downs and the sale of inventories. Reconciliation to Consolidated Financial Statements Profit Fiscal year (in millions of €) 2023 2022 Siemens Energy Investment 668 (2,911) Siemens Real Estate 67 118 Innovation (195) (190) Governance (451) (582) Centrally carried pension expense (104) (113) Amortization of intangible assets acquired in business combinations (865) (990) Financing, eliminations and other items (256) (474) Reconciliation to Consolidated Financial Statements (1,135) (5,141) In fiscal 2023 and 2022, Financing, eliminations and other items includes a loss of €167 million and €308 million, respectively, mainly due to measuring our investment in Thoughtworks Holding, Inc. at fair value through profit and loss at fiscal year-end. In fiscal 2023, and 2022, Profit of SFS includes interest income of €1,942 million and €1,399 million, respectively and interest expenses of €985 million and €428 million, respectively. 40

Siemens Report FY2023 Page 85 Page 87

Siemens Report FY2023 Page 85 Page 87