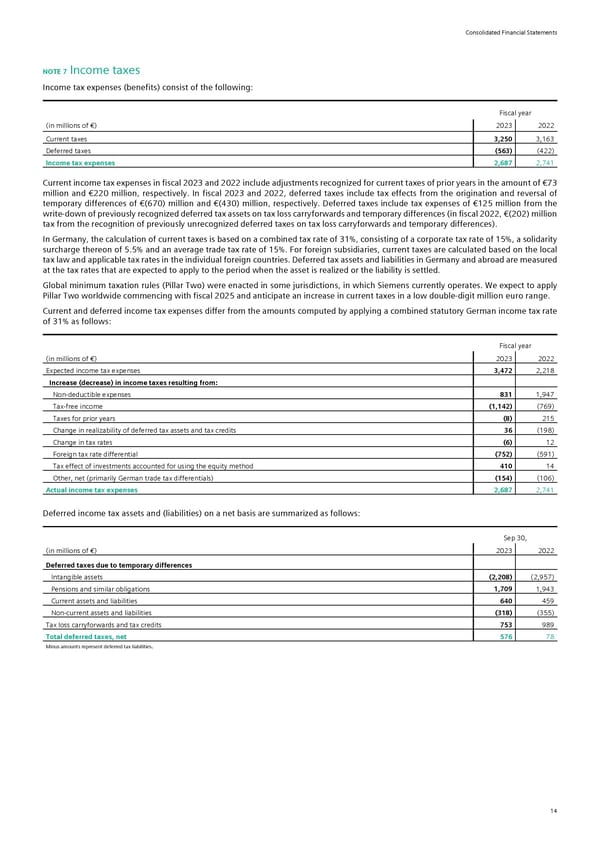

Consolidated Financial Statements NOTE 7 Income taxes Income tax expenses (benefits) consist of the following: Fiscal year (in millions of €) 2023 2022 Current taxes 3,250 3,163 Deferred taxes (563) (422) Income tax expenses 2,687 2,741 Current income tax expenses in fiscal 2023 and 2022 include adjustments recognized for current taxes of prior years in the amount of €73 million and €220 million, respectively. In fiscal 2023 and 2022, deferred taxes include tax effects from the origination and reversal of temporary differences of €(670) million and €(430) million, respectively. Deferred taxes include tax expenses of €125 million from the write-down of previously recognized deferred tax assets on tax loss carryforwards and temporary differences (in fiscal 2022, €(202) million tax from the recognition of previously unrecognized deferred taxes on tax loss carryforwards and temporary differences). In Germany, the calculation of current taxes is based on a combined tax rate of 31%, consisting of a corporate tax rate of 15%, a solidarity surcharge thereon of 5.5% and an average trade tax rate of 15%. For foreign subsidiaries, current taxes are calculated based on the local tax law and applicable tax rates in the individual foreign countries. Deferred tax assets and liabilities in Germany and abroad are measured at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Global minimum taxation rules (Pillar Two) were enacted in some jurisdictions, in which Siemens currently operates. We expect to apply Pillar Two worldwide commencing with fiscal 2025 and anticipate an increase in current taxes in a low double-digit million euro range. Current and deferred income tax expenses differ from the amounts computed by applying a combined statutory German income tax rate of 31% as follows: Fiscal year (in millions of €) 2023 2022 Expected income tax expenses 3,472 2,218 Increase (decrease) in income taxes resulting from: Non-deductible expenses 831 1,947 Tax-free income (1,142) (769) Taxes for prior years (8) 215 Change in realizability of deferred tax assets and tax credits 36 (198) Change in tax rates (6) 12 Foreign tax rate differential (752) (591) Tax effect of investments accounted for using the equity method 410 14 Other, net (primarily German trade tax differentials) (154) (106) Actual income tax expenses 2,687 2,741 Deferred income tax assets and (liabilities) on a net basis are summarized as follows: Sep 30, (in millions of €) 2023 2022 Deferred taxes due to temporary differences Intangible assets (2,208) (2,957) Pensions and similar obligations 1,709 1,943 Current assets and liabilities 640 459 Non-current assets and liabilities (318) (355) Tax loss carryforwards and tax credits 753 989 Total deferred taxes, net 576 78 Minus amounts represent deferred tax liabilities. 14

Siemens Report FY2023 Page 59 Page 61

Siemens Report FY2023 Page 59 Page 61