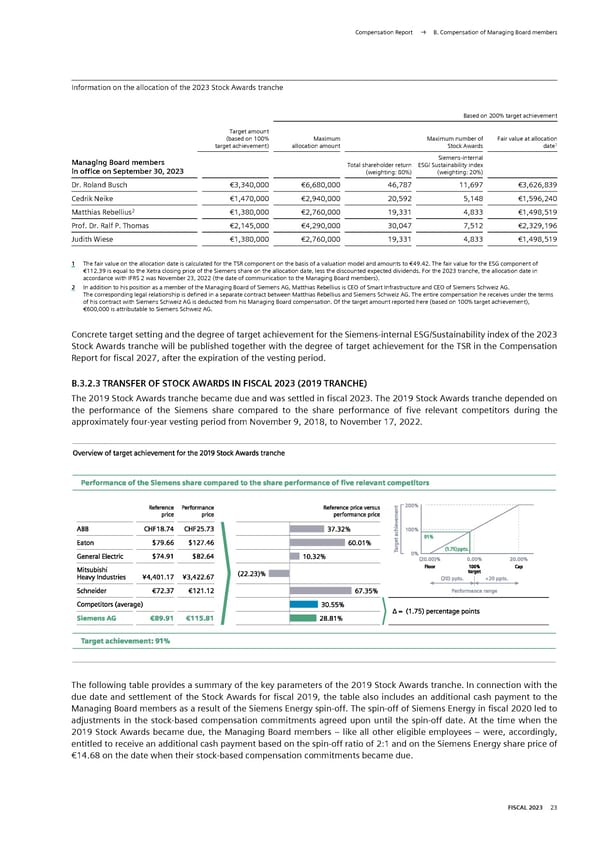

Compensation Report → B. Compensation of Managing Board members Information on the allocation of the 2023 Stock Awards tranche Based on 200% target achievement Target amount (based on 100% Maximum Maximum number of Fair value at allocation 1 target achievement) allocation amount Stock Awards date Managing Board members Siemens-internal in office on September 30, 2023 Total shareholder return ESG/ Sustainability index (weighting: 80%) (weighting: 20%) Dr. Roland Busch €3,340,000 €6,680,000 46,787 11,697 €3,626,839 Cedrik Neike €1,470,000 €2,940,000 20,592 5,148 €1,596,240 2 Matthias Rebellius €1,380,000 €2,760,000 19,331 4,833 €1,498,519 Prof. Dr. Ralf P. Thomas €2,145,000 €4,290,000 30,047 7,512 €2,329,196 Judith Wiese €1,380,000 €2,760,000 19,331 4,833 €1,498,519 1 The fair value on the allocation date is calculated for the TSR component on the basis of a valuation model and amounts to €49.42. The fair value for the ESG component of €112.39 is equal to the Xetra closing price of the Siemens share on the allocation date, less the discounted expected dividends. For the 2023 tranche, the allocation date in accordance with IFRS 2 was November 23, 2022 (the date of communication to the Managing Board members). 2 In addition to his position as a member of the Managing Board of Siemens AG, Matthias Rebellius is CEO of Smart Infrastructure and CEO of Siemens Schweiz AG. The corresponding legal relationship is defined in a separate contract between Matthias Rebellius and Siemens Schweiz AG. The entire compensation he receives under the terms of his contract with Siemens Schweiz AG is deducted from his Managing Board compensation. Of the target amount reported here (based on 100% target achievement), €600,000 is attributable to Siemens Schweiz AG. Concrete target setting and the degree of target achievement for the Siemens-internal ESG/Sustainability index of the 2023 Stock Awards tranche will be published together with the degree of target achievement for the TSR in the Compensation Report for fiscal 2027, after the expiration of the vesting period. B.3.2.3 TRANSFER OF STOCK AWARDS IN FISCAL 2023 (2019 TRANCHE) The 2019 Stock Awards tranche became due and was settled in fiscal 2023. The 2019 Stock Awards tranche depended on the performance of the Siemens share compared to the share performance of five relevant competitors during the approximately four-year vesting period from November 9, 2018, to November 17, 2022. Overview of target achievement for the 2019 Stock Awards tranche Performance of the Siemens share compared to the share performance of five relevant competitors Reference Performance Reference price versus price price performance price ABB CHF18.74 CHF25.73 37.32% Eaton $79.66 $127.46 60.01% (1.75)ppts. General Electric $74.91 $82.64 ■ 10.32% (20.00)% 0.00% Mitsubishi Floor 100% Heavy Industries ¥4,401.17 ¥3,422.67 (22.23)% target (20) ppts. I +20 ppts. ◄---------------------------- ---------------------- Schneider €72.37 €121.12 67.35% Performance range Competitors (average) 30.55% A = (1.75) percentage points Siemens AG €89.91 €115.81 28.81% Target achievement: 91% The following table provides a summary of the key parameters of the 2019 Stock Awards tranche. In connection with the due date and settlement of the Stock Awards for fiscal 2019, the table also includes an additional cash payment to the Managing Board members as a result of the Siemens Energy spin-off. The spin-off of Siemens Energy in fiscal 2020 led to adjustments in the stock-based compensation commitments agreed upon until the spin-off date. At the time when the 2019 Stock Awards became due, the Managing Board members – like all other eligible employees – were, accordingly, entitled to receive an additional cash payment based on the spin-off ratio of 2:1 and on the Siemens Energy share price of €14.68 on the date when their stock-based compensation commitments became due. FISCAL 2023 23

Siemens Report FY2023 Page 173 Page 175

Siemens Report FY2023 Page 173 Page 175