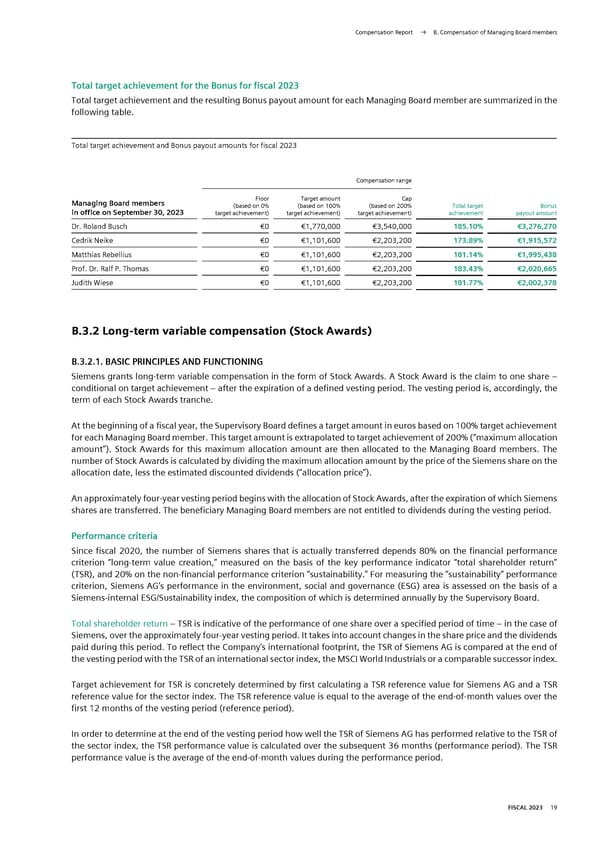

Compensation Report → B. Compensation of Managing Board members Total target achievement for the Bonus for fiscal 2023 Total target achievement and the resulting Bonus payout amount for each Managing Board member are summarized in the following table. Total target achievement and Bonus payout amounts for fiscal 2023 Compensation range Managing Board members Floor Target amount Cap in office on September 30, 2023 (based on 0% (based on 100% (based on 200% Total target Bonus target achievement) target achievement) target achievement) achievement payout amount Dr. Roland Busch €0 €1,770,000 €3,540,000 185.10% €3,276,270 Cedrik Neike €0 €1,101,600 €2,203,200 173.89% €1,915,572 Matthias Rebellius €0 €1,101,600 €2,203,200 181.14% €1,995,438 Prof. Dr. Ralf P. Thomas €0 €1,101,600 €2,203,200 183.43% €2,020,665 Judith Wiese €0 €1,101,600 €2,203,200 181.77% €2,002,378 B.3.2 Long-term variable compensation (Stock Awards) B.3.2.1. BASIC PRINCIPLES AND FUNCTIONING Siemens grants long-term variable compensation in the form of Stock Awards. A Stock Award is the claim to one share – conditional on target achievement – after the expiration of a defined vesting period. The vesting period is, accordingly, the term of each Stock Awards tranche. At the beginning of a fiscal year, the Supervisory Board defines a target amount in euros based on 100% target achievement for each Managing Board member. This target amount is extrapolated to target achievement of 200% (“maximum allocation amount”). Stock Awards for this maximum allocation amount are then allocated to the Managing Board members. The number of Stock Awards is calculated by dividing the maximum allocation amount by the price of the Siemens share on the allocation date, less the estimated discounted dividends (“allocation price”). An approximately four-year vesting period begins with the allocation of Stock Awards, after the expiration of which Siemens shares are transferred. The beneficiary Managing Board members are not entitled to dividends during the vesting period. Performance criteria Since fiscal 2020, the number of Siemens shares that is actually transferred depends 80% on the financial performance criterion “long-term value creation,” measured on the basis of the key performance indicator “total shareholder return” (TSR), and 20% on the non-financial performance criterion “sustainability.” For measuring the “sustainability” performance criterion, Siemens AG’s performance in the environment, social and governance (ESG) area is assessed on the basis of a Siemens-internal ESG/Sustainability index, the composition of which is determined annually by the Supervisory Board. Total shareholder return – TSR is indicative of the performance of one share over a specified period of time – in the case of Siemens, over the approximately four-year vesting period. It takes into account changes in the share price and the dividends paid during this period. To reflect the Company’s international footprint, the TSR of Siemens AG is compared at the end of the vesting period with the TSR of an international sector index, the MSCI World Industrials or a comparable successor index. Target achievement for TSR is concretely determined by first calculating a TSR reference value for Siemens AG and a TSR reference value for the sector index. The TSR reference value is equal to the average of the end-of-month values over the first 12 months of the vesting period (reference period). In order to determine at the end of the vesting period how well the TSR of Siemens AG has performed relative to the TSR of the sector index, the TSR performance value is calculated over the subsequent 36 months (performance period). The TSR performance value is the average of the end-of-month values during the performance period. FISCAL 2023 19

Siemens Report FY2023 Page 169 Page 171

Siemens Report FY2023 Page 169 Page 171