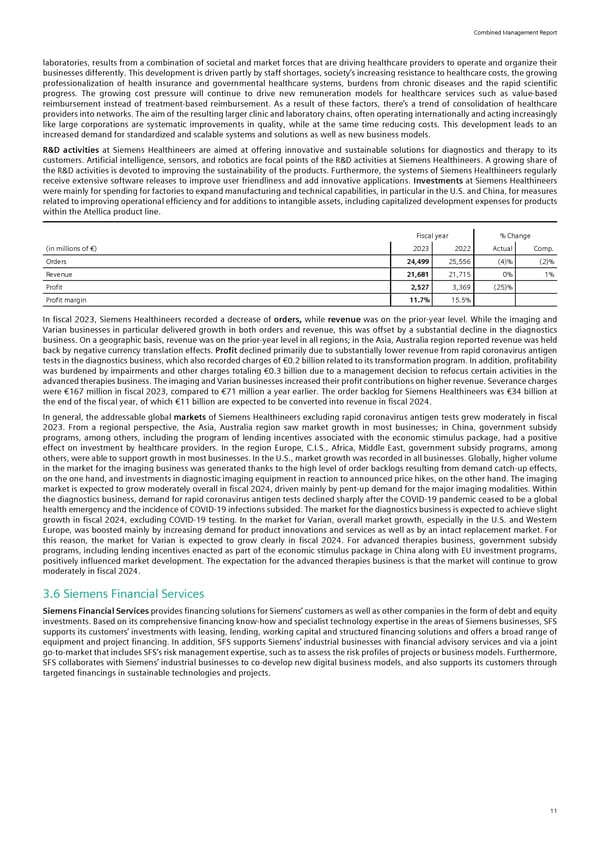

Combined Management Report laboratories, results from a combination of societal and market forces that are driving healthcare providers to operate and organize their businesses differently. This development is driven partly by staff shortages, society’s increasing resistance to healthcare costs, the growing professionalization of health insurance and governmental healthcare systems, burdens from chronic diseases and the rapid scientific progress. The growing cost pressure will continue to drive new remuneration models for healthcare services such as value-based reimbursement instead of treatment-based reimbursement. As a result of these factors, there’s a trend of consolidation of healthcare providers into networks. The aim of the resulting larger clinic and laboratory chains, often operating internationally and acting increasingly like large corporations are systematic improvements in quality, while at the same time reducing costs. This development leads to an increased demand for standardized and scalable systems and solutions as well as new business models. R&D activities at Siemens Healthineers are aimed at offering innovative and sustainable solutions for diagnostics and therapy to its customers. Artificial intelligence, sensors, and robotics are focal points of the R&D activities at Siemens Healthineers. A growing share of the R&D activities is devoted to improving the sustainability of the products. Furthermore, the systems of Siemens Healthineers regularly receive extensive software releases to improve user friendliness and add innovative applications. Investments at Siemens Healthineers were mainly for spending for factories to expand manufacturing and technical capabilities, in particular in the U.S. and China, for measures related to improving operational efficiency and for additions to intangible assets, including capitalized development expenses for products within the Atellica product line. Fiscal year % Change (in millions of €) 2023 2022 Actual Comp. Orders 24,499 25,556 (4)% (2)% Revenue 21,681 21,715 0% 1% Profit 2,527 3,369 (25)% Profit margin 11.7% 15.5% In fiscal 2023, Siemens Healthineers recorded a decrease of orders, while revenue was on the prior-year level. While the imaging and Varian businesses in particular delivered growth in both orders and revenue, this was offset by a substantial decline in the diagnostics business. On a geographic basis, revenue was on the prior-year level in all regions; in the Asia, Australia region reported revenue was held back by negative currency translation effects. Profit declined primarily due to substantially lower revenue from rapid coronavirus antigen tests in the diagnostics business, which also recorded charges of €0.2 billion related to its transformation program. In addition, profitability was burdened by impairments and other charges totaling €0.3 billion due to a management decision to refocus certain activities in the advanced therapies business. The imaging and Varian businesses increased their profit contributions on higher revenue. Severance charges were €167 million in fiscal 2023, compared to €71 million a year earlier. The order backlog for Siemens Healthineers was €34 billion at the end of the fiscal year, of which €11 billion are expected to be converted into revenue in fiscal 2024. In general, the addressable global markets of Siemens Healthineers excluding rapid coronavirus antigen tests grew moderately in fiscal 2023. From a regional perspective, the Asia, Australia region saw market growth in most businesses; in China, government subsidy programs, among others, including the program of lending incentives associated with the economic stimulus package, had a positive effect on investment by healthcare providers. In the region Europe, C.I.S., Africa, Middle East, government subsidy programs, among others, were able to support growth in most businesses. In the U.S., market growth was recorded in all businesses. Globally, higher volume in the market for the imaging business was generated thanks to the high level of order backlogs resulting from demand catch-up effects, on the one hand, and investments in diagnostic imaging equipment in reaction to announced price hikes, on the other hand. The imaging market is expected to grow moderately overall in fiscal 2024, driven mainly by pent-up demand for the major imaging modalities. Within the diagnostics business, demand for rapid coronavirus antigen tests declined sharply after the COVID-19 pandemic ceased to be a global health emergency and the incidence of COVID-19 infections subsided. The market for the diagnostics business is expected to achieve slight growth in fiscal 2024, excluding COVID-19 testing. In the market for Varian, overall market growth, especially in the U.S. and Western Europe, was boosted mainly by increasing demand for product innovations and services as well as by an intact replacement market. For this reason, the market for Varian is expected to grow clearly in fiscal 2024. For advanced therapies business, government subsidy programs, including lending incentives enacted as part of the economic stimulus package in China along with EU investment programs, positively influenced market development. The expectation for the advanced therapies business is that the market will continue to grow moderately in fiscal 2024. 3.6 Siemens Financial Services Siemens Financial Services provides financing solutions for Siemens’ customers as well as other companies in the form of debt and equity investments. Based on its comprehensive financing know-how and specialist technology expertise in the areas of Siemens businesses, SFS supports its customers’ investments with leasing, lending, working capital and structured financing solutions and offers a broad range of equipment and project financing. In addition, SFS supports Siemens’ industrial businesses with financial advisory services and via a joint go-to-market that includes SFS’s risk management expertise, such as to assess the risk profiles of projects or business models. Furthermore, SFS collaborates with Siemens’ industrial businesses to co-develop new digital business models, and also supports its customers through targeted financings in sustainable technologies and projects. 11

Siemens Report FY2023 Page 12 Page 14

Siemens Report FY2023 Page 12 Page 14