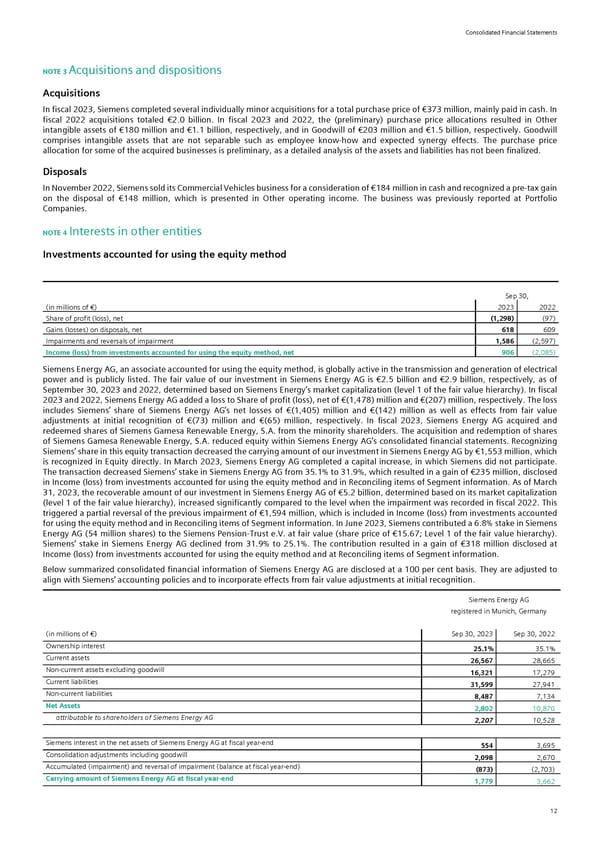

Consolidated Financial Statements NOTE 3 Acquisitions and dispositions Acquisitions In fiscal 2023, Siemens completed several individually minor acquisitions for a total purchase price of €373 million, mainly paid in cash. In fiscal 2022 acquisitions totaled €2.0 billion. In fiscal 2023 and 2022, the (preliminary) purchase price allocations resulted in Other intangible assets of €180 million and €1.1 billion, respectively, and in Goodwill of €203 million and €1.5 billion, respectively. Goodwill comprises intangible assets that are not separable such as employee know-how and expected synergy effects. The purchase price allocation for some of the acquired businesses is preliminary, as a detailed analysis of the assets and liabilities has not been finalized. Disposals In November 2022, Siemens sold its Commercial Vehicles business for a consideration of €184 million in cash and recognized a pre-tax gain on the disposal of €148 million, which is presented in Other operating income. The business was previously reported at Portfolio Companies. NOTE 4 Interests in other entities Investments accounted for using the equity method Sep 30, (in millions of €) 2023 2022 Share of profit (loss), net (1,298) (97) Gains (losses) on disposals, net 618 609 Impairments and reversals of impairment 1,586 (2,597) Income (loss) from investments accounted for using the equity method, net 906 (2,085) Siemens Energy AG, an associate accounted for using the equity method, is globally active in the transmission and generation of electrical power and is publicly listed. The fair value of our investment in Siemens Energy AG is €2.5 billion and €2.9 billion, respectively, as of September 30, 2023 and 2022, determined based on Siemens Energy’s market capitalization (level 1 of the fair value hierarchy). In fiscal 2023 and 2022, Siemens Energy AG added a loss to Share of profit (loss), net of €(1,478) million and €(207) million, respectively. The loss includes Siemens’ share of Siemens Energy AG’s net losses of €(1,405) million and €(142) million as well as effects from fair value adjustments at initial recognition of €(73) million and €(65) million, respectively. In fiscal 2023, Siemens Energy AG acquired and redeemed shares of Siemens Gamesa Renewable Energy, S.A. from the minority shareholders. The acquisition and redemption of shares of Siemens Gamesa Renewable Energy, S.A. reduced equity within Siemens Energy AG’s consolidated financial statements. Recognizing Siemens’ share in this equity transaction decreased the carrying amount of our investment in Siemens Energy AG by €1,553 million, which is recognized in Equity directly. In March 2023, Siemens Energy AG completed a capital increase, in which Siemens did not participate. The transaction decreased Siemens’ stake in Siemens Energy AG from 35.1% to 31.9%, which resulted in a gain of €235 million, disclosed in Income (loss) from investments accounted for using the equity method and in Reconciling items of Segment information. As of March 31, 2023, the recoverable amount of our investment in Siemens Energy AG of €5.2 billion, determined based on its market capitalization (level 1 of the fair value hierarchy), increased significantly compared to the level when the impairment was recorded in fiscal 2022. This triggered a partial reversal of the previous impairment of €1,594 million, which is included in Income (loss) from investments accounted for using the equity method and in Reconciling items of Segment information. In June 2023, Siemens contributed a 6.8% stake in Siemens Energy AG (54 million shares) to the Siemens Pension-Trust e.V. at fair value (share price of €15.67; Level 1 of the fair value hierarchy). Siemens’ stake in Siemens Energy AG declined from 31.9% to 25.1%. The contribution resulted in a gain of €318 million disclosed at Income (loss) from investments accounted for using the equity method and at Reconciling items of Segment information. Below summarized consolidated financial information of Siemens Energy AG are disclosed at a 100 per cent basis. They are adjusted to align with Siemens’ accounting policies and to incorporate effects from fair value adjustments at initial recognition. Siemens Energy AG registered in Munich, Germany (in millions of €) Sep 30, 2023 Sep 30, 2022 Ownership interest 25.1% 35.1% Current assets 26,567 28,665 Non-current assets excluding goodwill 16,321 17,279 Current liabilities 31,599 27,941 Non-current liabilities 8,487 7,134 Net Assets 2,802 10,870 attributable to shareholders of Siemens Energy AG 2,207 10,528 Siemens interest in the net assets of Siemens Energy AG at fiscal year-end 554 3,695 Consolidation adjustments including goodwill 2,098 2,670 Accumulated (impairment) and reversal of impairment (balance at fiscal year-end) (873) (2,703) Carrying amount of Siemens Energy AG at fiscal year-end 1,779 3,662 12

Siemens Report FY2023 Page 57 Page 59

Siemens Report FY2023 Page 57 Page 59