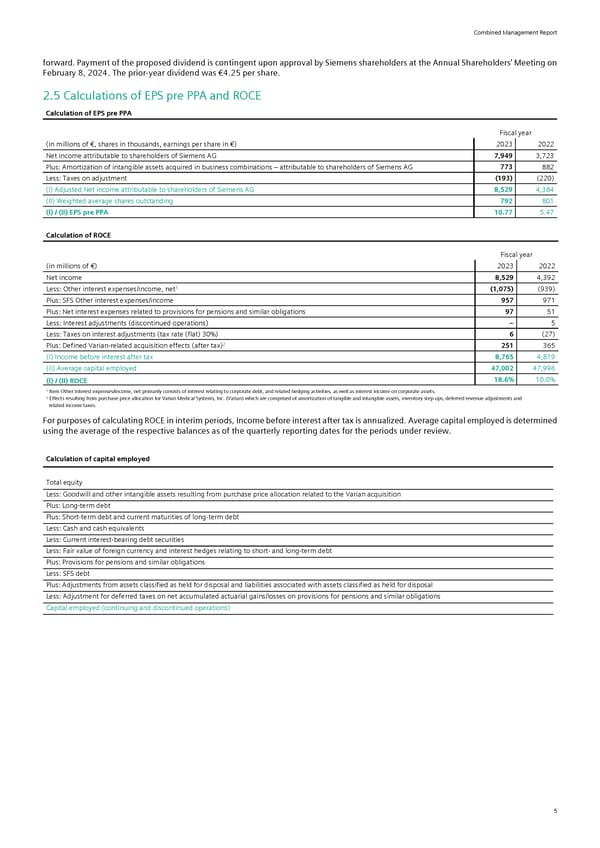

Combined Management Report forward. Payment of the proposed dividend is contingent upon approval by Siemens shareholders at the Annual Shareholders’ Meeting on February 8, 2024. The prior-year dividend was €4.25 per share. 2.5 Calculations of EPS pre PPA and ROCE Calculation of EPS pre PPA Fiscal year (in millions of €, shares in thousands, earnings per share in €) 2023 2022 Net income attributable to shareholders of Siemens AG 7,949 3,723 Plus: Amortization of intangible assets acquired in business combinations – attributable to shareholders of Siemens AG 773 882 Less: Taxes on adjustment (193) (220) (I) Adjusted Net income attributable to shareholders of Siemens AG 8,529 4,384 (II) Weighted average shares outstanding 792 801 (I) / (II) EPS pre PPA 10.77 5.47 Calculation of ROCE Fiscal year (in millions of €) 2023 2022 Net income 8,529 4,392 1 (1,075) Less: Other interest expenses/income, net (939) Plus: SFS Other interest expenses/income 957 971 Plus: Net interest expenses related to provisions for pensions and similar obligations 97 51 Less: Interest adjustments (discontinued operations) − 5 Less: Taxes on interest adjustments (tax rate (flat) 30%) 6 (27) Plus: Defined Varian-related acquisition effects (after tax)2 251 365 (I) Income before interest after tax 8,765 4,819 (II) Average capital employed 47,002 47,996 (I) / (II) ROCE 18.6% 10.0% 1 Item Other interest expenses/income, net primarily consists of interest relating to corporate debt, and related hedging activities, as well as interest income on corporate assets. 2 Effects resulting from purchase price allocation for Varian Medical Systems, Inc. (Varian) which are comprised of amortization of tangible and intangible assets, inventory step-ups, deferred revenue adjustments and related income taxes. For purposes of calculating ROCE in interim periods, Income before interest after tax is annualized. Average capital employed is determined using the average of the respective balances as of the quarterly reporting dates for the periods under review. Calculation of capital employed Total equity Less: Goodwill and other intangible assets resulting from purchase price allocation related to the Varian acquisition Plus: Long-term debt Plus: Short-term debt and current maturities of long-term debt Less: Cash and cash equivalents Less: Current interest-bearing debt securities Less: Fair value of foreign currency and interest hedges relating to short- and long-term debt Plus: Provisions for pensions and similar obligations Less: SFS debt Plus: Adjustments from assets classified as held for disposal and liabilities associated with assets classified as held for disposal Less: Adjustment for deferred taxes on net accumulated actuarial gains/losses on provisions for pensions and similar obligations Capital employed (continuing and discontinued operations) 5

Siemens Report FY2023 Page 6 Page 8

Siemens Report FY2023 Page 6 Page 8