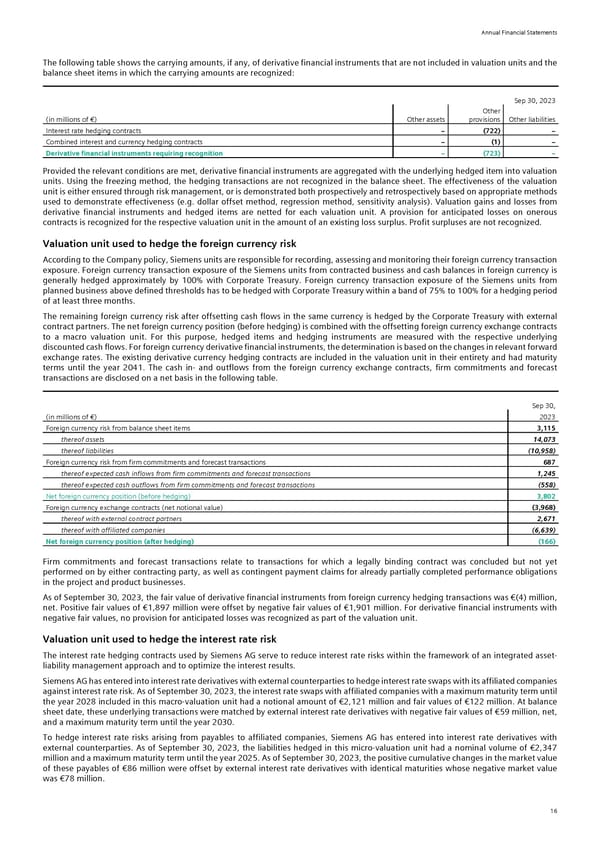

Annual Financial Statements The following table shows the carrying amounts, if any, of derivative financial instruments that are not included in valuation units and the balance sheet items in which the carrying amounts are recognized: Sep 30, 2023 Other (in millions of €) Other assets provisions Other liabilities Interest rate hedging contracts − (722) − Combined interest and currency hedging contracts − (1) − Derivative financial instruments requiring recognition − (723) − Provided the relevant conditions are met, derivative financial instruments are aggregated with the underlying hedged item into valuation units. Using the freezing method, the hedging transactions are not recognized in the balance sheet. The effectiveness of the valuation unit is either ensured through risk management, or is demonstrated both prospectively and retrospectively based on appropriate methods used to demonstrate effectiveness (e.g. dollar offset method, regression method, sensitivity analysis). Valuation gains and losses from derivative financial instruments and hedged items are netted for each valuation unit. A provision for anticipated losses on onerous contracts is recognized for the respective valuation unit in the amount of an existing loss surplus. Profit surpluses are not recognized. Valuation unit used to hedge the foreign currency risk According to the Company policy, Siemens units are responsible for recording, assessing and monitoring their foreign currency transaction exposure. Foreign currency transaction exposure of the Siemens units from contracted business and cash balances in foreign currency is generally hedged approximately by 100% with Corporate Treasury. Foreign currency transaction exposure of the Siemens units from planned business above defined thresholds has to be hedged with Corporate Treasury within a band of 75% to 100% for a hedging period of at least three months. The remaining foreign currency risk after offsetting cash flows in the same currency is hedged by the Corporate Treasury with external contract partners. The net foreign currency position (before hedging) is combined with the offsetting foreign currency exchange contracts to a macro valuation unit. For this purpose, hedged items and hedging instruments are measured with the respective underlying discounted cash flows. For foreign currency derivative financial instruments, the determination is based on the changes in relevant forward exchange rates. The existing derivative currency hedging contracts are included in the valuation unit in their entirety and had maturity terms until the year 2041. The cash in- and outflows from the foreign currency exchange contracts, firm commitments and forecast transactions are disclosed on a net basis in the following table. Sep 30, (in millions of €) 2023 Foreign currency risk from balance sheet items 3,115 thereof assets 14,073 thereof liabilities (10,958) Foreign currency risk from firm commitments and forecast transactions 687 thereof expected cash inflows from firm commitments and forecast transactions 1,245 thereof expected cash outflows from firm commitments and forecast transactions (558) Net foreign currency position (before hedging) 3,802 Foreign currency exchange contracts (net notional value) (3,968) thereof with external contract partners 2,671 thereof with affiliated companies (6,639) Net foreign currency position (after hedging) (166) Firm commitments and forecast transactions relate to transactions for which a legally binding contract was concluded but not yet performed on by either contracting party, as well as contingent payment claims for already partially completed performance obligations in the project and product businesses. As of September 30, 2023, the fair value of derivative financial instruments from foreign currency hedging transactions was €(4) million, net. Positive fair values of €1,897 million were offset by negative fair values of €1,901 million. For derivative financial instruments with negative fair values, no provision for anticipated losses was recognized as part of the valuation unit. Valuation unit used to hedge the interest rate risk The interest rate hedging contracts used by Siemens AG serve to reduce interest rate risks within the framework of an integrated asset- liability management approach and to optimize the interest results. Siemens AG has entered into interest rate derivatives with external counterparties to hedge interest rate swaps with its affiliated companies against interest rate risk. As of September 30, 2023, the interest rate swaps with affiliated companies with a maximum maturity term until the year 2028 included in this macro-valuation unit had a notional amount of €2,121 million and fair values of €122 million. At balance sheet date, these underlying transactions were matched by external interest rate derivatives with negative fair values of €59 million, net, and a maximum maturity term until the year 2030. To hedge interest rate risks arising from payables to affiliated companies, Siemens AG has entered into interest rate derivatives with external counterparties. As of September 30, 2023, the liabilities hedged in this micro-valuation unit had a nominal volume of €2,347 million and a maximum maturity term until the year 2025. As of September 30, 2023, the positive cumulative changes in the market value of these payables of €86 million were offset by external interest rate derivatives with identical maturities whose negative market value was €78 million. 16

Siemens Report FY2023 Page 131 Page 133

Siemens Report FY2023 Page 131 Page 133