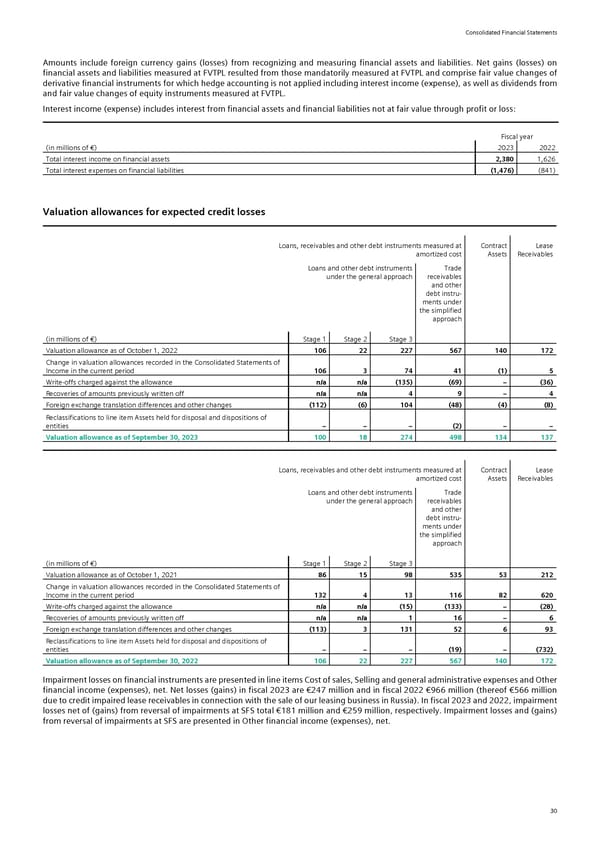

Consolidated Financial Statements Amounts include foreign currency gains (losses) from recognizing and measuring financial assets and liabilities. Net gains (losses) on financial assets and liabilities measured at FVTPL resulted from those mandatorily measured at FVTPL and comprise fair value changes of derivative financial instruments for which hedge accounting is not applied including interest income (expense), as well as dividends from and fair value changes of equity instruments measured at FVTPL. Interest income (expense) includes interest from financial assets and financial liabilities not at fair value through profit or loss: Fiscal year (in millions of €) 2023 2022 Total interest income on financial assets 2,380 1,626 Total interest expenses on financial liabilities (1,476) (841) Valuation allowances for expected credit losses Loans, receivables and other debt instruments measured at Contract Lease amortized cost Assets Receivables Loans and other debt instruments Trade under the general approach receivables and other debt instru- ments under the simplified approach (in millions of €) Stage 1 Stage 2 Stage 3 Valuation allowance as of October 1, 2022 106 22 227 567 140 172 Change in valuation allowances recorded in the Consolidated Statements of Income in the current period 106 3 74 41 (1) 5 Write-offs charged against the allowance n/a n/a (135) (69) − (36) Recoveries of amounts previously written off n/a n/a 4 9 − 4 Foreign exchange translation differences and other changes (112) (6) 104 (48) (4) (8) Reclassifications to line item Assets held for disposal and dispositions of entities − − − (2) − − Valuation allowance as of September 30, 2023 100 18 274 498 134 137 Loans, receivables and other debt instruments measured at Contract Lease amortized cost Assets Receivables Loans and other debt instruments Trade under the general approach receivables and other debt instru- ments under the simplified approach (in millions of €) Stage 1 Stage 2 Stage 3 Valuation allowance as of October 1, 2021 86 15 98 535 53 212 Change in valuation allowances recorded in the Consolidated Statements of Income in the current period 132 4 13 116 82 620 Write-offs charged against the allowance n/a n/a (15) (133) − (28) Recoveries of amounts previously written off n/a n/a 1 16 − 6 Foreign exchange translation differences and other changes (113) 3 131 52 6 93 Reclassifications to line item Assets held for disposal and dispositions of entities − − − (19) − (732) Valuation allowance as of September 30, 2022 106 22 227 567 140 172 Impairment losses on financial instruments are presented in line items Cost of sales, Selling and general administrative expenses and Other financial income (expenses), net. Net losses (gains) in fiscal 2023 are €247 million and in fiscal 2022 €966 million (thereof €566 million due to credit impaired lease receivables in connection with the sale of our leasing business in Russia). In fiscal 2023 and 2022, impairment losses net of (gains) from reversal of impairments at SFS total €181 million and €259 million, respectively. Impairment losses and (gains) from reversal of impairments at SFS are presented in Other financial income (expenses), net. 30

Siemens Report FY2023 Page 75 Page 77

Siemens Report FY2023 Page 75 Page 77