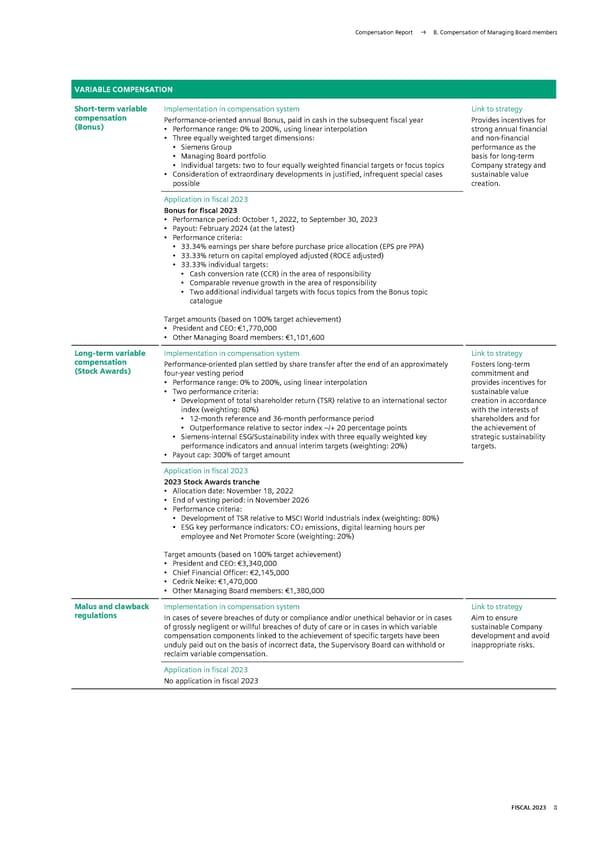

Compensation Report → B. Compensation of Managing Board members VARIABLE COMPENSATION Short-term variable Implementation in compensation system Link to strategy compensation Performance-oriented annual Bonus, paid in cash in the subsequent fiscal year Provides incentives for (Bonus) • Performance range: 0% to 200%, using linear interpolation strong annual financial • Three equally weighted target dimensions: and non-financial • Siemens Group performance as the • Managing Board portfolio basis for long-term • Individual targets: two to four equally weighted financial targets or focus topics Company strategy and • Consideration of extraordinary developments in justified, infrequent special cases sustainable value possible creation. Application in fiscal 2023 Bonus for fiscal 2023 • Performance period: October 1, 2022, to September 30, 2023 • Payout: February 2024 (at the latest) • Performance criteria: • 33.34% earnings per share before purchase price allocation (EPS pre PPA) • 33.33% return on capital employed adjusted (ROCE adjusted) • 33.33% individual targets: • Cash conversion rate (CCR) in the area of responsibility • Comparable revenue growth in the area of responsibility • Two additional individual targets with focus topics from the Bonus topic catalogue Target amounts (based on 100% target achievement) • President and CEO: €1,770,000 • Other Managing Board members: €1,101,600 Long-term variable Implementation in compensation system Link to strategy compensation Performance-oriented plan settled by share transfer after the end of an approximately Fosters long-term (Stock Awards) four-year vesting period commitment and • Performance range: 0% to 200%, using linear interpolation provides incentives for • Two performance criteria: sustainable value • Development of total shareholder return (TSR) relative to an international sector creation in accordance index (weighting: 80%) with the interests of • 12-month reference and 36-month performance period shareholders and for • Outperformance relative to sector index –/+ 20 percentage points the achievement of • Siemens-internal ESG/Sustainability index with three equally weighted key strategic sustainability performance indicators and annual interim targets (weighting: 20%) targets. • Payout cap: 300% of target amount Application in fiscal 2023 2023 Stock Awards tranche • Allocation date: November 18, 2022 • End of vesting period: in November 2026 • Performance criteria: • Development of TSR relative to MSCI World Industrials index (weighting: 80%) • ESG key performance indicators: CO 2 emissions, digital learning hours per employee and Net Promoter Score (weighting: 20%) Target amounts (based on 100% target achievement) • President and CEO: €3,340,000 • Chief Financial Officer: €2,145,000 • Cedrik Neike: €1,470,000 • Other Managing Board members: €1,380,000 Malus and clawback Implementation in compensation system Link to strategy regulations In cases of severe breaches of duty or compliance and/or unethical behavior or in cases Aim to ensure of grossly negligent or willful breaches of duty of care or in cases in which variable sustainable Company compensation components linked to the achievement of specific targets have been development and avoid unduly paid out on the basis of incorrect data, the Supervisory Board can withhold or inappropriate risks. reclaim variable compensation. Application in fiscal 2023 No application in fiscal 2023 FISCAL 2023 8

Siemens Report FY2023 Page 158 Page 160

Siemens Report FY2023 Page 158 Page 160