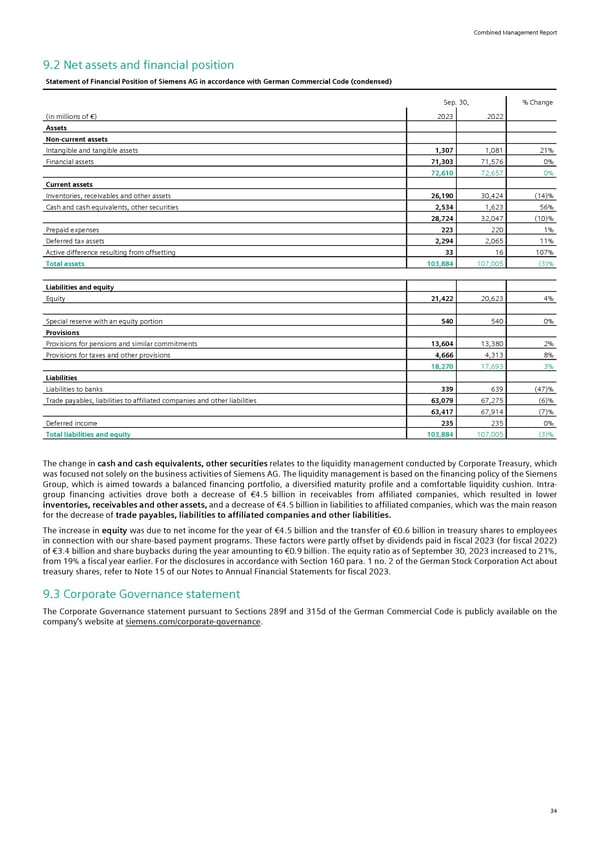

Combined Management Report 9.2 Net assets and financial position Statement of Financial Position of Siemens AG in accordance with German Commercial Code (condensed) Sep. 30, % Change (in millions of €) 2023 2022 Assets Non-current assets Intangible and tangible assets 1,307 1,081 21% Financial assets 71,303 71,576 0% 72,610 72,657 0% Current assets Inventories, receivables and other assets 26,190 30,424 (14)% Cash and cash equivalents, other securities 2,534 1,623 56% 28,724 32,047 (10)% Prepaid expenses 223 220 1% Deferred tax assets 2,294 2,065 11% Active difference resulting from offsetting 33 16 107% Total assets 103,884 107,005 (3)% Liabilities and equity Equity 21,422 20,623 4% Special reserve with an equity portion 540 540 0% Provisions Provisions for pensions and similar commitments 13,604 13,380 2% Provisions for taxes and other provisions 4,666 4,313 8% 18,270 17,693 3% Liabilities Liabilities to banks 339 639 (47)% Trade payables, liabilities to affiliated companies and other liabilities 63,079 67,275 (6)% 63,417 67,914 (7)% Deferred income 235 235 0% Total liabilities and equity 103,884 107,005 (3)% The change in cash and cash equivalents, other securities relates to the liquidity management conducted by Corporate Treasury, which was focused not solely on the business activities of Siemens AG. The liquidity management is based on the financing policy of the Siemens Group, which is aimed towards a balanced financing portfolio, a diversified maturity profile and a comfortable liquidity cushion. Intra- group financing activities drove both a decrease of €4.5 billion in receivables from affiliated companies, which resulted in lower inventories, receivables and other assets, and a decrease of €4.5 billion in liabilities to affiliated companies, which was the main reason for the decrease of trade payables, liabilities to affiliated companies and other liabilities. The increase in equity was due to net income for the year of €4.5 billion and the transfer of €0.6 billion in treasury shares to employees in connection with our share-based payment programs. These factors were partly offset by dividends paid in fiscal 2023 (for fiscal 2022) of €3.4 billion and share buybacks during the year amounting to €0.9 billion. The equity ratio as of September 30, 2023 increased to 21%, from 19% a fiscal year earlier. For the disclosures in accordance with Section 160 para. 1 no. 2 of the German Stock Corporation Act about treasury shares, refer to Note 15 of our Notes to Annual Financial Statements for fiscal 2023. 9.3 Corporate Governance statement The Corporate Governance statement pursuant to Sections 289f and 315d of the German Commercial Code is publicly available on the company’s website at siemens.com/corporate-governance. 34

Siemens Report FY2023 Page 35 Page 37

Siemens Report FY2023 Page 35 Page 37