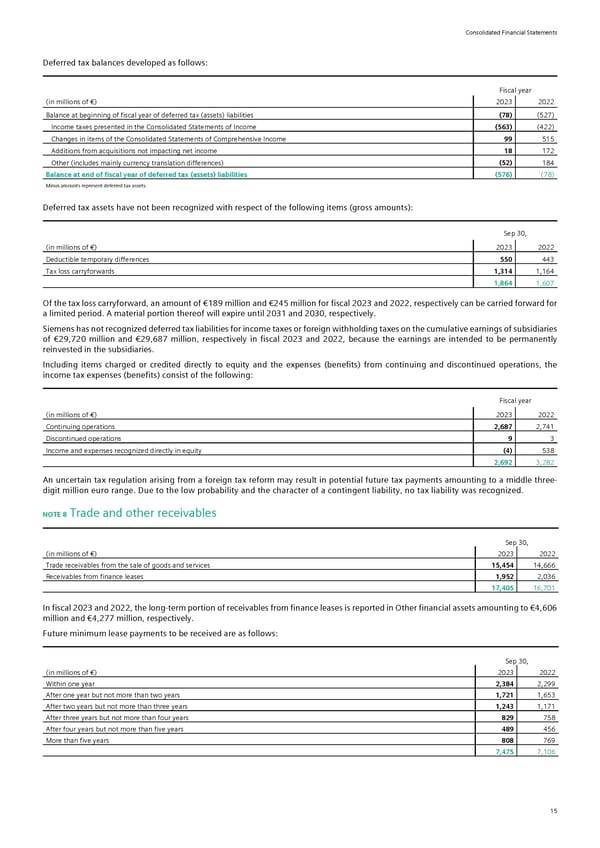

Consolidated Financial Statements Deferred tax balances developed as follows: Fiscal year (in millions of €) 2023 2022 Balance at beginning of fiscal year of deferred tax (assets) liabilities (78) (527) Income taxes presented in the Consolidated Statements of Income (563) (422) Changes in items of the Consolidated Statements of Comprehensive Income 99 515 Additions from acquisitions not impacting net income 18 172 Other (includes mainly currency translation differences) (52) 184 Balance at end of fiscal year of deferred tax (assets) liabilities (576) (78) Minus amounts represent deferred tax assets. Deferred tax assets have not been recognized with respect of the following items (gross amounts): Sep 30, (in millions of €) 2023 2022 Deductible temporary differences 550 443 Tax loss carryforwards 1,314 1,164 1,864 1,607 Of the tax loss carryforward, an amount of €189 million and €245 million for fiscal 2023 and 2022, respectively can be carried forward for a limited period. A material portion thereof will expire until 2031 and 2030, respectively. Siemens has not recognized deferred tax liabilities for income taxes or foreign withholding taxes on the cumulative earnings of subsidiaries of €29,720 million and €29,687 million, respectively in fiscal 2023 and 2022, because the earnings are intended to be permanently reinvested in the subsidiaries. Including items charged or credited directly to equity and the expenses (benefits) from continuing and discontinued operations, the income tax expenses (benefits) consist of the following: Fiscal year (in millions of €) 2023 2022 Continuing operations 2,687 2,741 Discontinued operations 9 3 Income and expenses recognized directly in equity (4) 538 2,692 3,282 An uncertain tax regulation arising from a foreign tax reform may result in potential future tax payments amounting to a middle three- digit million euro range. Due to the low probability and the character of a contingent liability, no tax liability was recognized. NOTE 8 Trade and other receivables Sep 30, (in millions of €) 2023 2022 Trade receivables from the sale of goods and services 15,454 14,666 Receivables from finance leases 1,952 2,036 17,405 16,701 In fiscal 2023 and 2022, the long-term portion of receivables from finance leases is reported in Other financial assets amounting to €4,606 million and €4,277 million, respectively. Future minimum lease payments to be received are as follows: Sep 30, (in millions of €) 2023 2022 Within one year 2,384 2,299 After one year but not more than two years 1,721 1,653 After two years but not more than three years 1,243 1,171 After three years but not more than four years 829 758 After four years but not more than five years 489 456 More than five years 808 769 7,475 7,106 15

Siemens Report FY2023 Page 60 Page 62

Siemens Report FY2023 Page 60 Page 62