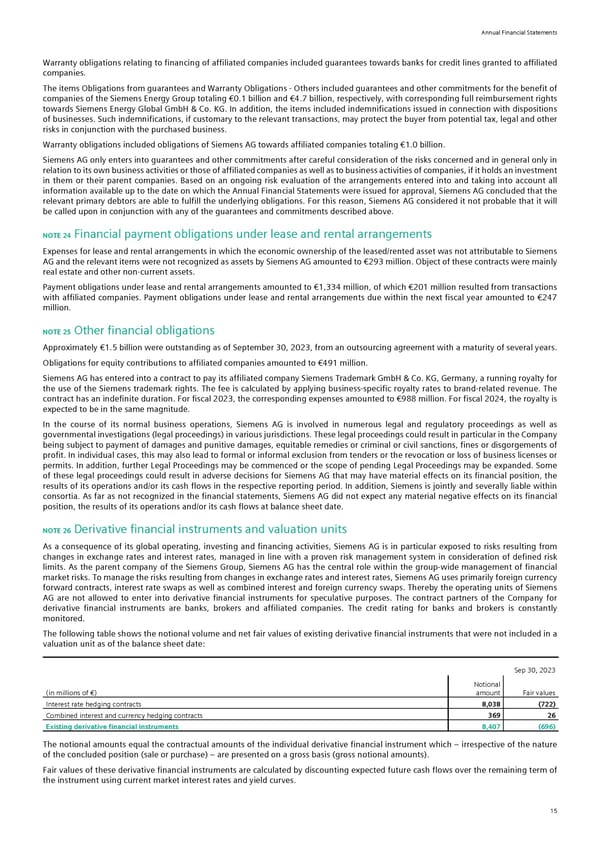

Annual Financial Statements Warranty obligations relating to financing of affiliated companies included guarantees towards banks for credit lines granted to affiliated companies. The items Obligations from guarantees and Warranty Obligations - Others included guarantees and other commitments for the benefit of companies of the Siemens Energy Group totaling €0.1 billion and €4.7 billion, respectively, with corresponding full reimbursement rights towards Siemens Energy Global GmbH & Co. KG. In addition, the items included indemnifications issued in connection with dispositions of businesses. Such indemnifications, if customary to the relevant transactions, may protect the buyer from potential tax, legal and other risks in conjunction with the purchased business. Warranty obligations included obligations of Siemens AG towards affiliated companies totaling €1.0 billion. Siemens AG only enters into guarantees and other commitments after careful consideration of the risks concerned and in general only in relation to its own business activities or those of affiliated companies as well as to business activities of companies, if it holds an investment in them or their parent companies. Based on an ongoing risk evaluation of the arrangements entered into and taking into account all information available up to the date on which the Annual Financial Statements were issued for approval, Siemens AG concluded that the relevant primary debtors are able to fulfill the underlying obligations. For this reason, Siemens AG considered it not probable that it will be called upon in conjunction with any of the guarantees and commitments described above. NOTE 24 Financial payment obligations under lease and rental arrangements Expenses for lease and rental arrangements in which the economic ownership of the leased/rented asset was not attributable to Siemens AG and the relevant items were not recognized as assets by Siemens AG amounted to €293 million. Object of these contracts were mainly real estate and other non-current assets. Payment obligations under lease and rental arrangements amounted to €1,334 million, of which €201 million resulted from transactions with affiliated companies. Payment obligations under lease and rental arrangements due within the next fiscal year amounted to €247 million. NOTE 25 Other financial obligations Approximately €1.5 billion were outstanding as of September 30, 2023, from an outsourcing agreement with a maturity of several years. Obligations for equity contributions to affiliated companies amounted to €491 million. Siemens AG has entered into a contract to pay its affiliated company Siemens Trademark GmbH & Co. KG, Germany, a running royalty for the use of the Siemens trademark rights. The fee is calculated by applying business-specific royalty rates to brand-related revenue. The contract has an indefinite duration. For fiscal 2023, the corresponding expenses amounted to €988 million. For fiscal 2024, the royalty is expected to be in the same magnitude. In the course of its normal business operations, Siemens AG is involved in numerous legal and regulatory proceedings as well as governmental investigations (legal proceedings) in various jurisdictions. These legal proceedings could result in particular in the Company being subject to payment of damages and punitive damages, equitable remedies or criminal or civil sanctions, fines or disgorgements of profit. In individual cases, this may also lead to formal or informal exclusion from tenders or the revocation or loss of business licenses or permits. In addition, further Legal Proceedings may be commenced or the scope of pending Legal Proceedings may be expanded. Some of these legal proceedings could result in adverse decisions for Siemens AG that may have material effects on its financial position, the results of its operations and/or its cash flows in the respective reporting period. In addition, Siemens is jointly and severally liable within consortia. As far as not recognized in the financial statements, Siemens AG did not expect any material negative effects on its financial position, the results of its operations and/or its cash flows at balance sheet date. NOTE 26 Derivative financial instruments and valuation units As a consequence of its global operating, investing and financing activities, Siemens AG is in particular exposed to risks resulting from changes in exchange rates and interest rates, managed in line with a proven risk management system in consideration of defined risk limits. As the parent company of the Siemens Group, Siemens AG has the central role within the group-wide management of financial market risks. To manage the risks resulting from changes in exchange rates and interest rates, Siemens AG uses primarily foreign currency forward contracts, interest rate swaps as well as combined interest and foreign currency swaps. Thereby the operating units of Siemens AG are not allowed to enter into derivative financial instruments for speculative purposes. The contract partners of the Company for derivative financial instruments are banks, brokers and affiliated companies. The credit rating for banks and brokers is constantly monitored. The following table shows the notional volume and net fair values of existing derivative financial instruments that were not included in a valuation unit as of the balance sheet date: Sep 30, 2023 Notional (in millions of €) amount Fair values Interest rate hedging contracts 8,038 (722) Combined interest and currency hedging contracts 369 26 Existing derivative financial instruments 8,407 (696) The notional amounts equal the contractual amounts of the individual derivative financial instrument which – irrespective of the nature of the concluded position (sale or purchase) – are presented on a gross basis (gross notional amounts). Fair values of these derivative financial instruments are calculated by discounting expected future cash flows over the remaining term of the instrument using current market interest rates and yield curves. 15

Siemens Report FY2023 Page 130 Page 132

Siemens Report FY2023 Page 130 Page 132