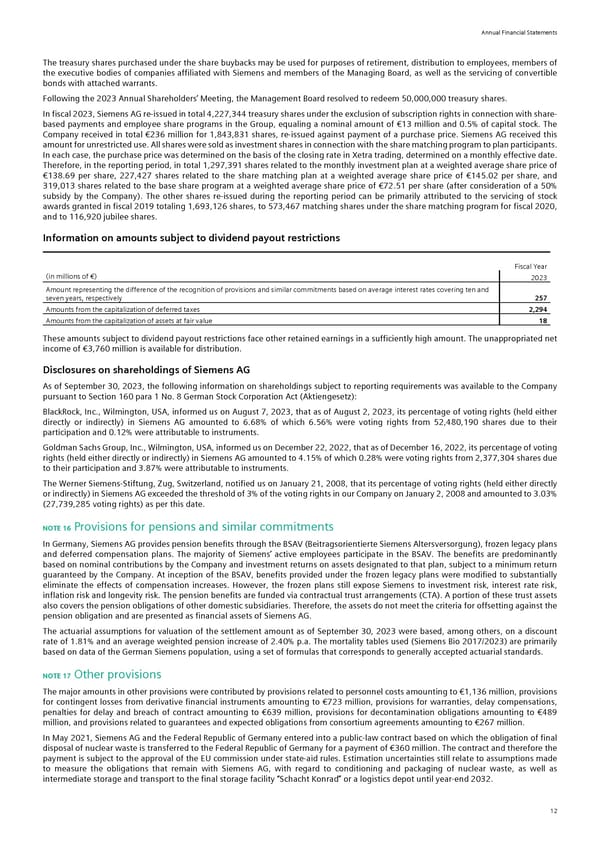

Annual Financial Statements The treasury shares purchased under the share buybacks may be used for purposes of retirement, distribution to employees, members of the executive bodies of companies affiliated with Siemens and members of the Managing Board, as well as the servicing of convertible bonds with attached warrants. Following the 2023 Annual Shareholders’ Meeting, the Management Board resolved to redeem 50,000,000 treasury shares. In fiscal 2023, Siemens AG re-issued in total 4,227,344 treasury shares under the exclusion of subscription rights in connection with share- based payments and employee share programs in the Group, equaling a nominal amount of €13 million and 0.5% of capital stock. The Company received in total €236 million for 1,843,831 shares, re-issued against payment of a purchase price. Siemens AG received this amount for unrestricted use. All shares were sold as investment shares in connection with the share matching program to plan participants. In each case, the purchase price was determined on the basis of the closing rate in Xetra trading, determined on a monthly effective date. Therefore, in the reporting period, in total 1,297,391 shares related to the monthly investment plan at a weighted average share price of €138.69 per share, 227,427 shares related to the share matching plan at a weighted average share price of €145.02 per share, and 319,013 shares related to the base share program at a weighted average share price of €72.51 per share (after consideration of a 50% subsidy by the Company). The other shares re-issued during the reporting period can be primarily attributed to the servicing of stock awards granted in fiscal 2019 totaling 1,693,126 shares, to 573,467 matching shares under the share matching program for fiscal 2020, and to 116,920 jubilee shares. Information on amounts subject to dividend payout restrictions Fiscal Year (in millions of €) 2023 Amount representing the difference of the recognition of provisions and similar commitments based on average interest rates covering ten and seven years, respectively 257 Amounts from the capitalization of deferred taxes 2,294 Amounts from the capitalization of assets at fair value 18 These amounts subject to dividend payout restrictions face other retained earnings in a sufficiently high amount. The unappropriated net income of €3,760 million is available for distribution. Disclosures on shareholdings of Siemens AG As of September 30, 2023, the following information on shareholdings subject to reporting requirements was available to the Company pursuant to Section 160 para 1 No. 8 German Stock Corporation Act (Aktiengesetz): BlackRock, Inc., Wilmington, USA, informed us on August 7, 2023, that as of August 2, 2023, its percentage of voting rights (held either directly or indirectly) in Siemens AG amounted to 6.68% of which 6.56% were voting rights from 52,480,190 shares due to their participation and 0.12% were attributable to instruments. Goldman Sachs Group, Inc., Wilmington, USA, informed us on December 22, 2022, that as of December 16, 2022, its percentage of voting rights (held either directly or indirectly) in Siemens AG amounted to 4.15% of which 0.28% were voting rights from 2,377,304 shares due to their participation and 3.87% were attributable to instruments. The Werner Siemens-Stiftung, Zug, Switzerland, notified us on January 21, 2008, that its percentage of voting rights (held either directly or indirectly) in Siemens AG exceeded the threshold of 3% of the voting rights in our Company on January 2, 2008 and amounted to 3.03% (27,739,285 voting rights) as per this date. NOTE 16 Provisions for pensions and similar commitments In Germany, Siemens AG provides pension benefits through the BSAV (Beitragsorientierte Siemens Altersversorgung), frozen legacy plans and deferred compensation plans. The majority of Siemens’ active employees participate in the BSAV. The benefits are predominantly based on nominal contributions by the Company and investment returns on assets designated to that plan, subject to a minimum return guaranteed by the Company. At inception of the BSAV, benefits provided under the frozen legacy plans were modified to substantially eliminate the effects of compensation increases. However, the frozen plans still expose Siemens to investment risk, interest rate risk, inflation risk and longevity risk. The pension benefits are funded via contractual trust arrangements (CTA). A portion of these trust assets also covers the pension obligations of other domestic subsidiaries. Therefore, the assets do not meet the criteria for offsetting against the pension obligation and are presented as financial assets of Siemens AG. The actuarial assumptions for valuation of the settlement amount as of September 30, 2023 were based, among others, on a discount rate of 1.81% and an average weighted pension increase of 2.40% p.a. The mortality tables used (Siemens Bio 2017/2023) are primarily based on data of the German Siemens population, using a set of formulas that corresponds to generally accepted actuarial standards. NOTE 17 Other provisions The major amounts in other provisions were contributed by provisions related to personnel costs amounting to €1,136 million, provisions for contingent losses from derivative financial instruments amounting to €723 million, provisions for warranties, delay compensations, penalties for delay and breach of contract amounting to €639 million, provisions for decontamination obligations amounting to €489 million, and provisions related to guarantees and expected obligations from consortium agreements amounting to €267 million. In May 2021, Siemens AG and the Federal Republic of Germany entered into a public-law contract based on which the obligation of final disposal of nuclear waste is transferred to the Federal Republic of Germany for a payment of €360 million. The contract and therefore the payment is subject to the approval of the EU commission under state-aid rules. Estimation uncertainties still relate to assumptions made to measure the obligations that remain with Siemens AG, with regard to conditioning and packaging of nuclear waste, as well as intermediate storage and transport to the final storage facility “Schacht Konrad” or a logistics depot until year-end 2032. 12

Siemens Report FY2023 Page 127 Page 129

Siemens Report FY2023 Page 127 Page 129