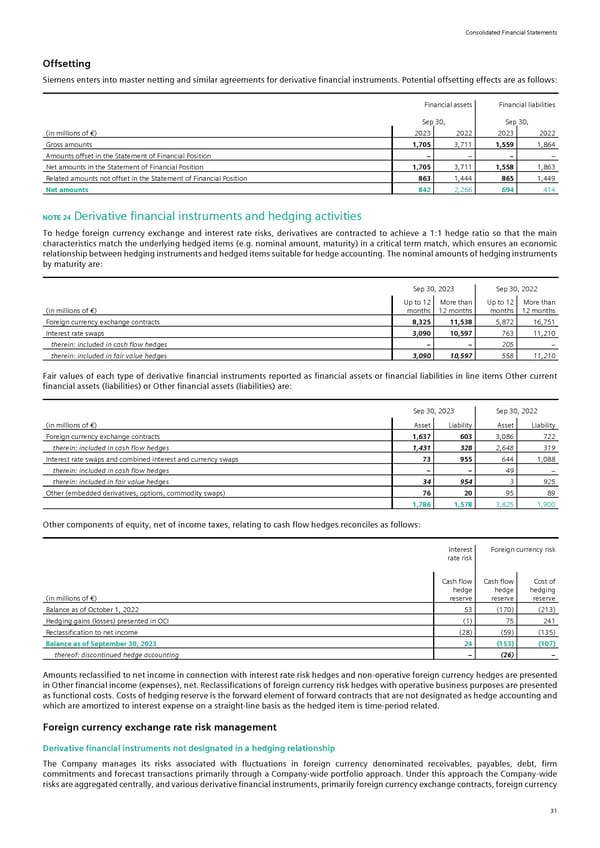

Consolidated Financial Statements Offsetting Siemens enters into master netting and similar agreements for derivative financial instruments. Potential offsetting effects are as follows: Financial assets Financial liabilities Sep 30, Sep 30, (in millions of €) 2023 2022 2023 2022 Gross amounts 1,705 3,711 1,559 1,864 Amounts offset in the Statement of Financial Position − > − > Net amounts in the Statement of Financial Position 1,705 3,711 1,558 1,863 Related amounts not offset in the Statement of Financial Position 863 1,444 865 1,449 Net amounts 842 2,266 694 414 NOTE 24 Derivative financial instruments and hedging activities To hedge foreign currency exchange and interest rate risks, derivatives are contracted to achieve a 1:1 hedge ratio so that the main characteristics match the underlying hedged items (e.g. nominal amount, maturity) in a critical term match, which ensures an economic relationship between hedging instruments and hedged items suitable for hedge accounting. The nominal amounts of hedging instruments by maturity are: Sep 30, 2023 Sep 30, 2022 Up to 12 More than Up to 12 More than (in millions of €) months 12 months months 12 months Foreign currency exchange contracts 8,325 11,538 5,872 16,751 Interest rate swaps 3,090 10,597 763 11,210 therein: included in cash flow hedges − − 205 − therein: included in fair value hedges 3,090 10,597 558 11,210 Fair values of each type of derivative financial instruments reported as financial assets or financial liabilities in line items Other current financial assets (liabilities) or Other financial assets (liabilities) are: Sep 30, 2023 Sep 30, 2022 (in millions of €) Asset Liability Asset Liability Foreign currency exchange contracts 1,637 603 3,086 722 therein: included in cash flow hedges 1,431 328 2,648 319 Interest rate swaps and combined interest and currency swaps 73 955 644 1,088 therein: included in cash flow hedges − − 49 − therein: included in fair value hedges 34 954 3 925 Other (embedded derivatives, options, commodity swaps) 76 20 95 89 1,786 1,578 3,825 1,900 Other components of equity, net of income taxes, relating to cash flow hedges reconciles as follows: Interest Foreign currency risk rate risk Cash flow Cash flow Cost of hedge hedge hedging (in millions of €) reserve reserve reserve Balance as of October 1, 2022 53 (170) (213) Hedging gains (losses) presented in OCI (1) 75 241 Reclassification to net income (28) (59) (135) Balance as of September 30, 2023 24 (153) (107) thereof: discontinued hedge accounting − (26) − Amounts reclassified to net income in connection with interest rate risk hedges and non-operative foreign currency hedges are presented in Other financial income (expenses), net. Reclassifications of foreign currency risk hedges with operative business purposes are presented as functional costs. Costs of hedging reserve is the forward element of forward contracts that are not designated as hedge accounting and which are amortized to interest expense on a straight-line basis as the hedged item is time-period related. Foreign currency exchange rate risk management Derivative financial instruments not designated in a hedging relationship The Company manages its risks associated with fluctuations in foreign currency denominated receivables, payables, debt, firm commitments and forecast transactions primarily through a Company-wide portfolio approach. Under this approach the Company-wide risks are aggregated centrally, and various derivative financial instruments, primarily foreign currency exchange contracts, foreign currency 31

Siemens Report FY2023 Page 76 Page 78

Siemens Report FY2023 Page 76 Page 78