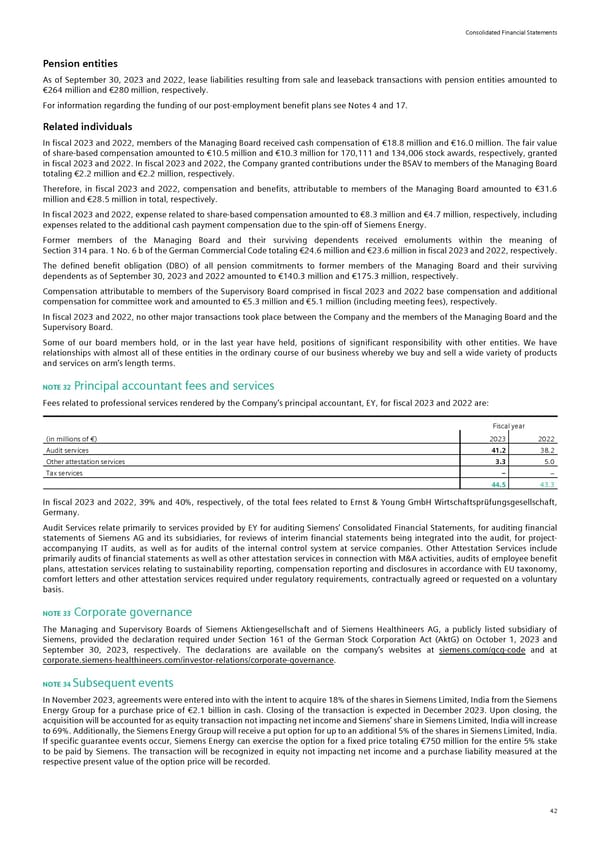

Consolidated Financial Statements Pension entities As of September 30, 2023 and 2022, lease liabilities resulting from sale and leaseback transactions with pension entities amounted to €264 million and €280 million, respectively. For information regarding the funding of our post-employment benefit plans see Notes 4 and 17. Related individuals In fiscal 2023 and 2022, members of the Managing Board received cash compensation of €18.8 million and €16.0 million. The fair value of share-based compensation amounted to €10.5 million and €10.3 million for 170,111 and 134,006 stock awards, respectively, granted in fiscal 2023 and 2022. In fiscal 2023 and 2022, the Company granted contributions under the BSAV to members of the Managing Board totaling €2.2 million and €2.2 million, respectively. Therefore, in fiscal 2023 and 2022, compensation and benefits, attributable to members of the Managing Board amounted to €31.6 million and €28.5 million in total, respectively. In fiscal 2023 and 2022, expense related to share-based compensation amounted to €8.3 million and €4.7 million, respectively, including expenses related to the additional cash payment compensation due to the spin-off of Siemens Energy. Former members of the Managing Board and their surviving dependents received emoluments within the meaning of Section 314 para. 1 No. 6 b of the German Commercial Code totaling €24.6 million and €23.6 million in fiscal 2023 and 2022, respectively. The defined benefit obligation (DBO) of all pension commitments to former members of the Managing Board and their surviving dependents as of September 30, 2023 and 2022 amounted to €140.3 million and €175.3 million, respectively. Compensation attributable to members of the Supervisory Board comprised in fiscal 2023 and 2022 base compensation and additional compensation for committee work and amounted to €5.3 million and €5.1 million (including meeting fees), respectively. In fiscal 2023 and 2022, no other major transactions took place between the Company and the members of the Managing Board and the Supervisory Board. Some of our board members hold, or in the last year have held, positions of significant responsibility with other entities. We have relationships with almost all of these entities in the ordinary course of our business whereby we buy and sell a wide variety of products and services on arm’s length terms. NOTE 32 Principal accountant fees and services Fees related to professional services rendered by the Company’s principal accountant, EY, for fiscal 2023 and 2022 are: Fiscal year (in millions of €) 2023 2022 Audit services 41.2 38.2 Other attestation services 3.3 5.0 Tax services – > 44.5 43.3 In fiscal 2023 and 2022, 39% and 40%, respectively, of the total fees related to Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft, Germany. Audit Services relate primarily to services provided by EY for auditing Siemens’ Consolidated Financial Statements, for auditing financial statements of Siemens AG and its subsidiaries, for reviews of interim financial statements being integrated into the audit, for project- accompanying IT audits, as well as for audits of the internal control system at service companies. Other Attestation Services include primarily audits of financial statements as well as other attestation services in connection with M&A activities, audits of employee benefit plans, attestation services relating to sustainability reporting, compensation reporting and disclosures in accordance with EU taxonomy, comfort letters and other attestation services required under regulatory requirements, contractually agreed or requested on a voluntary basis. NOTE 33 Corporate governance The Managing and Supervisory Boards of Siemens Aktiengesellschaft and of Siemens Healthineers AG, a publicly listed subsidiary of Siemens, provided the declaration required under Section 161 of the German Stock Corporation Act (AktG) on October 1, 2023 and September 30, 2023, respectively. The declarations are available on the company’s websites at siemens.com/gcg-code and at corporate.siemens-healthineers.com/investor-relations/corporate-governance. NOTE 34 Subsequent events In November 2023, agreements were entered into with the intent to acquire 18% of the shares in Siemens Limited, India from the Siemens Energy Group for a purchase price of €2.1 billion in cash. Closing of the transaction is expected in December 2023. Upon closing, the acquisition will be accounted for as equity transaction not impacting net income and Siemens’ share in Siemens Limited, India will increase to 69%. Additionally, the Siemens Energy Group will receive a put option for up to an additional 5% of the shares in Siemens Limited, India. If specific guarantee events occur, Siemens Energy can exercise the option for a fixed price totaling €750 million for the entire 5% stake to be paid by Siemens. The transaction will be recognized in equity not impacting net income and a purchase liability measured at the respective present value of the option price will be recorded. 42

Siemens Report FY2023 Page 87 Page 89

Siemens Report FY2023 Page 87 Page 89