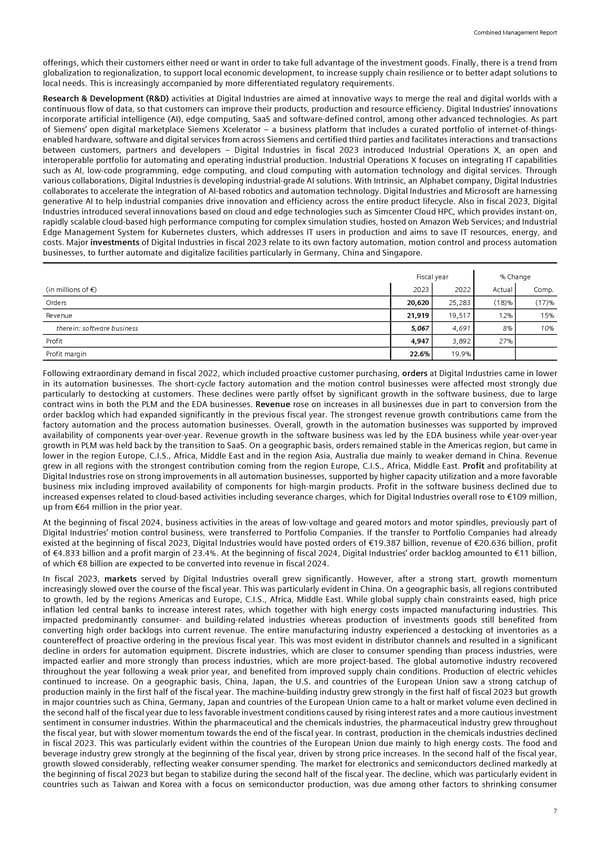

Combined Management Report offerings, which their customers either need or want in order to take full advantage of the investment goods. Finally, there is a trend from globalization to regionalization, to support local economic development, to increase supply chain resilience or to better adapt solutions to local needs. This is increasingly accompanied by more differentiated regulatory requirements. Research & Development (R&D) activities at Digital Industries are aimed at innovative ways to merge the real and digital worlds with a continuous flow of data, so that customers can improve their products, production and resource efficiency. Digital Industries’ innovations incorporate artificial intelligence (AI), edge computing, SaaS and software-defined control, among other advanced technologies. As part of Siemens’ open digital marketplace Siemens Xcelerator – a business platform that includes a curated portfolio of internet-of-things- enabled hardware, software and digital services from across Siemens and certified third parties and facilitates interactions and transactions between customers, partners and developers – Digital Industries in fiscal 2023 introduced Industrial Operations X, an open and interoperable portfolio for automating and operating industrial production. Industrial Operations X focuses on integrating IT capabilities such as AI, low-code programming, edge computing, and cloud computing with automation technology and digital services. Through various collaborations, Digital Industries is developing industrial-grade AI solutions. With Intrinsic, an Alphabet company, Digital Industries collaborates to accelerate the integration of AI-based robotics and automation technology. Digital Industries and Microsoft are harnessing generative AI to help industrial companies drive innovation and efficiency across the entire product lifecycle. Also in fiscal 2023, Digital Industries introduced several innovations based on cloud and edge technologies such as Simcenter Cloud HPC, which provides instant-on, rapidly scalable cloud-based high performance computing for complex simulation studies, hosted on Amazon Web Services; and Industrial Edge Management System for Kubernetes clusters, which addresses IT users in production and aims to save IT resources, energy, and costs. Major investments of Digital Industries in fiscal 2023 relate to its own factory automation, motion control and process automation businesses, to further automate and digitalize facilities particularly in Germany, China and Singapore. Fiscal year % Change (in millions of €) 2023 2022 Actual Comp. Orders 20,620 25,283 (18)% (17)% Revenue 21,919 19,517 12% 15% therein: software business 5,067 4,691 8% 10% Profit 4,947 3,892 27% Profit margin 22.6% 19.9% Following extraordinary demand in fiscal 2022, which included proactive customer purchasing, orders at Digital Industries came in lower in its automation businesses. The short-cycle factory automation and the motion control businesses were affected most strongly due particularly to destocking at customers. These declines were partly offset by significant growth in the software business, due to large contract wins in both the PLM and the EDA businesses. Revenue rose on increases in all businesses due in part to conversion from the order backlog which had expanded significantly in the previous fiscal year. The strongest revenue growth contributions came from the factory automation and the process automation businesses. Overall, growth in the automation businesses was supported by improved availability of components year-over-year. Revenue growth in the software business was led by the EDA business while year-over-year growth in PLM was held back by the transition to SaaS. On a geographic basis, orders remained stable in the Americas region, but came in lower in the region Europe, C.I.S., Africa, Middle East and in the region Asia, Australia due mainly to weaker demand in China. Revenue grew in all regions with the strongest contribution coming from the region Europe, C.I.S., Africa, Middle East. Profit and profitability at Digital Industries rose on strong improvements in all automation businesses, supported by higher capacity utilization and a more favorable business mix including improved availability of components for high-margin products. Profit in the software business declined due to increased expenses related to cloud-based activities including severance charges, which for Digital Industries overall rose to €109 million, up from €64 million in the prior year. At the beginning of fiscal 2024, business activities in the areas of low-voltage and geared motors and motor spindles, previously part of Digital Industries’ motion control business, were transferred to Portfolio Companies. If the transfer to Portfolio Companies had already existed at the beginning of fiscal 2023, Digital Industries would have posted orders of €19.387 billion, revenue of €20.636 billion, profit of €4.833 billion and a profit margin of 23.4%. At the beginning of fiscal 2024, Digital Industries’ order backlog amounted to €11 billion, of which €8 billion are expected to be converted into revenue in fiscal 2024. In fiscal 2023, markets served by Digital Industries overall grew significantly. However, after a strong start, growth momentum increasingly slowed over the course of the fiscal year. This was particularly evident in China. On a geographic basis, all regions contributed to growth, led by the regions Americas and Europe, C.I.S., Africa, Middle East. While global supply chain constraints eased, high price inflation led central banks to increase interest rates, which together with high energy costs impacted manufacturing industries. This impacted predominantly consumer- and building-related industries whereas production of investments goods still benefited from converting high order backlogs into current revenue. The entire manufacturing industry experienced a destocking of inventories as a countereffect of proactive ordering in the previous fiscal year. This was most evident in distributor channels and resulted in a significant decline in orders for automation equipment. Discrete industries, which are closer to consumer spending than process industries, were impacted earlier and more strongly than process industries, which are more project-based. The global automotive industry recovered throughout the year following a weak prior year, and benefited from improved supply chain conditions. Production of electric vehicles continued to increase. On a geographic basis, China, Japan, the U.S. and countries of the European Union saw a strong catchup of production mainly in the first half of the fiscal year. The machine-building industry grew strongly in the first half of fiscal 2023 but growth in major countries such as China, Germany, Japan and countries of the European Union came to a halt or market volume even declined in the second half of the fiscal year due to less favorable investment conditions caused by rising interest rates and a more cautious investment sentiment in consumer industries. Within the pharmaceutical and the chemicals industries, the pharmaceutical industry grew throughout the fiscal year, but with slower momentum towards the end of the fiscal year. In contrast, production in the chemicals industries declined in fiscal 2023. This was particularly evident within the countries of the European Union due mainly to high energy costs. The food and beverage industry grew strongly at the beginning of the fiscal year, driven by strong price increases. In the second half of the fiscal year, growth slowed considerably, reflecting weaker consumer spending. The market for electronics and semiconductors declined markedly at the beginning of fiscal 2023 but began to stabilize during the second half of the fiscal year. The decline, which was particularly evident in countries such as Taiwan and Korea with a focus on semiconductor production, was due among other factors to shrinking consumer 7

Siemens Report FY2023 Page 8 Page 10

Siemens Report FY2023 Page 8 Page 10